The winter QRA is now complete. How did I do?

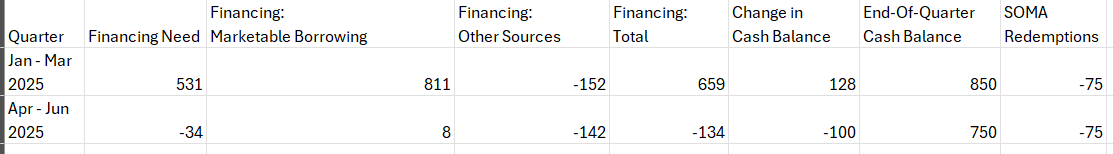

My final projection, made to paid subscribers last Friday and released on twitter Monday morning was

Actuals were:

Financing Need/Borrowing Estimate

Only 11b off on Q1 and 14b off on Q2, so pretty much nailed the financing need (the non-debt withdrawals (govt spending) - deposits (taxes) ) for the quarter. It appears that Treasury views the likely bumper crop of capital gains tax receipts similar to what I laid out in the Jan 6th post.

I was however off by 115b on the borrowing estimate. Why? because I incorrectly projected the end of quarter TGA balance to be 750b instead of 850b.

End of Qtr balance

This isnt a level that Treasury just arbitrarily picks. It reflects the risk policy level for the TGA, which the Total Treasury Model (TTM) calculates for each day. So the TTM in essence models out what this value will be. The problem this time was that

Treasury uses 50b increments. I dont know why they forecast the financing need and borrowing to the 1b but the TGA level only to the 50b. Its also unclear whether they use true rounding or just round down. Previous quarters vs. actuals suggested they rounded down. Now Im not so sure. The TTM run used for my initial QRA projection on Jan. 6 forecast a 795b end of qtr level, which i described as a coin flip 800 v 750 but opted to round down. A poor choice in retrospect.

I had to update the TTM after that initial projection for both some tweaks to better match it to actual January numbers but also to fix a significant bug that was causing Q2 interest paid on notes and bonds to be excluded from the model. I provided that update on Monday Jan 27th (before one last tweak on Friday) to update the financing need/borrowing but didnt check to see if the assumed TGA level needed to change. If I had I would have seen the TTM projecting an 825b close level for the TGA on June 30th. I would have rounded that down to 800b, but been closer.

So going forward I am going to project the precise TGA end of quarter level and not try to guess how Treasury is going to round it. It will never be right unless it projects something on a 50b increment but it will better convey how the TTM has the TGA modeled and forces me to update the number with any subsequent tweak I made after the original call

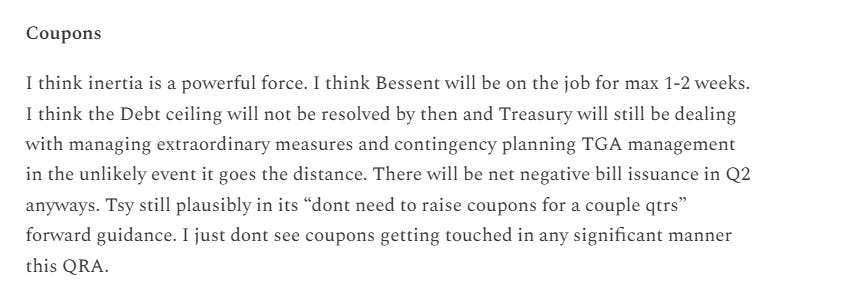

Coupons

My projection on Jan 6th for coupons was no increase of significance.

Given the first 2 weeks of this administration Im not sure how solid a leg “inertia” is to stand on anymore, but it really didnt make sense this QRA. There just isnt clarity on what the deficits will be over the next few years. Wil the TCJA be extended? What will spending cuts look like? Those questions are wrapped up with a need to raise/suspend/kill the debt ceiling. I dont think Treasury changes the issuance composition until they have that clarity. They forward guided to no increase next quarter as well.

Arguably the statement applies to the summer QRA as well but if the debt ceiling is resolved by then (and presumptively the clarity around what the deficits will be) . Then I think its the likely time for issuance composition changes.

6 week benchmark bills

Treasury finally made an honest woman out of the 42-day “Cash management Bill” that has been regularly issued every week since the TGA rebuild in summer 2023. Talk about a long engagement. This should also mean that the Federal Reserve will start buying some with the proceeds it reinvests from maturing bills. At a 60b coupon cap for QT this would have made a difference on the realized runoff for some months, but at 25b cap it shouldnt since coupons should always hit that until QT ends.

Buybacks

Treasury is going to keep doing buyback for liquidity support. Not necessarily a surprise.

What is sort of a surprise is the ~60b buybacks for cash management purposes. That statement combined with their guidance on issuance variability and significant usage of CMBs means a very difficult to project bill issuance pattern.

Conclusion

Im unsure what the Wall Street research houses were projecting (if you know Id love to hear about it in the comments) but Im confidant my projection was among if not the best on the financing need.

Whats Next for the TGA?

The extraordinary measures have not run out yet but that day is coming soon. As I discussed in my debt ceiling post on Sunday, I am updating the TTM to project the trust fund growth and shrink at a daily level. Next post will describe how I have manage to do that and make a more precise projection of the TGA path as the drawdown starts.

As always. Thanks for reading.

John

I'm not sure if I understood correctly: Bessent is going to continue issuing short term bills and drawing from the TGA until the debt ceiling is lifted right?

Cc cc c