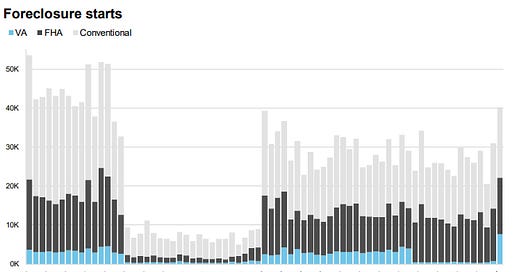

The moratorium on VA foreclosures expired in December and there was a sharp uptick in VA foreclosure starts in January

Is this the start of a large wave of forced sales/foreclosures like what FHA will likely experience next year?

No.

Per my modelling, the VA has the situation under control. Their new loss mitigation workout, the VA Servicing Purchase modification (aka “VASP”) will provide a meaningful payment relief option to nearly every seriously delinquent loan in their portfolio. I know because I have calculated the arrears on and simulated loss mitigation for every VA loan in the GNMA_II MBS for February, all 3.6 million of them. I provide the detailed numbers on the seriously delinquent loans later in the piece.

VASP also doesn’t leave behind troubled mods originated over the past 2 years. There are far fewer of them in the VA portfolio vs. the FHA portfolio but VASP offers those loans a realistic solution too, something the FHA permanent waterfall does not do for the struggling borrowers who got saddled with a Modification of Doom.

While not without some controversy, VASP is also not extend and pretend. It is an end game solution that requires regular payment. It will absolutely be effective at giving struggling Veterans one last fighting chance to retain their homes, but nonpayment from there will result in forced sale/foreclosure.

To be sure, there will be a modest wave of forced sales/foreclosures on VA loans this year as borrowers with either no intention to pay or severely lacking a present ability to pay on the mortgage finally shake out this year into a post-VASP normal. But modest is likely the extent of the wave, a much more gentle return to normal foreclosure activity versus the shock likely to hit the FHA portfolio after next February. The VA seems likely to achieve a “soft landing”.

