Winter QRA projection and Treasury model update

Is the fiscal deficit train slowing down?

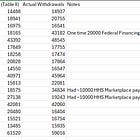

In my last Total Treasury Model update a few weeks ago I noted that the actual financing need for Treasury in the October-December quarter was ~486 billion dollars, a full 45b less than Treasury projected (though only 19b less than the 507b the TTM projected right before the QRA) in the Fall QRA in early November.

That trend of shrinking financing need in FY26 looks likely to continue as the non-withheld tax receipts received via EFT in mid January were strong though we wont know the full extent of the strength until the paper checks come in over the next week and a half.

I recognize that we are in a mid term election year that the current administration is likely particularly driven to win and that often leads to policy responses that involve spending. So perhaps the train speeds up with policy actions not yet taken, but at least for now, it is slowing a bit in the actual data and putting aside potential midyear shenanigans, I expect that to continue through the end of the fiscal year.

Projecting the Winter QRA

The winter QRA is the most challenging to project and Treasury’s error between QRA projected and actuals over recent years bears that out. The reason its tough to project is not due to regular spending. By this point in the fiscal year there is enough data to inform good projections on the big spending categories (Social Security, Medicare, Medicaid etc.). Surprises occasionally occur in these (and the smaller) spending categories, but they often miss in opposite directions vs. whats modeled thus netting out and keeping the models headline financing need projection close to what gets realized.

The challenge is projecting the April tax receipts and projecting the tax refunds which are mostly paid out in the early February to June time frame.

Individual tax refunds have been very consistent over the past 3 years clocking in at 298.5b in FY 23, 298.9b in FY 24, and 302.7b in FY 25. This fiscal year however, they should rise markedly due to tax policy changes in last summers budget reconciliation act (the One Big Beautiful Bill). The act contained significant tax cuts (no tax on tips, SALT increase, auto interest deduction etc.) but the IRS did not adjust the withholding tables after the the OBBA became law. Thus, folks were more likely to overpay on their withholding last year. The tax foundation estimates these income tax cuts at a total of 129 billion. But… assuming they are correct, will all of that actually translate to higher refunds or lower receipts when folks file by April 15th. People are not always the most efficient with their taxes.

Complicating the picture is the other big impactor on April Tax receipts, capital gains taxes. I did a detailed dive into capital gains tax receipts last year in my 2025 Winter QRA projection piece if you are interested in the mechanics behind how I make my projections.

