Winter QRA wrapup and Treasury Model update

The buybacks are coming, the buybacks are coming

******Note for Mortgage readers….. FHA MBS data should drop Monday afternoon, post by Tuesday night******

I have to admit, I did not have 60b in Treasury cash management buybacks in March/April on my QRA bingo card (I was anticipating only 30b) but it strikes me as a good move on Treasury’s part to blunt the edge of the huge TGA level rise with Aprils tax receipts without requiring even more sharp reductions in bill issuance than they will already do in March. I expect this will become the norm going forward.

Other than that surprise, the QRA went largely as expected.

No change in coupons

Treasury Financing Need estimates for Q1 and Q2 higher than mine, but not hugely so.

Assumed TGA level for end of June at 900b

Coupons

At some point Treasury will change the nominal coupon issuance, but it may be a while yet.

Not only did Treasury leave the coupons alone this QRA but their forward guidance indicates continuing to do so for “at least the next several quarters”. Their mention of the SOMA Treasury bill purchases is also noteworthy. Treasury understands that those purchases will soon enough reduce Treasury’s need to issue bills (or coupons) to the rest of the public. The Fed indicated these purchases would slow down after April. How much they slow it will likely be a significant input to Treasury’s coupon levels calculus late this year.

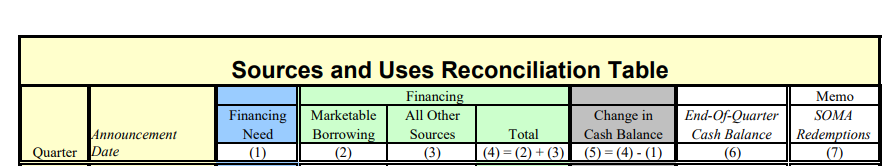

The QRA numbers from Treasury

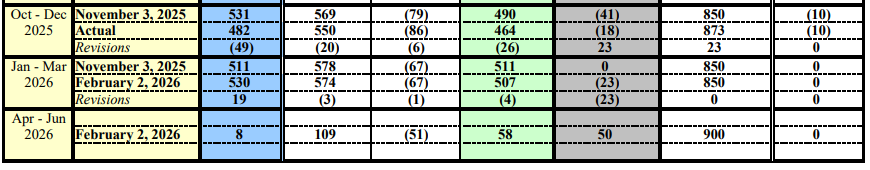

My final call from last weekend:

I am 52b less financing need for Q1 and 70b less financing need for Q2.

When I first started making these projections I graded myself on how close I got to Treasury’s projections. Not anymore. The actuals are are my measuring stick now. Note the 49b downward revision Treasury had to do for Oct-Dec 2025. The TTM was only 23b higher in my last projection before the Fall QRA. Thats my measuring stick now, for better or worse. The realized financing need for Q1 and Q2 will likely come in between my number and Treasury’s, but I bet both come in closer to mine.

900b End of June assumed TGA level

Note that I never call it a target because its not a target, its just the amount (to the nearest 50b or the 50b right below) that Treasury expects will be in the TGA on the last day of the quarter. Treasury’s “target” is to keep the TGA always above (but as close to it as they can manage) the risk policy level of week ahead net TGA spending less receipts + gross debt maturities.

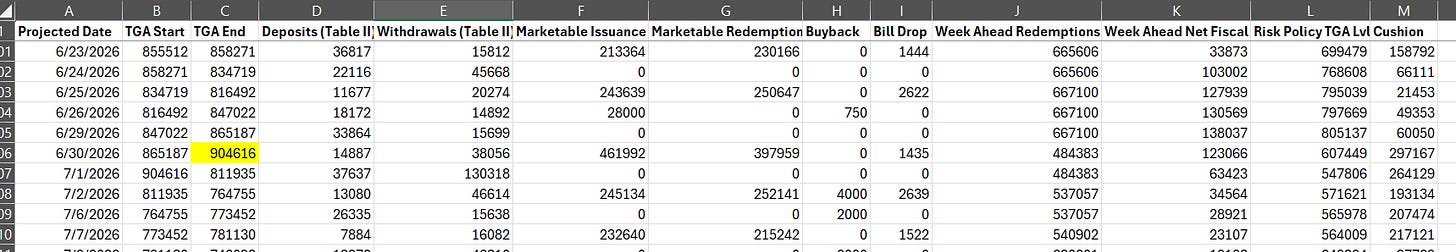

Regardless the 900b was not unexpected. Wait a second John you literally called for 850b. Thats true, it was a boardline call though and the TTM literally projected 905b at the close of 6/30 as paid subscribers knew from the model output.

I probably should have updated the call to 900b in my final update but in the past in these borderline cases Treasury has tended to assume the next lower 50b so I didnt.

Bill Issuance

The bigger cash management buybacks near tax day, in particular the two in March, did have a practical impact on the bill issuance pattern pushing back a week in my modelling for when Treasury is likely to start reducing bill issuance rates for the short tenor bills in advance of the April receipts. That then ripples through the rest of the fiscal year and I had to make some adjustments to the expected further reductions in May and June and increases in July.

TTM performance

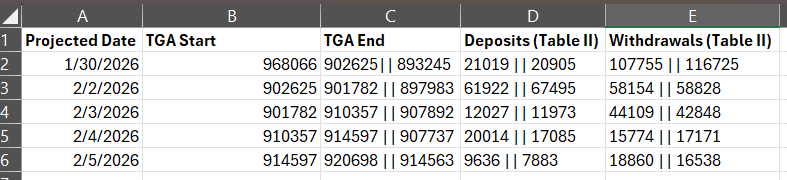

The TTM has done well through the first week of Feb. Judge for yourself. The number before the double pipe is the published projection for that day (from last weeks model output available in full to paid subscribers). The number after the double pipe is the actual figure for that day as published in the Daily Treasury Statement.

I did make a material adjustment to the model this week though. I significantly adjusted up expectations for the HHS - Medicare Prescription Drugs category. When I overhauled expectations at the turn of the fiscal year I thought spending in this category would drop some based on projections in the Medicare Trustees report and the grand pharma “deal” Trump was Trumping about last summer. Nope, spending in this category seems on track to go from ~162b last year to 194b this year. This weeks model output reflects this change and 2 other minor adjustments/bug fixes to other categories. In net the TTM is projecting a little more financing need Q1 and Q2 as a result. So if I was doing a QRA projection today the numbers would be 485b for Jan-Mar and -48b for Apr-Jun. So still a good bit lower than Treasury’s but up a little from my final QRA call.

If reasonably accurate projections of the path of the TGA, months in advance projections on bill issuance changes and daily projections (again reasonably accurate) on every TGA spending and receipt category are of interest to you, please consider becoming a paid subscriber.

Thanks,

John

Full Model Output for paid subscribers below the paywall.