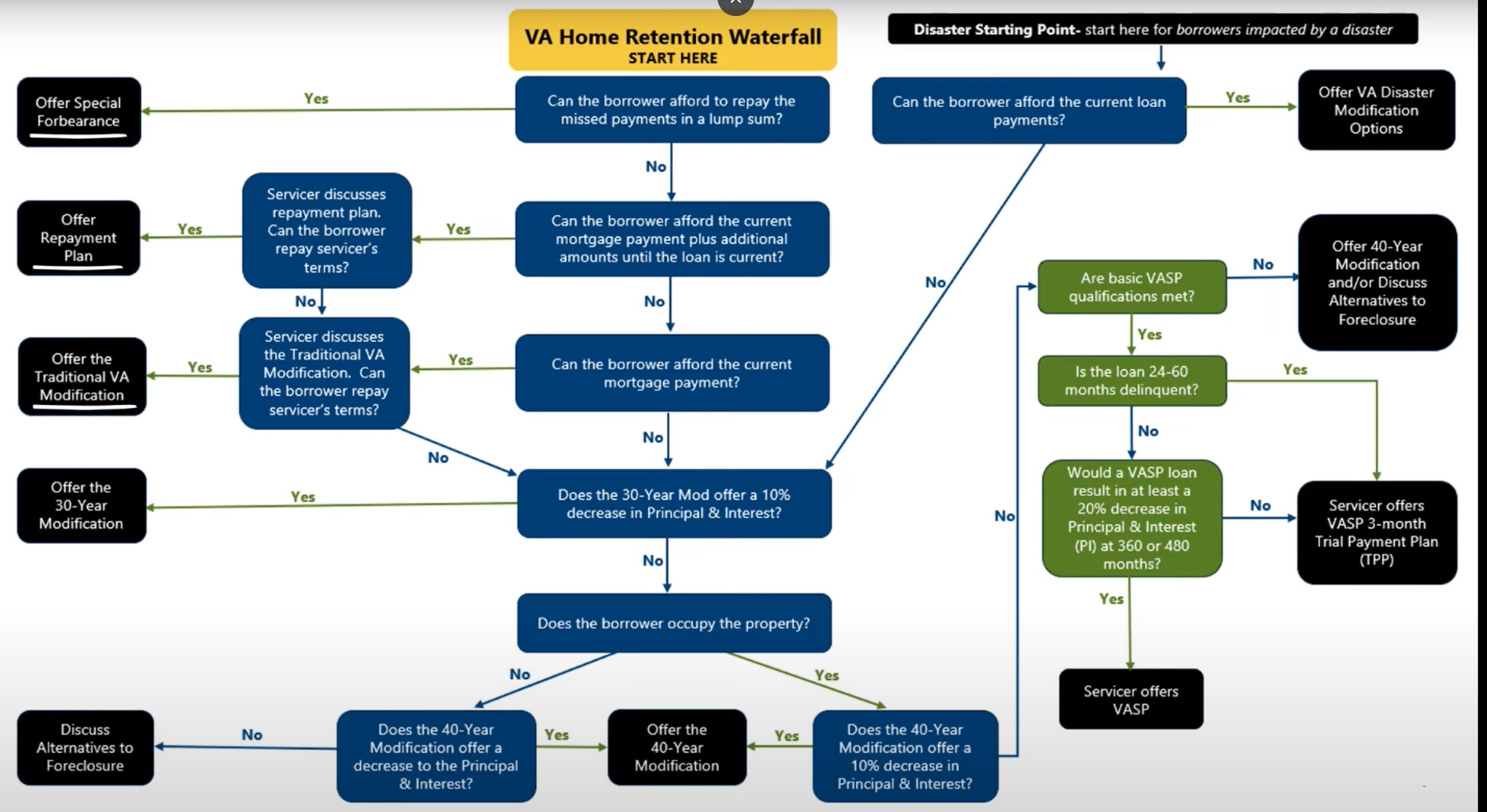

What is VASP?

The VA Servicing Purchase (VASP) program is a new home retention option in the VA Loss Mit Waterfall. VASP was introduced in May 2024 with mandatory servicer adoption by October. Under VASP, the VA purchases seriously delinquent VA-guaranteed loans from servicers and then immediately modifies them to a 2.5% rate at either a 30 or 40 year term to hit a target payment reduction of 20%. Post purchase the VA becomes the owner/holder of the loan and carries it on its own book with servicing functions on the loan transferred to a contracted servicer. From that point forward the loan will not return to MBS pools.

Where does VASP fit in on the VA waterfall?

VASP is the “last resort” option in the VA loss mit procedures (aka waterfall), though for most borrowers these days it is basically the only option.

The reason for that is that there are very few borrowers who are able to both resume their mortgage payment and either repay the missed payments in lump sum or make an additional payment on top of the mortgage payment for 12-24 months to repay the arrears. If you are not one of those borrowers and need to add the arrears to the loan balance than you need a modification, and those modifications (the Traditional, 30-Year, and 40-Year) all involve setting the interest rate to market

Modifications that set the new interest rate to market work fine when market interest rates are lower than the rate on the mortgage or possibly if the mortgage was very far along in its amortization schedule. Given the makeup of the VA portfolio though (Still heavily skewed towards pandemic era interest rates) there are very few present day VA mortgages for which even the 40 year mod can achieve a 10% reduction in payment with rates where they are today. I present the specific numbers below.

You might note that unlike FHA there is no “partial claim” option in the waterfall for the VA to cover the missed payments while the Veteran resumes the payments. During the Covid response, the VA did temporarily perform partial claims initially stand alone to cure the arrears from Covid forbearances and then in combination with modifications (that set rates to market) to cover arrears and reduce principal in an attempt to keep the payment from going higher due to the increased rate of the mod.

There were two problems though 1. Rates became so high that even with a 30% principal reduction (the limit the VA set for partial claims with modifications) it was challenging to provide any meaningful payment relief (essentially the same problem the FHA faced) and 2. The statutory/funding authority for the VA to buy just a portion of the debt in a modification of a servicer/holders loan (which is what is happening when they do a “partial claim” in conjunction with a modification) is murky and doesnt exist for a standalone “partial claim” outside of extraordinary disasters like Covid.

