The dark, ugly corner of the FHA mortgages

The 100,000+ 70% delinquent FHA Loan Modifications of Doom

The 160,000 FHA Covid-19 Recovery Modifications performed over the last 2 years have/are running ~70% delinquent, ~55% seriously delinquent. The GNMA MBS disclosure data provides hard data on the majority of them with the other 40-45% of them that were never securitized likely faring worse. These modifications tell both an infuriating tale of borrower fraud/abuse and a sad tale of borrowers who received a terrible loss mit workout while waiting for the FHA to patch a hole in their loss mit programs. An abject failure by the FHA. The extend and pretend music is still playing for these mortgages, though that music now has an end date, and when it stops many of these mortgages will head to foreclosure.

Many of yall may have read the Wall Street Journal Opinion piece published last weekend regarding FHA delinquencies and loss mitigation policies to “mask the growing troubles in the housing market by paying off borrowers and mortgage servicers to prevent foreclosure”. If not here is a link (https://archive.ph/TOxl7).

Over the past 3 weeks I have been deep in the GNMA MBS disclosure data (monthly performance data for ~6.8 of the 7.8 million FHA loans outstanding) chasing essentially the same story. So in one sense I was highly annoyed to be sorta scooped by the WSJ piece (though due credit also to Melody Wright who has been generally ringing this bell for quite some time). On the other hand, the attention it has brought to the issue is a good thing. The FHA’s policy actions over the last 2-3 years warrant public scrutiny and criticism and they have left a large mess to be cleaned up. Understanding exactly what that mess is, and whats caused it is important both for market participants trying to assess whats ahead for the housing market and policy makers fixing the broken policies.

My take on the WSJ FHA article

The WSJ piece gets alot of things right (and when I say right I mean I see the same things when I take a detailed look in the FHA MBS disclosure data and do a detailed review of the current FHA loss mitigation programs).

The piece is correct that FHA borrowers have become more risky as measured by things like debt-to-income ratios

The piece is also correct that the FHA (or the mortgage servicers though they will eventually get it back from the FHA at claim) has been de facto paying the missed mortgage payments for many borrowers over the past couple years and that you really do, as a borrower these days, either have to try to get foreclosed, or just completely ghost your servicer. But if you played along in the loss mit game, you would (still will) get a partial claim or modification (or both at the same time) to bring your mortgage current and then you could do it again, over and over.

What’s a partial claim? Its when the FHA pays money towards a borrowers mortgage and tacks the amount on as an interest free junior lien payable when the mortgage is paid off.

The most common type of partial claim is the standalone partial claim. When a borrower falls at least 3 payments behind, their servicer will contact them and initiate loss mitigation to try and bring the loan current. If the borrower tells their mortgage servicer that they are financially able to resume making the mortgage payments each month but cant cover the missed payments to bring it current, the servicer will offer a partial claim where the FHA pays the arrears to the servicer to bring the borrower current. So in effect, the FHA makes the missed payments for the borrower.

Often times, this is a good thing both for the borrower and the FHA, particularly if the hardship that caused the borrower to miss their payments was temporary (unemployment before finding another job, car broke down and had to be fixed). Borrower resumes making payments on the loan without the often overwhelming burden of trying to also pay back the arrears right away. Its also good for the FHA since it lessens the chance of foreclosure and a potentially large loss to the insurance fund.

The Partial Claim Game

But partial claims can currently be gamed and abused. Why? because the only required substantiation that the borrower is actually financially able (or willing) to resume the mortgage payment is that the borrower attests to the servicer they are able to resume the mortgage payment. Thats it. So if a borrower keeps attesting… “Yeah uhh, sure I can make the mortgage payment now, bring me current” every 4 months or so, they will keep receiving partial claims even if they never actually make a mortgage payment. From the MBS disclosure data about 48,000 loans received 3 or more partial claims. Nine loans had 10 or more (14 took the cake). Below is the payment history on one of the more egregious loans. Current as of 2/1/2022 (bottom of the table), then 1, 2, 3 months delinquent, partial claim to bring it current 6/1/2022, then 1,2,3 so forth and so on.

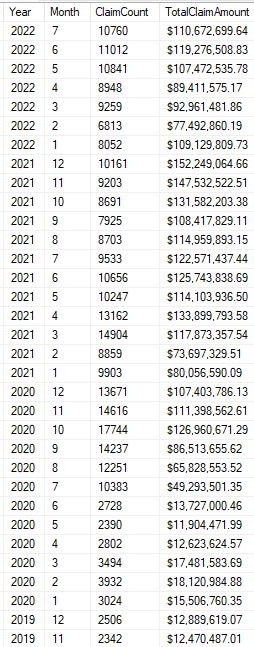

By my calculations, the FHA made ~2.6 billion dollars in mortgage payments from these stand alone partial claims last year. “Mortgage stimmies” if you want to think of it that way. Note also how unusual they were pre-covid.

