The mortgages on properties likely affected by the Palisades fire are not typical with some interesting implications on who holds the residual risk of loss.

The Data

The data I present will not perfectly reflect the actual mortgages in place as of a week ago when the fire started, but it should be broadly representative. I draw this data from HMDA origination filings for Single Family 1-4 units from the years 2020-2023. I specifically exclude the 2018 and 2019 filings because I suspect/assume that these loans were refinanced during the pandemic. I cannot say for sure whether those originated in 2020-2023 have been prepaid or not but I think its likely that most of them are still active.

Geographically, I limit the data to the following census tracts: 9800.19, 2626.01, 2624.00, 2626.04, 2625.01, 2627.06, 2627.04, 8005.06 whose geographic area aligns with the footprint of the Palisades fire. I cannot determine what percent of these mortgages are on homes that have been destroyed but given the images of entire neighborhoods being wiped out I think its likely that many of them are.

The property values and thus loan amounts are of course very high in this geography.

Types of Loans:

FHA: 1 - Honestly a bit surprised there was any at all

VA: 16 - Including 4 with loan amounts > 2 million dollars with the highest being 3.995 million. Perhaps surprising to some, but there is no limit (aside from the property value) to the amount of the 25% guarantee the VA will provide on a loan to a Veteran with unencumbered entitlement (e.g. no other VA loans using entitlement). Conforming loan limits are irrelevant in such cases.

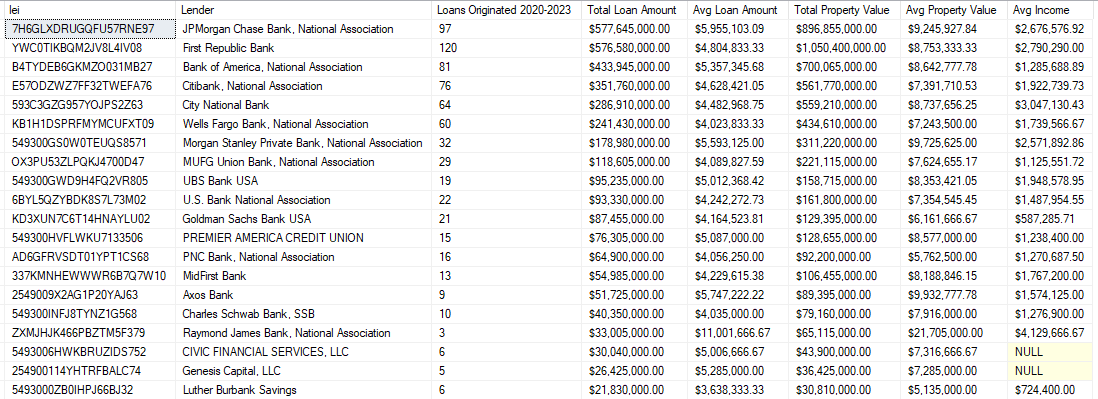

Conventional: 4,889 of which 1,462 were at or under the conforming loan limit (789 sold to FNMA/FHLMC) and 3427 were over it. In total 3430 of the 4889 conventional loans were originated with a HMDA purchaser_type of 0 - Not Applicable. Put differently, it is likely that these 3430 loans were never sold and are still on the books of the originating institutions and thus they bear the residual risk of loss. This is very different than the mortgage lending profiles for most geographies where the significant majority of mortgages are ultimately backed by the taxpayer (FHA, VA, GSEs). So who originated these loans? The top 20 by total loan amount

Are these banks really at risk of residual loss though even if the structure was fully destroyed? Well three things potentially stand in front of that:

Insurance coverage

Value of the land

The other assets of the borrowers

Insurance Coverage

These mortgages will have required the properties to carry fire insurance. Of course, we have all heard how insurance companies have recently dropped coverage on properties in the Palisades (1600 by State Farm last July per reports). When a lender non-renews coverage on a mortgaged property, its on the borrower to replace that coverage with satisfactory coverage from another insurer and if they dont/cant, the lender will take out and “force place” a policy on the property and charge the borrower for it. So in theory there is always some sort of policy in place to protect the lender. Coverage timing gaps can happen though if the lender is sloppy but given the size of these loans I doubt it would happen here. Coverage amount gaps can also happen if the lender themselves are unable to purchase sufficient coverage for the property because no insurer private or public will provide it. Technically, the lender could declare default in such case but given the nature of the borrowers that seems unlikely. Rather, the lender/borrower would be forced to resort to the California FAIR plan. The FAIR plan limits each property to 3 million, which for the most part would be sufficient for the lenders given the avg loan amount, but not for all of these mortgages. The top 20 lenders by total loan amount for loans with loan amounts > 3 million dollars.

Value of the land

Fire destroys structures not the land itself and in the case of the Pacific Palisades, that land is highly desirable and thus valuable. In a recent interview with KTLA, the LA County Tax Assessor noted that 2/3 of a property’s assessed value is the value of the land itself. That would provide the banks considerable protection even for the high amount mortgages; though given the scope of the destruction and likely length of the rebuild that land value may take a hit for a while.

Other Assets of the Borrowers

Purchase money loans in California are non-recourse; meaning the lender can foreclose on the collateral (house/land) securing the loan but they cannot pursue a deficiency judgment to try and recover any loss exceeding what they get at foreclosure from the rest of the borrowers’ assets.

Refinance loans in California, however, are recourse loans. Of the 3430 lender held (likely lender held anyways) loans originated from 2020 thru the end of 2023, nearly 2/3s of them (2151) had a refinance loan purpose. Sometimes lenders will forego pursuit of deficiency judgments on recourse loans even when they expect a loss after foreclosure because the judicial foreclosure process is too expensive/slow vs. any recovery a deficiency judgment might provide them, but with loans of this magnitude and the wealth of the borrowers I doubt that would be the case here. The loans > 3 million with avg income of the borrower.

Summary

Even though banks hold way more residual loss risk on mortgage properties in the Palisades than is typical for most geographies. I dont think much loss will make it past the insurance companies and borrowers and ultimately fall to them.

As always thanks for reading.

John