Treasury Model 2026 Update and early peek at Winter QRA

Can a substacker beat Treasury for 3 straight quarters?

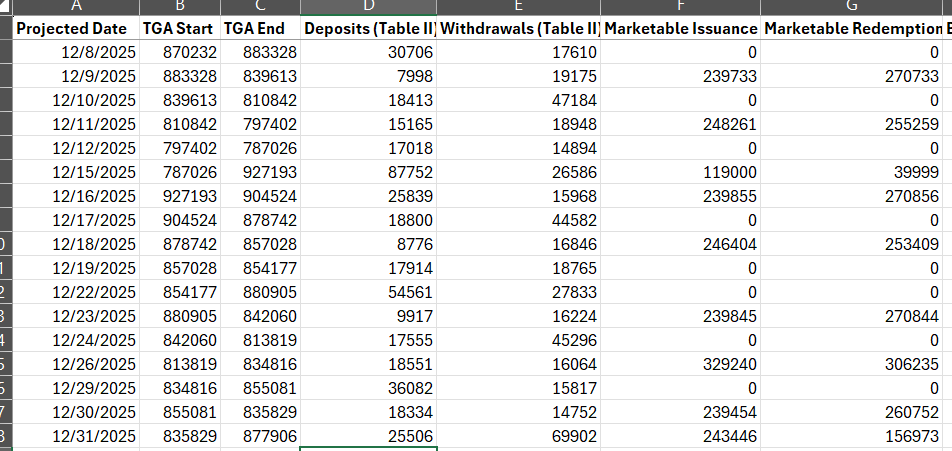

In my most recent Total Treasury Model (“TTM”) update I projected a TGA end of year close level of 877.9b.

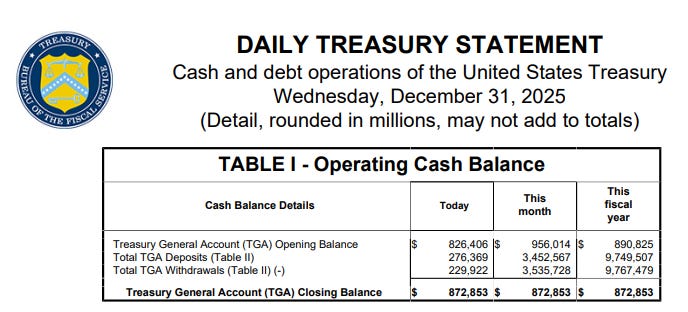

Turns out I was off by about 5b as the TGA closed at 872.8b on 12/31

The TTM cant perfectly predict the path of the TGA months to a year in advance, but it usually gets pretty close.

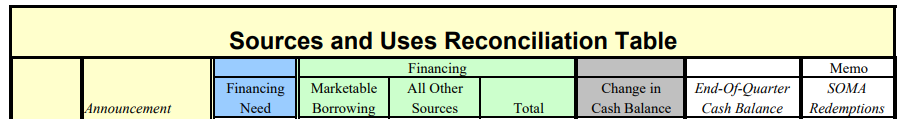

So much so that the TTM had outperformed Treasury’s QRA projections (essentially Treasury’s internal models) for the front quarter for both the Spring and Summer QRAs. October thru December results are now in, did the TTM earn the trifecta?

Indeed it did.