And as the WSJ piece points out, the servicer gets paid an incentive payment each time they process one of these partial claims or any other loss mitigation resolution for that matter. Here is the what they got paid.

and here are the loss mit numbers for the last couple fiscal years as reported by the FHA’s Insurance Fund in its annual report to Congress. ~425k retention loss mit actions, ~324k of them stand alone partial claims

What the WSJ piece probably should have but did not mention though is that there is a statutory limit to the aggregate amount of partial claims. For any given loan, partial claims are limited to 30% of the unpaid principal balance at the time the first partial claim is made. For 5% 30 yr mortgages this amounts to ~40-45 missed mortgage payments, more for lower rate mortgages, less for higher rate mortgages. You could play the partial claim game for a while, but not forever.

Covid Recovery Modifications started good, ended toxic

Some borrowers incur financial hardships which prevent them from being able to afford their current mortgage payment for the immediate future. For them, just resolving the arrears wont result in them keeping the loan current. They need a lower payment going forward. Enter Loan Modifications, which change the terms of the loan and until very recently were the only FHA option for borrowers who could not continue to afford their mortgage payment. Lowering the rate or extending the term of the loan can lower the monthly payment to something the borrower can maybe afford to make. (The FHA targets a 25% payment reduction)

For FHA loan modifications, the new interest rate must be set to market rates, specifically the Freddie Mac Primary Mortgage Market Survey rate plus an additional 25–50 basis points.

This worked well in FY 2021 and early FY 2022, when market rates were in the low 3% range—reducing monthly payments through significant reductions on the interest rate. But the past two and a half years have been a different story. Market rates have fluctuated between 6–8%, far higher than the original rates on most defaulted loans. While servicers can extend the loan term to 40 years, even a 0.75% interest rate increase can offset the payment reduction from the extended term.

One last option, lower the principal

If meaningfully lowering the monthly payment is impossible by just adjusting the rate and term of the loan, the only possibility left is to lower the principal. Accordingly, the FHA allows partial claims to be used in combination with a loan mod. The partial claim funds cover the arrears (accumulated missed payments etc.) and then are applied (up to the 30% UPB at first partial claim max) to lower the principal of the modified loan until the FHA’s 25% lower payment target is hit.

For example, say a borrower has:

A $300,000 remaining principal balance

$10,000 in arrears

No prior partial claims

The modification + partial claim could reduce the principal to $220,000, a major reduction. But if their interest rate jumps from 5% to 7%, the payment savings from the principal reduction shrinks significantly. Even with a 40-year term extension, the borrower may only see a 15% payment reduction, short of the 25% target.

And if 15% doesn’t turn out to be enough? They've exhausted their entire partial claim allotment—drastically diminishing the borrowers future loss mitigation options.

Modifications that raised the interest rate significantly happened, alot, over the past two fiscal years.

FHA policy failure

Pretty much every one of these mods that contained a large interest rate rise to market represents an FHA policy and servicing failure. Both the borrowers and the FHA Insurance Fund would have been better off just continuing to do partial claims over and over when the borrower gets too far behind but keeping the loan at the lower interest rate. The rise in the rate that removes all the Partial Claim firepower basically dooms the loan over the long run, which is bad for a borrower who is genuinely trying to afford the home and bad for the insurance fund when it eventually pays a much larger claim on the doomed loan. Who is it good for though? The MBS investor who gets repaid earlier on a low coupon MBS that they can now reinvest in a higher market rate coupon security.

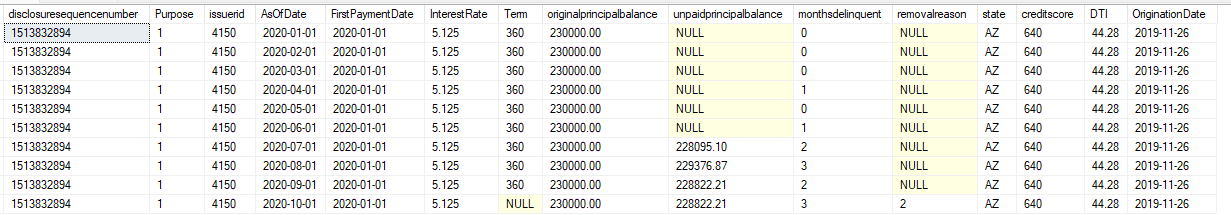

Here is a particularly poignant example:

Purchase (purpose = 1) loan is originated in Arizona late 2019, securitized and enters the MBS pools Jan 2020.

