Sept 23 QT

For those who enjoy tracking it...

TLDR

QT will reduce Fed balance sheet by ~80b in September: 60b for UST, 20b for MBS. UST reduction is somewhat heavier on the end of month maturities. 21.6b of UST is bill rolloff spread through the month.

Note for new readers – If this is your first time reading my posts on QT and are interested in the mechanics behind QT and how I reach these projections. Please see my earlier posts starting with Reverse Engineering QT on September 29, 2022.

Also, if you are interested previewing the scripts authored by @dharmatrade that leverage the FED APIs to pre-calculate QT treasury/bill runoff schedules and MBS payments for the upcoming month implementing the QT rules and MBS estimation methods described in this series of posts, reach out to him on twitter. His scripts are a huge help in putting these posts together.

Greetings!

I don’t think the intra month when of the QT rolloff really matters very much. Uh John, that’s a strange lead in to an article about uh, the intra month when of the QT roll off. Yeah, kinda is but I think its important to note because I want readers to have a solid understanding of what QT (at least the Treasury portion of it) really is. It’s just a 60b (until June 2024 when the cap wont be reached) monthly expense to the Treasury that also has the effect of draining grossly in excess reserves from the system (eventually this latter aspect to it will become important but until RRP gets close to 0 its not really worth talking about imo). For more detail, please read my recent piece on Treasury issuance being what really matters found here (https://johncomiskey.substack.com/p/treasury-issuance-is-what-really).

There is an element of fun in the tracking of the QT progress, similar to how it can be fun to track hurricanes even when its clear they are going to just recurve in the Atlantic and be of no threat to anyone. So notwithstanding that I dont think how QT rolloff plays out in a particular month is of particular importance right now, I nonetheless present how QT will indeed play out in September.

September MBS Payments

August prepayments were up a bit, rising 9.5% vs July. Using @DharmaTrade ‘s scripts which faithfully only apply the 109.5% multiplier to the prepayment portion of each MBS payment, we reach the following MBS payment projections:

*The former FHLMC Gold amounts have been added to the UMBS as they were converted into it via the cusip consolidation process

**Note an additional 25,000,000 in Fed held CMBS is also expected to rolloff bringing us to a total MBS rolloff of 20,006,817,874

September UST Rolloff

Fed coupons maturing in September are:

· Total notes/bonds: 39,401,415,000

· Total FRNS/TIPS: 0

· Total Coupons: 39,401,415,000

Coupons will fall well short of the 60b cap in September and accordingly there will be 20,598,585,000 rolloff of bills as well. The Fed does this proportionally to the amount of bills maturing each Tue/Thur. For September, the rolloff percentage for bills is ~ 50.6616%. This is calculated by 20,598,585,000 (total bills to rolloff) / 40,659,184,100 (total bills maturing).

QT Balance Sheet Impact by Date in September

Weekly Projections for September

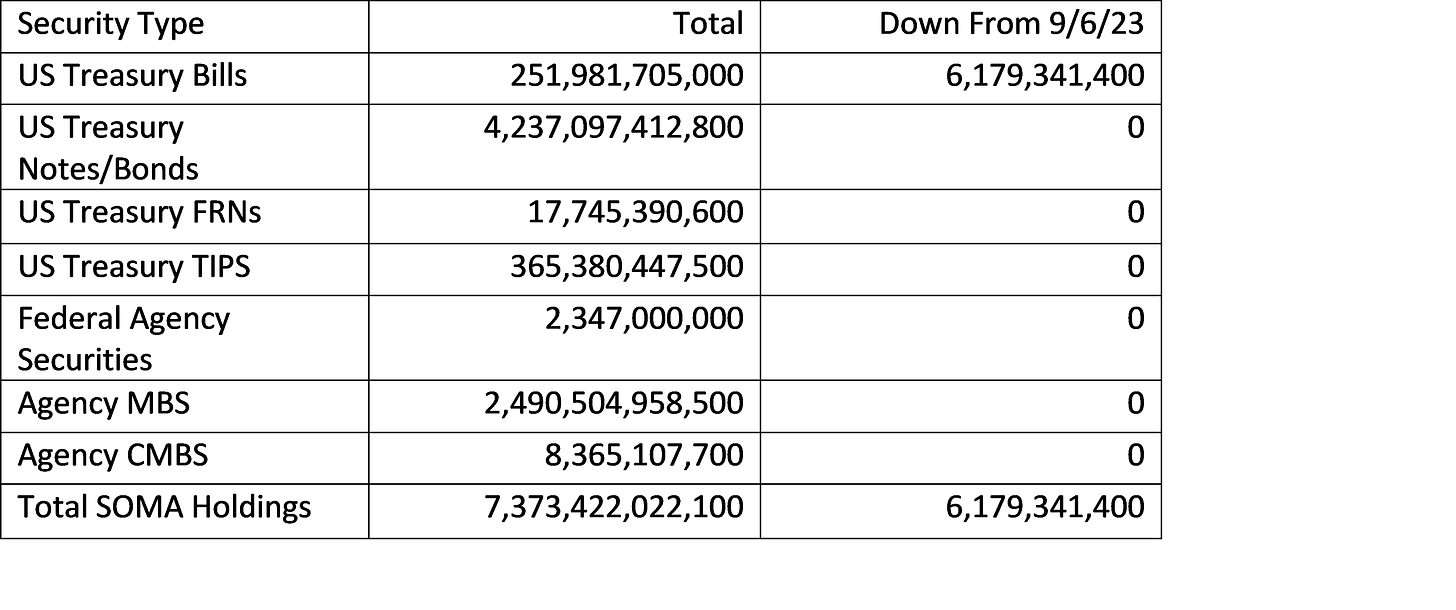

9/6/23 SOMA Domestic Security Holdings baseline

9/13/23 SOMA Domestic Security Holdings projection

9/20/23 SOMA Domestic Security Holdings projection

9/27/23 SOMA Domestic Security Holdings projection

10/4/23 SOMA Domestic Security Holdings projection

* Note, the Bills and Total SOMA Holdings reflect a projected ~300m of bill rolloff on 10/3 which is technically part of Octobers QT but will reflect on the 10/4 balance sheet. I forgot to include the 1.26b bill rolloff that occurred on 9/5 in last months report, apologies for that, sloppy omission.

As always, thanks for reading.

Best,

John

thank you, appreciate, have a great week!