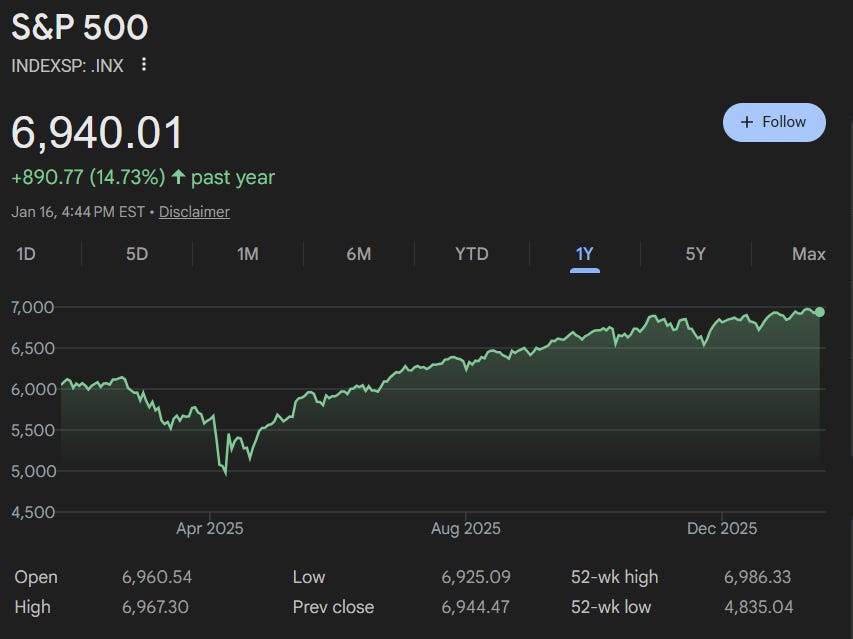

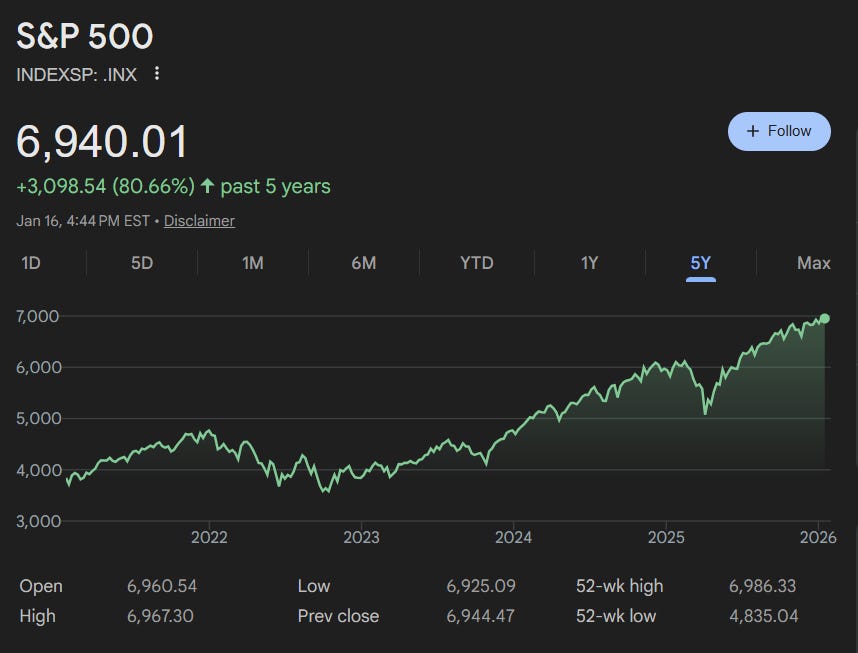

For this year, the setup is largely the same. The April/May tariff drop aside, the S&P 500 rose steadily last year ending the year near all time higs.

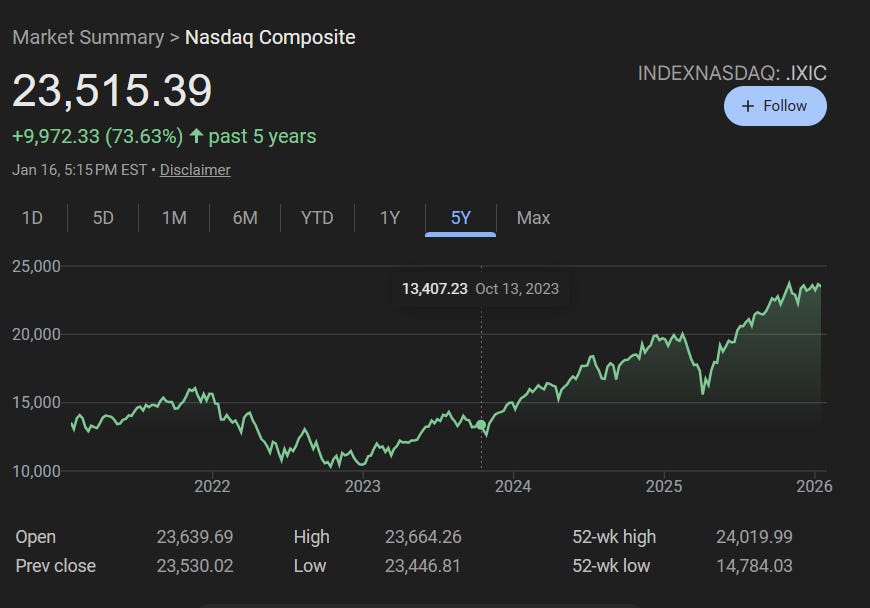

same generally with the nasdaq and russell 2000

If you bought and sold a stock after holding it for a short time period, April/May aside, you were likely realizing a capital gain.

If however you bought and sold a stock after holding it for longer than a year. You were very likely realizing a capital gain and probably a fairly large one

less pronounced with the russell but still likely a capital gain here if selling in 2025.

The bottom line being that capital gains taxes should be strong again this April.