Starting Payment 1252 PI + 375? TI = 1627/month.

Borrower starts to struggle and Lakeview Loan Servicing (issuerid 4150) buys it out of the pool in Oct 2020 eventually doing a Covid Recovery Mod (when they were still helpful) in June of 2021

New Payment = 1065 + 375 = 1440/month

Even adding 13k of arrears to the principal balance the mod brings a meaningful payment reduction due to the much lower rate (5.125 → 3.375) and the borrower still has ~70k of partial claims funds available if needed to assist with future loss mit.

Borrower stays current for the next 2 years but then misses 4 consecutive payments. Lakeview then buys the loan out of the pool to perform further loss mitigation (removalreason = 4).

That loss mitigation ended up being a modification that brings literally almost no payment relief but completely exhausts their partial claim funds.

New Payment 1062 +375 = 1437/month

Almost no payment reduction. Why go this route? Likely because the borrower was evaluated first for a partial claim but indicated they could not continue their payment. So next the servicer moves on to the recovery mod + partial claim but the best they can get to given the huge rise in rate (3.375 → 7.25) is a paltry reduction in payment even extending the term to 40 years and blowing through ~65k in partial claims funds to pay down the principal but they offer it anyways and the borrower likely fearing the alternative is being forced out of their house takes the mod of doom.

Somewhat surprisingly the borrower sort of hangs on making payments for 5-6 months before going seriously delinquent again. Lakeview again buys it back from the pools to perform further loss mitigation (story continues later in the article)

A new hope, the payment supplement partial claim

To their credit, the FHA eventually created the new Payment Supplemental partial claim that in effect lowers the monthly payment for a few years by leveraging the partial claim pot but leaving the original loans terms, and critically the low interest rate, untouched. So borrowers who can afford a 25% lower payment have an option to get it for a few years instead of dooming the loan with a modification that hikes the interest rate

The WSJ piece alludes to this new program in a negative light and if you want to take the stance that the FHA shouldnt do loss mit at all and just pull the FC trigger asap because a contract is a contract then fine, but in a world where we do have loss mit, the programs should be as effective as possible and not further doom the borrowers like the covid recovery mods that set the interest rates significantly higher basically have. The Payment Supplemental addresses this but unfortunately has come too late, with only 15 being completed through Sept 30, 2024 and mandatory servicer adoption of the program not until January of this year.

I get that the federal rule making process and servicer implementation of a new and operationally complex loss mit program like the payment supplemental takes time, but the FHA could have guided servicers to keep doing stand alone partial claims as needed for borrowers who couldn’t afford the monthly payment until the payment supplementals were ready to go. Toxic mods that significantly hiked the interest rate didn’t need to and shouldn’t have happened.

Its fair game to argue the FHA shouldn’t have partial claim authority to help borrowers make mortgage payments (a contract is a contract), but so long as they do, borrowers who understand the loss mit game (or just luck into the right moves) shouldn’t have wildly different outcomes vs. those who don’t. Thats policy failure.

What happens when Covid Recovery Mods fail to work

So what if the 15% ( or < 1% as was the case in our AZ loan) payment reduction wasn’t enough to make the payment affordable in the long run (or the borrower just be fraudin/abusin) and the borrower defaults again, now with no partial claim pot remaining. Short Sale/Foreclosure time? Nope. not necessarily. Just mod it again. Really?!? you serious John. How is that possible?

The FHA Covid-19 Loss Mitigation procedures were/are ridiculously loose

Four key reasons:

Borrowers no longer had to document their financial situation to receive loss mitigation to substantiate that they can afford the new payments. Just attest that you can make those payments and you are good to go regardless of whether you actually can (or intend to)

Borrowers no longer had to actually make 3 or so trial payments (actually demonstrating they can afford it/will pay it) on a modified loan before it becomes permanent with failure likely leading to a short sale/foreclosure.

