Updated X-Date analysis

and daily TGA projections through 6/9

TLDR

High danger of X-Date week of 6/5, moderate danger on 6/2

Projected levels of TGA close balance thru 6/9 detailed within

***Note – If you have not read the X-Date analysis from my prior article or the update I posted Friday identifying a material TGA flow I had not been accounting for which led to a material reduction to projected TGA levels in June. I suggest reading that first for context. https://johncomiskey.substack.com/p/projecting-the-x-date-and-the-tga

***

Hello again!

My core thesis of a near miss on 6/9 is no longer really intact. It may still happen and technically I still model a positive (~700 million) value for the TGA on 6/9, but there is literally no more cushion to be wrong with undermodeling the deficit and still achieve a near miss on 6/9 (and that doesn’t account for potential intraday payment/receipt flows for which I have no visibility). So unless my model is over on the deficit between here and 6/9, whatever the payment prioritization plan actually is will likely need to take effect then (albeit briefly since the TGA refills with mid-June tax receipts starting Monday 6/12).

This post recalculates the X-Date using the most current information available, including the Treasury Daily Debt Subject to the limit report (as of 5/17 released on 5/19), the actual TGA balance (which captures my models under model of the net withdraws – deposits by ~5.2b over the timespan of 5/11 through 5/17) and the actual withdrawal and deposit values on 5/18 (another ~2.6b light on deficit).

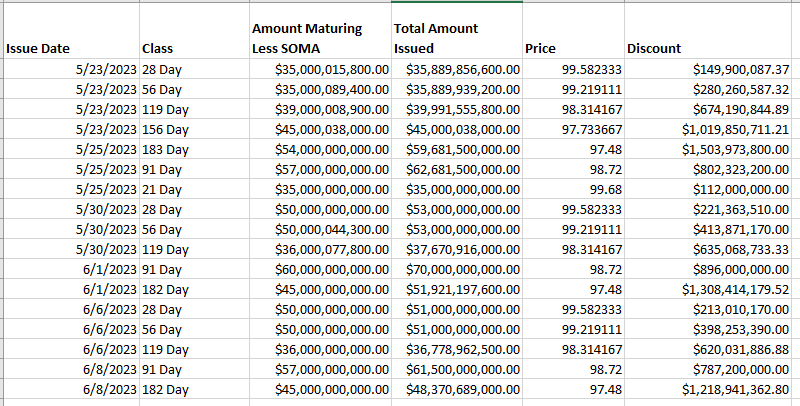

The overall analysis has also been remediated to account for the discount on treasury bills when they are issued as well as inflation protected and US Savings Securities increments (the missing material information from my previous analysis).

Accordingly, I have extended the analysis to project when the extraordinary measures will be used through net public debt issuance through 6/1 and with that project daily TGA closing balances through 6/9.

So where does this reanalysis lead? To a TGA level perilously close to 0 starting 6/2 and being just a hairs breadth higher than 0 on 6/9.

Projected TGA level through 6/9

The columns in the Projected TGA level figure.

TGA Start Balance – Uses actual for 5/18. Uses projected close balance of the prior day for subsequent days.

Deposits and Withdrawals – Uses actual for 5/18 and projected deposits and withdrawals from the model output attached in my previous post.

Net debt – Net debt issuance for the day (how the 92b in extraordinary measures remaining will get used). We know the timeframe for when 82b of those extraordinary measures will be used per the Treasuries announced bill auctions and the TBACs quarterly refunding guidance for coupons. I think the remaining 10b are most likely to be used with increased bill issuance of 5b each on 5/30 and 6/1. Doesn’t meaningfully change the analysis if all ten are used on 5/30 or 6/1.

Bills Discount – The amount of discount on newly issued bills relative to their par value (effectively how Treasury “pays interest” on the bills. They sell them for less than par and redeem them for par at a later date). I project bill discounts beyond 5/25 (no auction results yet) using the most recent realized price of the equivalent maturity bill. While the realized price on auction of those bills will change a little as bill interest rates move, it shouldn’t make a material difference. I also spread SOMA maturing amounts and net issuance roughly proportionally across the bills issuing that day.

I do not project any discount/premium for the notes/bonds issued on 5/31 though there likely will be one. On 5/15 there was 929m discount, on 5/1 it was 300m discount. Perhaps Ill be able to project one next week. I should be able to project next weekend once the auctions have been held.

TGA Close Balance – The balance in the TGA at the close of the day, taking into account net debt issuance and deficit (withdrawals – deposits). Note the value calculated on 5/18 is about 1.4b higher than reported on the Daily Treasury Statement. This reflects some shifting in extraordinary measures accounts which effectively means the remaining extraordinary measures would be increased by the same. I have no way of predicting those day to day fluctuations at present, but they should exactly balance out over time.

Remaining Extraordinary Measures – Amount of extraordinary measures remaining after the net debt issuance of the day is accounted for.

This represents a 10b shift down from the 11b I nowcast projected on 6/9 from my DTS Results post this past Friday (5/19). That shift is a result of four things.

1. I failed to include ~2.5 of under modeled deficit in that 11b number

2. My rough assessment of 25b due to missed bill discount and inflation protection increments turned into 26.5b on more precise calculations

3. I had not included the 1b in bond/notes discounts on 5/15

4. There are ~5b of extraordinary measures that seem missing to me. I calculate there should be 97b remaining as of 5/17. The disconnect happens on 5/15 (the TGA drops more than expected that date with the extra drop seemingly not reflected in increased remaining extraordinary measures. I do not have an explanation for it yet. Regardless, this analysis assumes they don’t exist and uses the 92b as reported by Treasury to reach the numbers it does.

With things this tight. It really does seem to be NowCast time using daily figures. I will keep posting Daily Treasury Statement projections and results on twitter and provide a further update next weekend truing up actuals from the past week and Treasury reported remaining extraordinary measures.

Thanks for reading!

John

Hi - what's driving your net debt forecasts for May 30 - May 31. Based on what treasury has announced, I see closer to -20bn and + 60bn respectively. Curious because you have TGA spiking significantly too and not clear what's driving that.

5/31 comes from TBAC qtrly refunding

https://home.treasury.gov/system/files/221/TBACRecommendedFinancingTableQ22023-05032023.pdf

though it actually should be 60.25 in "New Money" - 31.11 in QT = ~29b (i erroneously was looking at 6/30 issuance)

5/30 does look to be -20bn as announced this morning. When I wrote my article Sunday night I figured they would issue enough to replace maturing bills and tack on 5b more (to split what i thought would be 10b of remaining EM). That obviously did not turn out to be the case.

So now I expect they will probably do a ~35b CMB that will issue on 6/1 to use the remaining EM after 5/31.

Ill update the post to reflect. Thank you for pointing it out.