Treasury did not jump the shark and reduce coupons and there were no real surprises in Treasury’s financing need/borrowing estimates. In other words, this QRA went about as expected/projected. I nailed Q3 but was a little off in Q4. I explain my Q4 variance below and include updated Total Treasury Model output at the end of this post.

Lets review

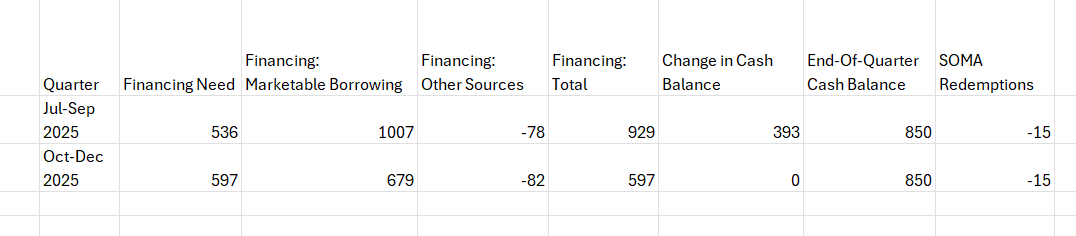

My projections:

Treasury’s projections:

Jul - Sep Financing Need/Marketable Borrowing

I hit the marketable borrowing number on the screws and was only off by 11b on the Financing Need. As I projected in my preview, Treasury did indeed revise up their financing need estimate

Unlike last QRA where I was significantly lower on the Q2 financing need vs. Treasury (rightfully so as the realized numbers were closer to my projections than Treasury’s), this time my Total Treasury Model (TTM) is in tight alignment through the end of September.

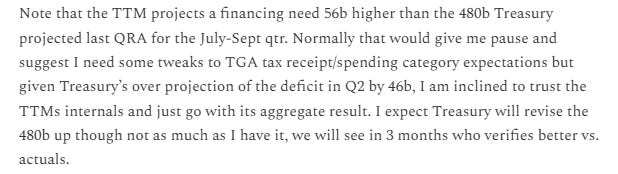

Oct - Dec Financing Need/Marketable Borrowing

I projected about 100b more deficit (Financing Need) than Treasury for the qtr with a similar over projection on the marketable borrowing need. Is the TTM setting up for another showdown with Treasury’s models? Nope, barring the unexpected, Treasury’s models will be closer.

After every QRA I carefully consider Treasury’s projections and reexamine the TTMs assumptions/coding in light of it. Its more of a macro take because the financing need is an aggregate deficit number vs. the micro takes I get when I tru up the model categories to align them with actuals for each category. Its helpful to reveal where I might have issues in the farther out timeframe projections of the model. This review came to 3 conclusions.

I didnt bump up Octobers Corporate or Non-Withheld tax receipts to account for the IRS extensions in LA County due to the fires in January. Treasury likely had this accounted for.

The TTM was way over projecting EPA and Federal Financing Bank withdrawals in Q4. Both categories had extraordinary withdrawals in Q4 2024 (EPA gold bars off the titanic if you recall). Unfortunately I didnt filter out those extraordinary withdrawals from the baseline expectations for Q4 2025. As a result, ~50b of extraordinary withdrawals was “baselined” in.

I think Treasury was factoring in a little more tariff income than I was.

I have addressed those issues in the TTM and the model output at the end of this post reflects those changes. The TTM now projects a 504b deficit for Q4 which is very close to Treasury’s projection in the QRA

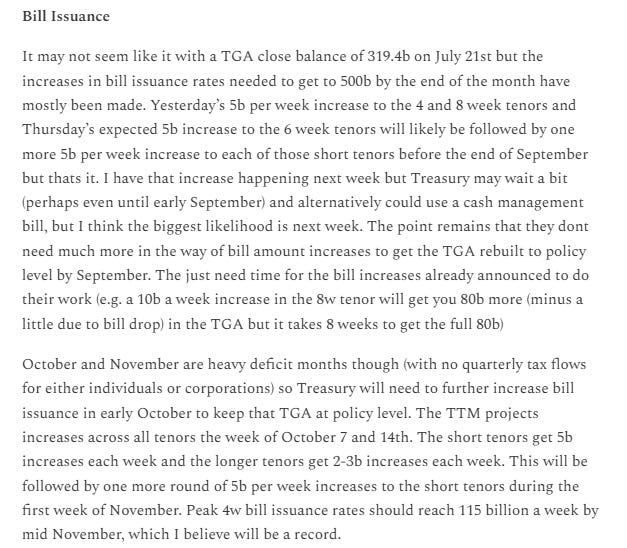

Bill Issuance

Treasury affirmed my bill issuance projections. One more round of increases in the next week then flat through September with another round of increases in October.

To be clear, I dont make those projections on a whim or because of historical pattern (though there is somewhat of a historical pattern) I make the bill issuance projections based on how much the TGA needs on a given day to be above the risk policy level. With Coupon Issuance and spending/receipts largely fixed, its the bill issuance that fluctuates to keep it above risk policy level but not overly so for extended periods of time. The TTMs daily projection of the required TGA level, TGA withdrawals/receipts, and coupon net issuance, allows me to back into a likely bill issuance pattern well before Treasury announces it. Sometimes Treasury will throw a curve ball with a CMB instead of increases to the benchmarks but mostly they dont.

Coupon Issuance

Technically I nailed the coupon issuance as well since Treasury indeed kept coupon issuance rates unchanged. I cant claim any special prognosticating powers here other than it just seemed most likely that Treasurys action wouldnt much mirror the Trump rhetoric.

Buybacks

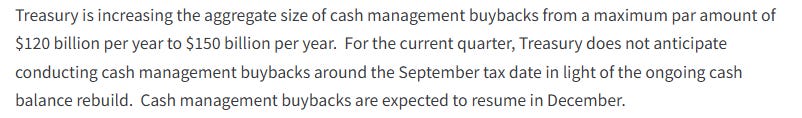

As I surmised in my QRA preview last week, Treasury did indeed increase liquidity support buyback a bit, which mechanically is a reduction in coupons, though they didnt increase it by much from 30→38 billion per quarter.

I also correctly projected that Treasury would use cash management buybacks in December.

Updated TTM

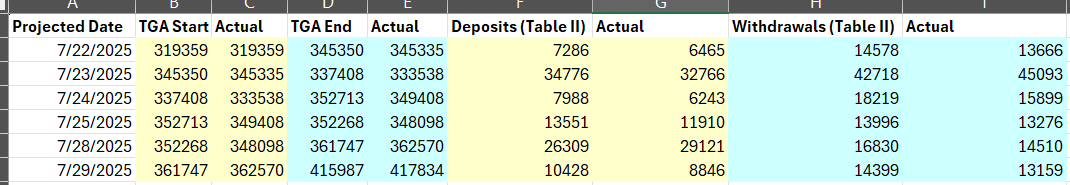

TTM did pretty well over the past week. Below is a comparison of the daily projections issued last week in my preview post with the actual results. Again, not bad for a substacker.

The updated daily output through the end of the year (including updated category internals) for paid subscribers (thank you for your support) is below the paywall. In addition to the TGA category tweaks described above, the TTM has also been updated with the full buyback schedule released in the QRA and a slightly reduced bill issuance need in Q4 due to the 90b or so reduction in modelled deficit.

Next Up

I am performing a deep dive into the servicing portfolios of the soon to be married Mr. Cooper/Nationstar and Rocket. Ill write about it soon.

Thanks,

John