If the Covid-19 recovery mod fails to meet the min 15% payment reduction threshold, hell EVEN IF the mod raises the payment, the servicer must still present it to the borrower and the borrower can accept it

There was/still currently is NO LIMIT to the number of Covid-19 recovery mods a borrower could get or the frequency in which they could get them

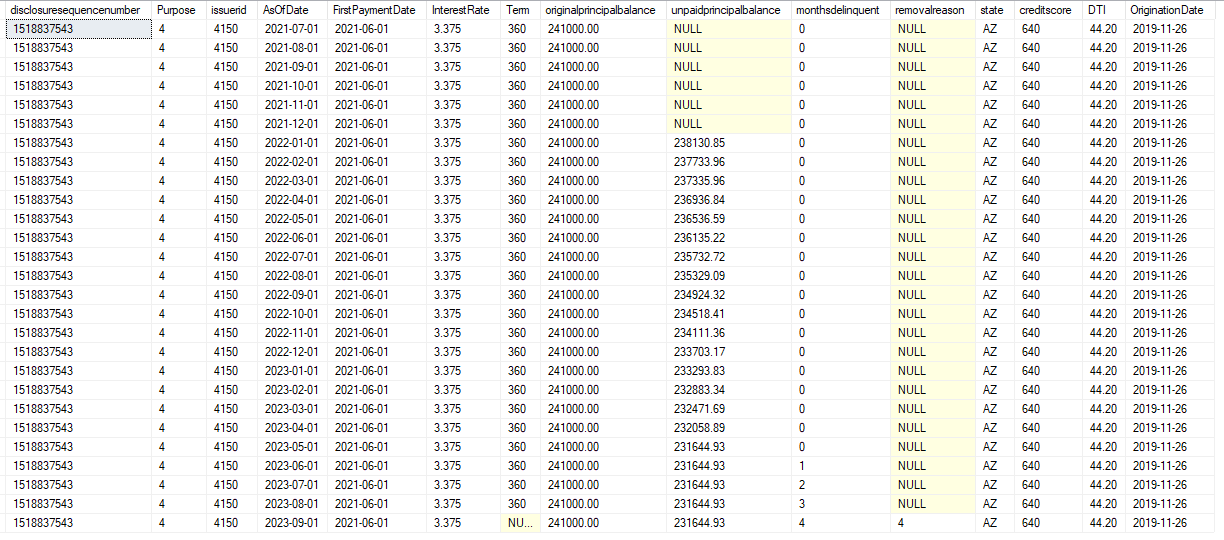

Finishing the story on the Arizona loan from earlier…

We left off with the mod of doom slipping into delinquency and a payment of 1437/month

and now the loan gets modified again

New Payment 1110 + 375 = 1485/month

This mod both raises the rate a little (7.250→7.375) and principal balance due to capitalizing the arrears. Borrower manages to make one payment on this mod and is now 6 months delinquent as of the end of January

Whats next for this borrower? Likely another mod, might get a little rate relief with the recent dip in rates but will probably add another 10k to the principal. Will that mod perform, highly unlikely.

What the WSJ article misunderstands

The WSJ article implies that its the new borrowers that are becoming seriously delinquent within the first year

No surprise, many are missing payments, especially recent borrowers. About 7.05% of FHA mortgages issued last year went seriously delinquent—90 or more days past when a payment is due—within 12 months. That’s more than at the 2008 peak of the subprime bubble (7.02%).

The MBS data indicates the author misunderstands the true culprit. When I query the MBS performance data looking for any FHA purchase or refinance loan originated in FY24 that hit 3 or more months delinquent at any time I get 11,268 out of a total of 723,486 such loans or about 1.6% that went seriously delinquent. This is generally in line with the 1.72% current serious delinquency rate for the FY2024 cohort from the November 2024 performance trends report.

The Modifications of Doom

Its not the new purchase and refinance loans that are the huge problem. Its the Covid-19 recovery modifications originated in FY24 and FY23 and the latter half of FY 22 that are the problem. The performance of these mods is just shockingly bad.

Consider non-HAMP loan modifications with a first payment date of April 1, 2024, meaning they were likely modified in March 2024.

5,240 of these modified loans were securitized and entered MBS pools (with possibly a few thousand more that remained on servicers' books, which likely performed even worse).

Of those 5,240 securitized loans:

3,995 are either still in the pools but delinquent or have already been removed due to serious delinquency.

3,154 are seriously delinquent or already removed for that reason.

This means that 76% of these March modifications are delinquent, and 60% have already reached serious delinquency—a staggering failure rate.

Compare to the delinquency and serious delinquency rates for the covid recovery mods from 2021. A staggering difference.

While the payment supplemental now in effect should help alot to reduce new toxic Covid-19 recovery mods, the damage has been done and the likely slowdown in the economy and spike in unemployment isnt going to help. The majority of these modified loans are almost certainly destined for short sale or FC when the extend and pretend music stops, but when will that be?

The WSJ piece concludes with an encouragement to the Trump administration to end the mortgage giveaways and laments that the resulting troubles to come might not get pinned on the Biden administration. What it doesnt mention though is that unless the Trump administration does something to change it, the FHA on Jan 16 already set the timeframe for when the music stops on the Mods of Doom. Here is what they did and what that timeline is.