VASP, on the other hand, is not subject to either of those problems.

38 USC 3872 (a) (2) provides the VA clear authority to purchase defaulted loans in full from a servicer/holder.

Because the VA now holds the loan, it can modify the terms of the loan as it sees fit to achieve meaningful payment relief which is what the VA did by setting the VASP rate at 2.5%

VASP also provides a solution for the Veterans who received modifications over the past two or so years that significantly raised their rates. There are significantly fewer of these in the VA portfolio than the FHA portfolio due in part to a VA rule that required loan modifications that raised the interest rate by more than a point to be pre-approved by the VA so they could review whether the modification was in the Veteran’s best interest, but also due to the VAs use of foreclosure moratoriums (not strictly required but heavily suggested that the servicers abide by) to “pause” the problem until they could get VASP rolled out.

Similar modifications in the FHA portfolio are likely doomed when extend and pretend stops for FHA. The payment supplemental partial claim should now fix most of the ongoing growth of the problem mods for the FHA but it does nothing to help the borrowers who already received one. Vastly different endgame outcomes for borrowers who knew how to play the FHA partial claim game vs. not.

In contrast, VASP puts the Veterans who received one of those mods on mostly equal footing with Veterans who received a partial claim before that temporary program expired but kept their rate. They both can avail the “last resort” loss mitigation option which will in almost all cases provide the Veteran a meaningful shot at affordability.

Restrictions on VASP

There are three notable restrictions on VASP.

It is only available to owner occupants

It is not available to Veterans who have not made at least six payments on their loan (or most recent modification)

It is not available to Veterans who are more than 60 months delinquent

I am able to account for 2 and 3 in my loan level loss mit simulations over the VA portfolio but have no way of knowing #1 so I assume all loans are owner occupied. That is, of course, not the case but you will have to apply your own estimations for the non-owner occupied rate.

How effective will VASP be?

VASP will be remarkably effective at providing Veterans meaningful payment relief and thus will be likely to lower the mortgage payment to something the Veteran can afford preventing forced sale or Foreclosure.

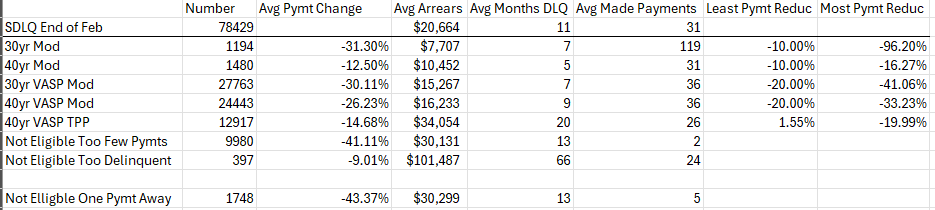

For example, last month 4632 VA loans were removed from MBS pools in order to conduct loss mitigation. The following table shows the results of the Loss Mit simulation on each of those loans and where in the Loss Mit waterfall they landed.

Note first how few (153 in total) loans would achieve at least a 10% reduction in payment under the traditional 30yr and 40yr modifications.

VASP on the other hand provides very meaningful payment relief to 3759 of the 4632 loans. Averaging 30% on the loans that fall to the 30yr VASP modification and 26% on those that fall to the 40yr VASP modification. Furthermore there is another 247 loans that dont quite reach the 20% payment reduction but for whom VASP will be offered assuming the borrower can successfully complete a 3 payment trial payment plan. But on average these borrowers will receive a nearly 17% payment reduction which while not 26-30% is still fairly meaningful.

There are 470 loans that are not eligible for VASP primarily because VASP requires a borrower to have made at least 6 payments on the loan, an important safeguard against abuse of the program and something that is lacking even in the permanent FHA Loss Mitigation procedures. Of those there are 86 loans that are 1 payment away. I think it is reasonable that most of those will make another payment in the next month or two to become eligible for VASP. All told, about 4200 of the 4632 pulled for loss mitigation will almost certainly receive a VASP modification and conversely only about 400-500 that are likely to end up in some sort of a forced sale/foreclosure situation.