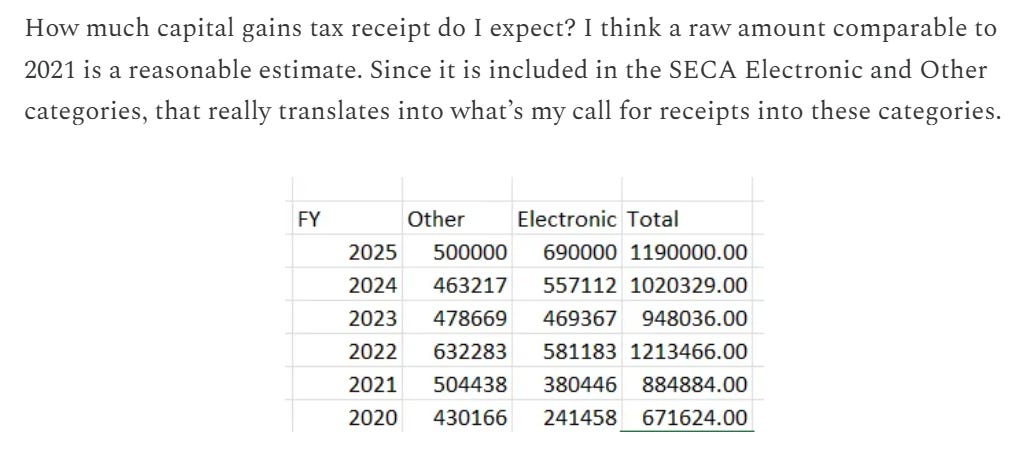

So whats the call then on the non withheld electronic (EFT) and other (paper checks) total receipts for FY 26 which is where the capital gains taxes will be felt?

Last year in early January I projected 1.19T combined across the categories.

The categories finished at 686.3b Electronic and 466.7b Other, so 40b light of my projection. But…… I wrote that piece/projection prior to the LA County fires and their impact on delayed receipts. which looks to be around 30-40b that shifted into FY26 from FY25 so my projection was very close though my split EFT v. Other was a little off since adjusting for the delayed receipts was ~ 715b Electronic, 470b Other. My projection for this year is

Electronic - 810b and Other - 470b

That reflects both non capital gains growth in income tax, strong capital gains tax receipts, shift of ~35b from FY25 to FY26 due to LA County fires as well the impact of lighter receipts due to some of the OBBB tax policy changes.

My projected impact on individual tax refunds is withdrawal growth from ~303b to 370b.

Other impacts to FY26 spending

Tax receipts/refunds are the biggest wildcards for projecting the Jan-Mar and Apr-Jun financing need but there are other receipts and spending changes that are having an impact this year vs. last

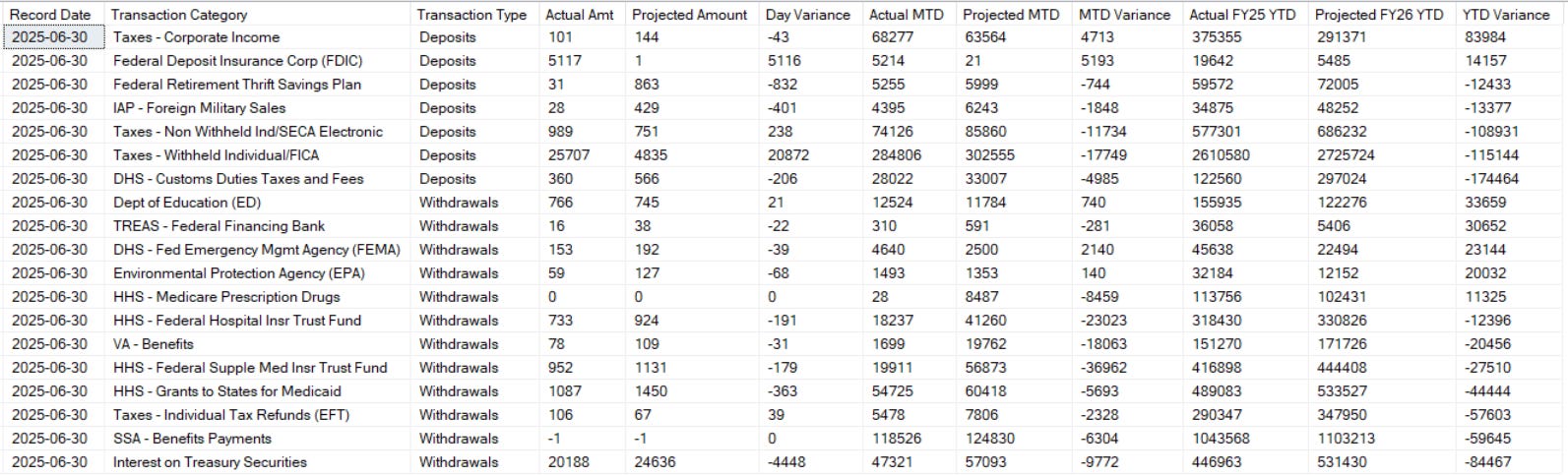

When I run a comparison of the current Total Treasury Model projected output for TGA categories on June 30 2026 vs the actual output for the same categories last year, these are the meaningful differences.

Lighter expected corporate income tax receipts more than offset by considerably higher withheld and non-withheld income tax receipts. Plus a significant impact from tariffs.

For withdrawals, the lowered student loan limits are having a meaningful effect on Dept of Education outlays and some of the FEMA and EPA gorge spending early last fiscal year was not repeated.

On the other hand, growth in interest on Treasury securities and growth in social security and medical spending continues to expand.

Putting it all together - Winter QRA projection