Updated Treasury Model and Final Look at Winter QRA

What about the coupons?

Non-withheld Income taxes in January finished (through the penultimate day of the month anyways) notably strong:

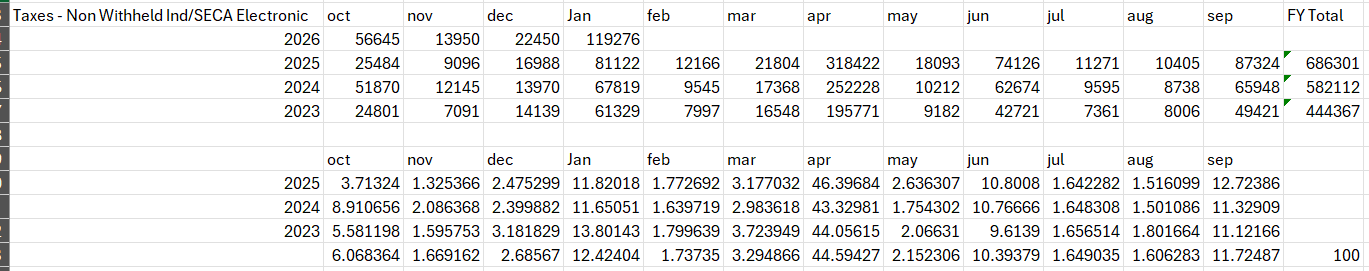

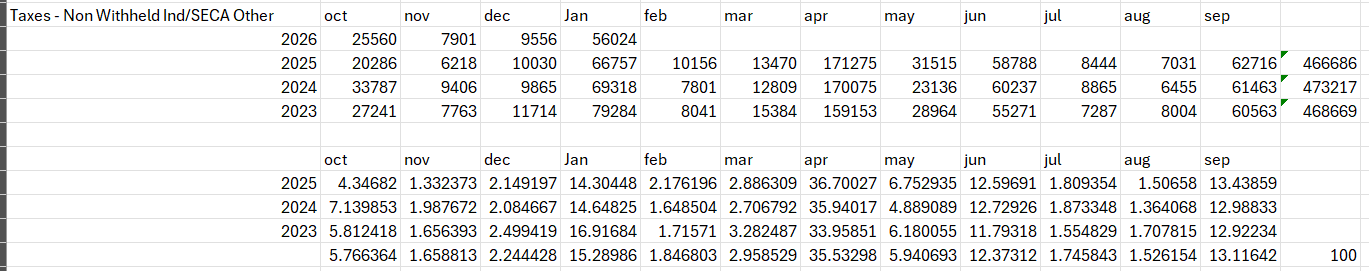

The numbers with the preceding 3 fiscal years of context:

Electronic (EFT) receipts ~+40b over last January:

Other (paper checks) receipts ~-10b over last January:

A net increase of ~30b over last year which supports my posit that capital gains tax receipts will be heavy again this April (though it also indicates that the Jan/Apr percentage share of the overall fiscal year take will probably more closely match 2023 than 2025). I updated the Total Treasury Model (TTM) to now expect a total of 1.29T in non-withheld income taxes for full fiscal year 26. This is split 840b for electronic receipts and 450b of other/paper receipts and represents a 10b overall increase to what the TTM had in mid January.

Other TTM updates

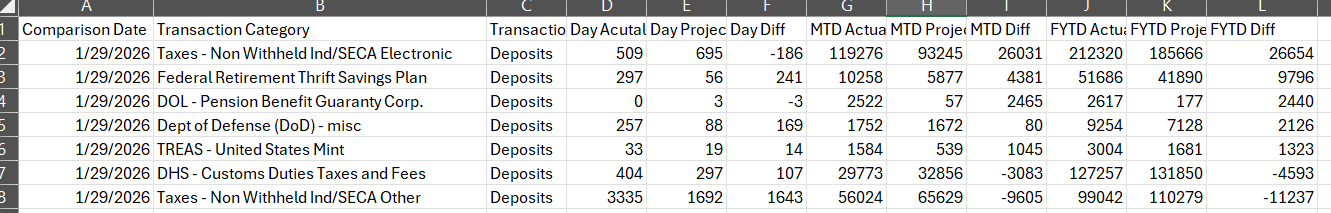

In addition to the non-withheld income tax updates. I updated a number of other categories where the projected amounts were straying from the actual amounts. Some of that stray is due to anomalous receipts/outlays that I just hardcode in as having happened, but some of that stray is structural vs. what I had previously modeled (e.g. non-withheld taxes) and I update those categories in such a way that future expectations are impacted. The list of modified deposit categories are:

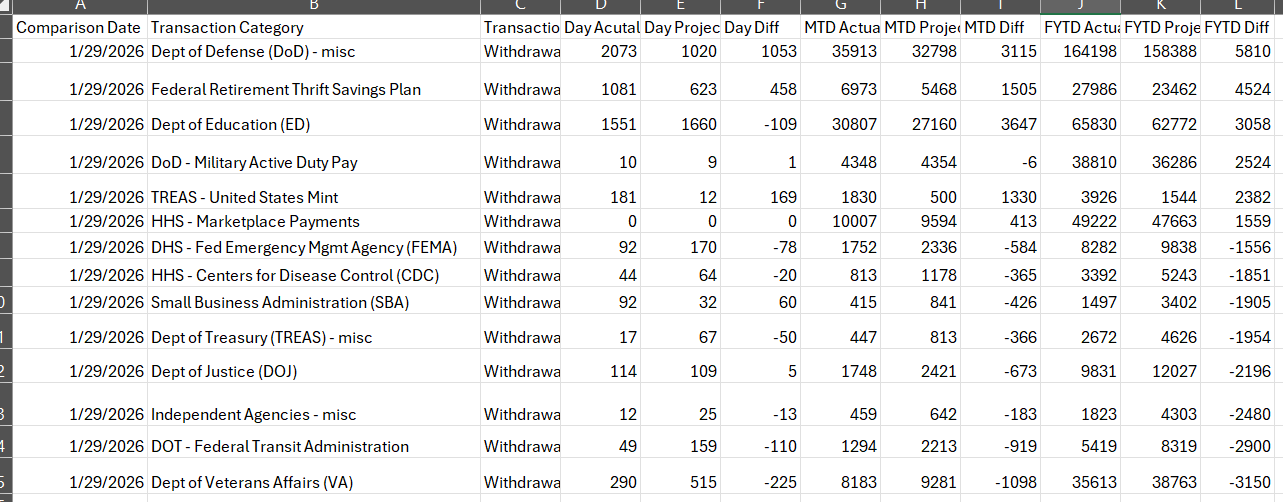

The list of modified withdrawal categories are:

I perform these updates every couple of weeks to give the model the best chance to be accurate with its future projections.

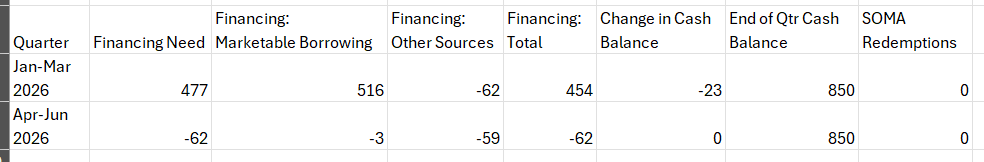

Updated QRA call

Jan-Mar is 27b lower on the financing need than my initial call a few weeks ago reflecting in significant part the higher realized January tax receipts.

Apr-Jun is nearly unchanged at 2b higher

Coupons

I neglected to make a call on coupons two weeks ago, mostly because I dont expect Treasury to change them. I would be shocked if they increased them meaningfully (meaning more than some 1b increase to a TIPS or FRN issue), particularly now that the Fed is buying significant amounts of treasury bills which will reduce the marketable borrowing pressure on Treasury further when those bills start maturing in the march to may timeframe. I think it is also useful to look at the projected net issuance of coupons and bills between now and the end of June. (the full model output for paid subscribers shows the projected net issuance on every day treasuries issue/mature).

For coupons that net issuance is ~ 678b. For bills that net issuance is ~ -57b. Granted the Jul-Sep figures are much more balanced at 330b and 317b but I just cant see Treasury increasing it this QRA or the Spring for that matter, maybe Summer.

I think its more likely Treasury would use the Feds purchase of T-bills and the accompanying reduced marketable issuance needs of Treasury bills as potentially a justification to reduce coupons in the short term so they can continue to supply the amount of bills that the market “desires”. I dont project this, but I would be less surprised by this outcome than I would be if Treasury opted to hike coupons.

Full Model Output

Paid subscribers receive the full updated model output every couple of weeks with daily projections of future Daily Treasury Statement content thru the end of FY26 including :

Daily projections of the start and close level of the TGA each day

Projections of every deposit and receipt category every day

Projections of all treasury issuance both announces and yet to be announced. I am am able to closely project the timing and extent of changes to bill issuance

Thanks for your support,

John

Model output is below the paywall.