Expanding to the full set of seriously delinquent loans as of the end of February and we see broadly similar numbers.

Within the current VA serious delinquencies it appears there are maybe 10,000 that are likely to go to forced sale/foreclosure. To be sure, now that the moratorium is over these loans likely will, but its a very different situation that faces the VA portfolio today vs. what is facing the FHA portfolio.

Why the 2.5% Rate?

One significant source of criticism of the VASP program is the 2.5% interest rate the VASP modifications carry. But if the VA’s goal was to create a Loss Mitigation option that offered a broad range of Veterans meaningful payment relief and one last shot at remaining in their homes, the VA had to go low.

To illustrate. The following tables contrast a theoretical 4.5% VASP interest rate vs. the 2.5%. At 4.5%, VASP just wouldn’t have been very effective.

At a VASP rate of 4.5% the VA would likely be facing 50-60k forced sales/foreclosures from the set of loans that are currently seriously delinquent. Thought of that way, its easy to understand why the VA made the policy choices they made.

Does a VASP Modification guarantee that loan wont be foreclosed on?

No it doesnt. Veterans receiving VASP modifications get meaningfully reduced payments, but they must actually make those payments. It is the “last resort” option on the home retention waterfall.

The program is very early on so its difficult to draw conclusions on what the “redefault” rate for VASP modifications will be. That information will also likely not be readily available either since these loans are now held as portfolio loans by the VA directly, instead of being in the MBS pools. The executive director of VA Loan Guaranty, John Bell III, did provide a glimpse though during his March 11 appearance before the House Subcommittee on Economic Opportunity, testifying that of the ~15,000 VASP modifications that had been performed so far, 31 of them were in the foreclosure process. Small but not nothing and the program is very early on.

Will VASP Modifications cause strategic nonpayment?

Its certainly possible. While a 2.5% rate was necessary to provide a meaningful payment relief loss mit option to the near entirety of the portfolio, it does also create a significant financial incentive for some Veterans with higher mortgage rates who are not struggling to strategically default, take the credit hit for a while and receive a 30yr 2.5% rate. The VAs requirement of 6 months of payments on the loan does place a notable hurdle to just blatant gaming of VASP, particularly with new originations but it cant prevent it.

Will Veterans take advantage of it? Personally I think many will, there is a thread of honor that binds almost every Veteran that Ive interacted with that I think will act as the big restraint on gaming the system. Is that a naive vantage point? Perhaps. There will probably be a little gaming of the system but I dont think it will be large.

Is there evidence of it in the data? Tough to tell. One way to look for it I think is by watching the ratio of borrowers 1 month delinquent, who make a payment that month (either staying at 1 month delinquent or making 2 payments to return current) vs those who do not (advancing to 2 months delinquent) and likewise with borrowers 2 months delinquent. Those pay ratios also reflect other things like seasonality and economic conditions but if there was widespread gaming of VASP it should show up as signal.

The pay ratios for each for the VA portfolio are down a little over the last year which could be interpreted as evidence of gaming. But the ratios for the FHAs are also down over that time frame and the way the two portfolios track so well month to month with the ups and downs suggest to me that underlying economic factors that impact both portfolios are the more likely explanation.

It is a measure I will continue to watch and expand the granularity of in future reports.

Conclusion

There will certainly be more foreclosures in the VA portfolio this year with the expiration of the moratorium in December and the shakeout of those loans where the borrower is either unwilling or severely unable to pay , but the effectiveness of the VASP program at delivering meaningful payment relief to a broad set of Veterans struggling with their mortgage payments implies the increase will be relatively modest. Put in central banker terms, it appears the VA is on track for a “soft landing” back to a new normal in foreclosure activity in stark contrast to the very “hard landing” that likely awaits the FHA next February.

As always thanks for reading

John

John...safe to say things changed with VA defaults on Friday