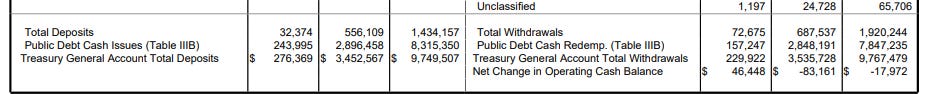

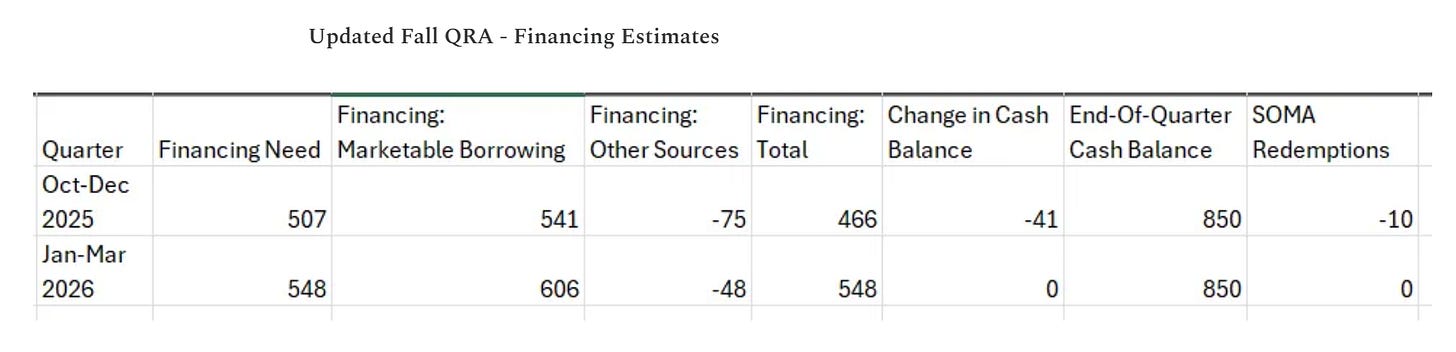

Treasury revised their projected Financing Need for Oct-Dec to 531b in the Fall QRA, up 37b from their original 494b projection. Should have stuck with the original since the actual financing need will be right around 486b with Daily Treasury Statement Table II withdrawals clocking in at 1920b for the qtr and deposits at 1434b

In my final QRA projection issued Nov 2nd the TTM projected 507b. Three for three baby!

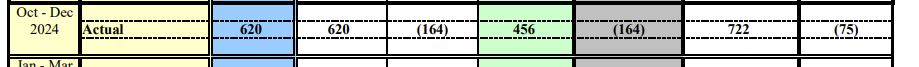

Aside from the self back patting (but hey, I fully admit/own and retrospect on my mistakes/misses so I think that gives me a little leeway to point out my successes) there is also an interesting angle here. A 486b realized financing need in Q4 25 (even if a bit lower than it would have been due to delayed LA County tax receipts) is down from the 620b realized financing need in Q4 26 (though with an admittedly unfavorable calendar effect that probably added 75b to it)

Perhaps “nothing stops this train”, but it is slowing down some. Will that slowdown continue into 2026? Great question that will be answered later in the piece.

But first Reserve Management Purchases (“RMPs”)

Are they QE John? Meh……… I dont think it matters what they are labeled as. They remove a tiny amount of duration from the available pool of credit risk free assets. They replace what isnt cash (but more or less might as well be), tbills, with actual cash, reserves. Call it what you will. What actually interests me is their impact on Treasury and how much marketable bill issuance Treasury will have to issue.

Mechanically, the RMPs impact Treasury in the same way the rollover of prepaying MBS into treasury bills does. In fact the Feds t-bill purchase schedules doesnt delineate between the t-bill purchases for MBS rollover and RMPs, it just lumps them all together. For the Treasury impact, it is initially zero when the Fed first settles the treasury bill buys from the secondary market. The impact comes about later when the bills that the Fed buys mature, because the Fed will then rollover those bills into new treasury bills issuing on that date (using the same auction add-on rules they have been using for more than a decade). So the Fed add ons will grow for the tbills issuing on the purchased tbills maturity date which means Treasury can reduce their offering size and achieve the same proceeds it needs to keep the TGA at the risk policy level.

