The notion that IRS cuts will result in 500b less revenue before April 15th is utter nonsense

Democracy Dies in the darkness of bad journalism

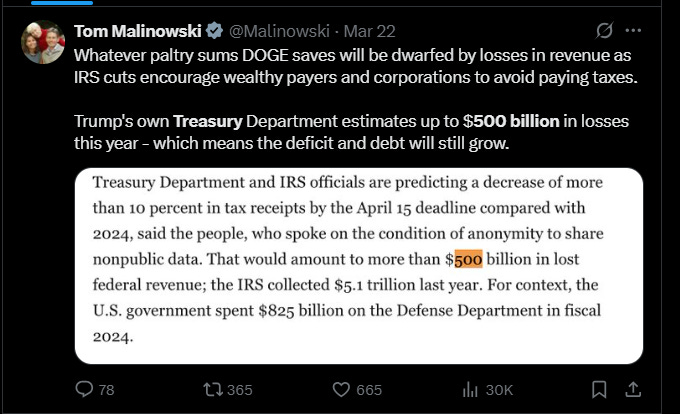

There were a variety of posts on X this weekend referencing a Washington Post article that cited anonymous Treasury Department and IRS sources claiming the Treasury would receive 500b less in tax revenue by April 15th vs. tax receipts in 2024. Here are a few.

and the article is here:

https://www.washingtonpost.com/business/2025/03/22/irs-tax-revenue-loss-federal-budget/

500b less by April 15th vs last year? A bold claim to say the least. Its also a claim that quickly becomes nonsense with even just a little due diligence which apparently the author, Jacob Bogage, either didnt do, or ignored the results of. Fortunately, I know a little something about the tax flows into the Treasury, so please allow me to assist in that diligence.

No more taxes between now and April 15th?

The only way Treasury ends the day on April 15th 2025 with $500b less in tax receipts than it had received by April 15th 2024 is if literally the tax flows just stop between now and then, including taxes from withholding, which is of course, utter effin nonsense.

The above table shows the fiscal year to date totals for the 4 significant tax deposit categories as reported in Table II of the Daily Treasury Statements for April 15th 2024 and March 20th 2025 (You can verify the data for yourself here: https://fiscaldata.treasury.gov/datasets/daily-treasury-statement/operating-cash-balance).

If tax receipts stopped cold turkey right now we would be just a touch more than 500b behind vs. last year come April 15th. Does anyone seriously think thats going to happen?

Where we are for tax receipts in 2025 vs 2024

Comparing apples to apples lets look at March 20th 2024 vs March 20th 2025

Uh oh….. looks like we are 35b ahead in 2025 vs. 2024. But wait John, the non-withheld and corporate income tax categories in 2025 are trailing 2024 so maybe 500b is overblown but there is a kernel of truth in the story?

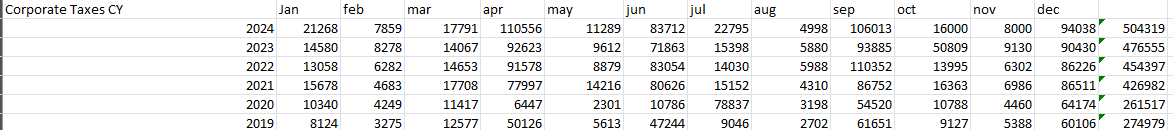

Yeah but…. The first quarter of FY24 (October 2023 thru Dec 2023) experienced about 70b more in non-withheld and corporate tax receipts than normal why? because the flooding in California in Jan 2023 caused the IRS to extend the filing deadline for most of California from April 15th to October/November 15th and shifted about 70b in tax receipts from FY 23 into FY 24.

The last couple of calendar years for each of the non withheld and corporate income tax categories are listed above to show how anomalous the October 2023 (and much lesser extent November 2023) receipts were because of the shift of California taxes from April to October of that year.

Adjust for that 70b and we are flat for corporate and +10b for self filers, in addition to the +95b for withheld taxes.

Can we track tax receipts between now and April 15th?

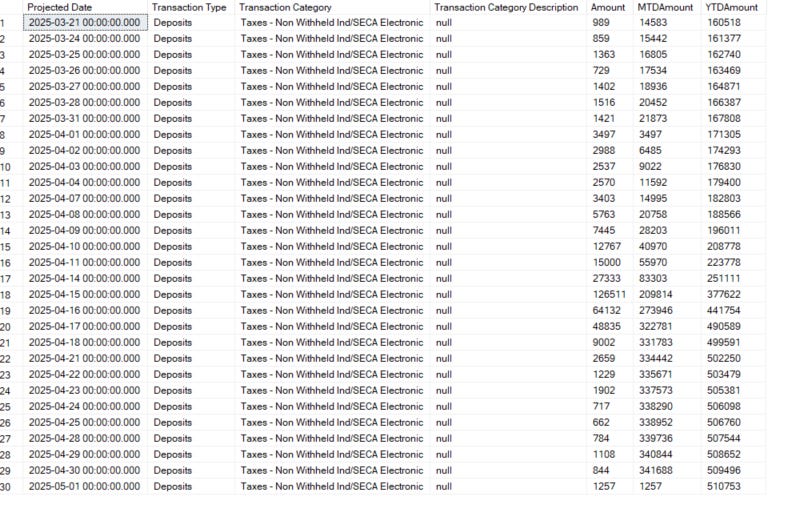

Why yes. My Total Treasury Model (“TTM”) projects the daily tax receipts and spending of the Treasury to predict things like the future path of the TGA level and what the Treasury’s financing needs will be with each Treasury Quarterly Refunding Announcement (“QRA”) and I do pretty well (seriously show me a Wall Street QRA projection thats done better)

The TTM is not perfect but its very close to Treasury at an aggregate level so its fairly safe to assume its generally in line with them on a per category level.

TTMs projections for Taxes through end of April

Withholding

Non-Withholding Electronic (people who dont file by mail/paper return)

Non-Withholding Electronic (people who do file by mail/paper return)

and Corporate

You can follow along at home by checking the Daily Treasury Statement from the Treasury each day and comparing actuals against what I project, I wont be perfect but Ill be reasonably close based on the TTMs historical record.

Conclusion

Reducing IRS resources could well encourage more tax fraud that ultimately reduces revenue to the Treasury, but 500b less vs. last year by April 15th is just fabricated bullshit.

Best,

John

Good work. Again.