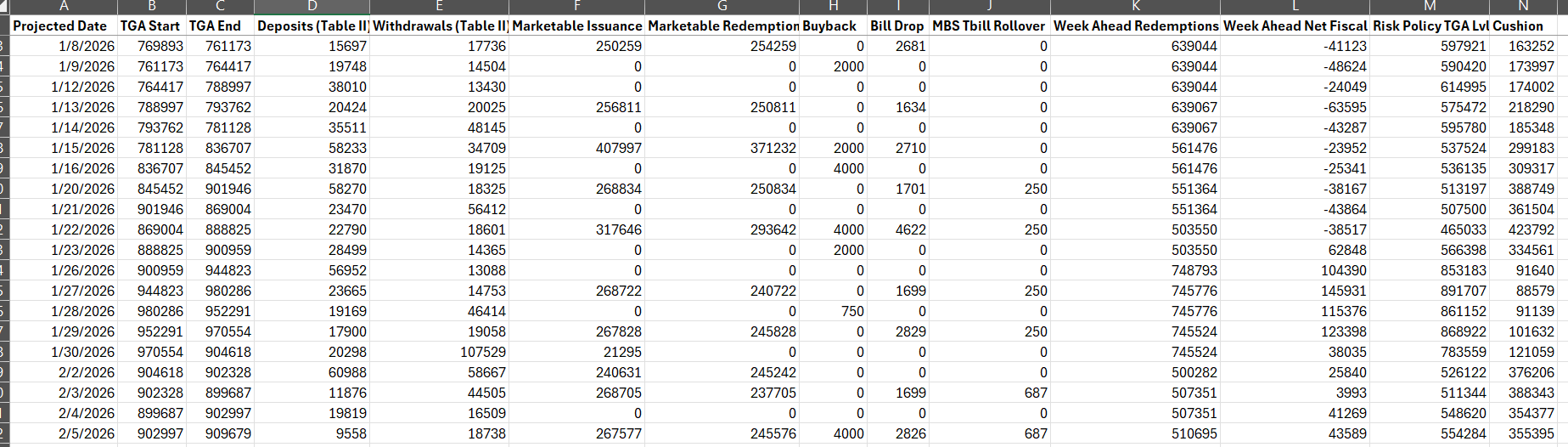

So the precise bills the Fed is buying makes a difference in when the Treasury gets “relief” in the future. The Fed splits their buys into two buckets, bills maturing in 1-4 months, and bills maturing in 4-12 months with about 40b in the former and 14b in the latter bucket for the December purchases. In November, I crudely modeled this (well the 15b or so from MBS rollover) figuring the purchases would spread out roughly evenly over the bills the Fed was willing to purchase during an operation and added the projected daily impact of the “Treasury relief” into the TTM so its impact on the TGA levels and thus the cushion above the risk policy level could be gauged. (Note the MBS Tbill Rollover column in the image below from the 12/4 TTM update)

There are two problems with this approach:

I was not including the Feds additional tbill holdings for the day (as a result of the RMP/T-Bill Rollover purchases) when calculating things like the SOMA add-on amount projected for the day that I include as part of the model output but more importantly

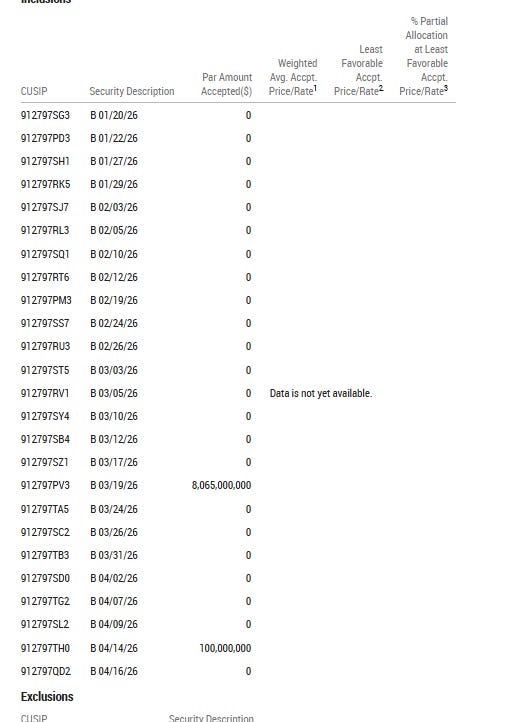

These bill purchases are not proving out to be spread evenly amongst the bill issues the Fed is willing to buy in the operation. For example see the purchases on 12/17

Fed bought 8.165 worth of bills on that day with almost all of them being those that mature on 3/19. I dont believe this is the Fed specifically trying to purchase those bills but rather some market force that caused primary dealers to more aggressively price those bills and the Fed just took the “best” deal.

Regardless, that is certainly not spread out. My problem is, given the admittedly limited purchase data we have so far, I dont really know how to project/model what has happened thus far, moreover Im not really sure its possible, but what I do know, is it is 100% possible to know that the Fed will have 8.065b more bills maturing on 3/19 after the 12/17 purchase settled then they did before, and that matters.

So I have spent the past few weeks updating the model to incorporate these bill purchases at a cusip level. It will be a pain in the ass but I will update the models config after each purchase operation for the bills actually purchased so the TTM when they mature and provide Treasury “relief” (and the projected SOMA add-ons for that day will likewise be correct). As for purchase operations that havent happened yet? Well best I can do right now is spread them over the available issues to buy in the maturity bucket and then update them when the actual purchases become known. Perhaps after a few months a clear and consistent pattern will emerge that allows me to better project the purchase operations that havent happened yet.

What about the purchase amounts beyond the December-January buys? I will have to keep updating the TTM after each purchase schedule comes out around the 9th but for now have the Fed buying ~54b for Jan-Feb, Feb-Mar, and Mar-Apr and after that buying ~22b (15b of which is MBS rollover) through the end of the fiscal year. That roughly matches the Feds guidance on these purchases but will update with actuals as they happen.

Will these RMPs make a material difference? Yeah they will and I think we will see it reflected this month.