TLDR

Borrowing estimates likely to appear “hawkish” on Monday, 275-300b for Q2. 1.2T (yes trillion) for Q3

Coupons likely the same (no increase/decreases) next refunding quarter

Bill issuance likely to increase this week in the short tenors reversing in June. Then across the tenors rises in first 2-3 weeks of July

Q3 TGA projected level at 900b

Greetings,

If the zerohedge article from Friday about the upcoming QRA (https://www.zerohedge.com/markets/how-janet-yellen-will-unleash-another-market-meltup-next-monday) is a true measure of street sentiment about the borrowing estimates to come tomorrow, then the street is likely in for a rude surprise. My Total Treasury model predicts a borrowing estimate between 275b and 300b for Q2. This represents an upward revision of 75-100b from the winter QRA. More striking however, is my projection that the borrowing estimate for Q3 will be a whopping ~1.2T!..... So does that mean that Treasury is likely to announce further increases in coupon issuance to help cover it? Nope, I expect the coupon issuance rates will remain the same and Treasury will cover it via bills.

Why Q3 Borrowing Estimate will be so high

Why? Because while the headline number for Q3 seems strikingly large, there are two big calendar effect caveats that accompany it. 1. End of month June coupon issuance will be a part of the number (since June 30th is a Sunday) and so will September end of month issuance (since Sept 30th is a Monday). This creates an ~ +215b effect on the number. 2. The estimated TGA minimum policy level for end of day September 26th is 765b due to 665b in debt maturing on 9/30, 10/1, and 10/3 + another 100b in net fiscal outflow that week due to the large first of the month expenditures. The actual TGA will likely be closer to 800b on that date to comfortably meet the min level. Being precise, Treasury will have to issue enough bills earlier in Q3 to make sure its high enough on 9/26. But! about 128b in net new coupons issue on the 27th and 30th, with fiscal flows largely flat those days this will drive the TGA to ~900b at the close of 9/30. Treasury wont need it that high; the minimum TGA policy level is only 629b on 9/30. There is just no way that I can see for them to avoid it. (and yes I am well aware I have incorrectly predicted a TGA end of qtr level rise in my last two QRA projections, perhaps I will whiff again, but I don’t think so this time). This quirk should be reflected In the QRAs assumed end of Q3 level (projecting 900b) and adds another +150b effect on the number. So comparing this years Q3 borrowing estimate to last years its closer to 835b vs. 760b ( when you account for the two quirks I mentioned above), an increase but not a shocking one. Assuming I am correct, will the market understand that when the 1.2T number prints, doubt it, but we will see.

Coupons

So wait, why wont we see increased coupon issuance? Well because Treasury indicated last QRA that this past refunding quarter (February thru April) was likely it for a little while and I am taking them at face value. Taxes have come in a bit lighter than what I believe Treasury projected for Q2 and the expenditures also seem a bit higher than expected (which should be reflected in the upward revised Q2 borrowing estimates tomorrow). But not massively, so perhaps the eventual coupon increases came in a little, but I doubt we see it over the next two refunding quarters.

April Tax Receipts

About those taxes…. Didn’t they come in stronger than last year? Yep sure did. So shouldn’t that mean a downward revised borrowing estimate for Q2? Nope, because the relevant thing to compare this years actuals to for QRA borrowing estimate purposes, is what Treasury was internally projecting for tax receipts right before the last QRA was released. Unlike what zerohedge would lead you to believe ( https://www.zerohedge.com/markets/how-janet-yellen-will-unleash-another-market-meltup-next-monday) the influx of capital gains taxes in mid April was not “unexpected”. Treasury absolutely “priced in” increased April tax receipts into its winter QRA borrowing projections. I think they priced in too much and that will reflect tomorrow. So how do I know what Treasury was projecting in January?

Well I don’t exactly, I only have the output from the Total Treasury model’s detailed daily TGA withdrawal/deposit projections, which I calibrate against Treasurys published QRA numbers. How did my model do over the last couple months on non-debt flows?

Total Treasury Model Recent Performance

Not perfect, but not bad either

February – Under projected Deposits by 19b, overprojected Withdrawals by 3b Net = +22b

March – Under projected Deposits by 9b, underprojected withdrawals by 32.5b Net = -23b

April (thru 25th) – Over projected Deposits by 86b, overprojected withdrawals by 13b Net = -73b

These 3 months are the most difficult to accurately project because of the large tax flows (refunds in feb/mar, receipts in April). But my model did generally ok, save for my overprojection on tax receipts. Its accuracy for daily withdrawal/deposit flows for May and June should be significantly better.

So I don’t literally know whether Treasury overestimated tax receipts or underestimated other spending but when I calibrate the model using the actual 4/25 TGA level, actual bill issuance thru April, project forward the daily tax/spend flows through June with a target TGA level of ~750b on June 28th and then fill in the likely bill issuance to get to that ~750b level, the model needs more bills to get there, roughly 85b of them. So overestimated receipts or underestimated spending, assuming I don’t have the tax/spend between now and June 30th significantly wrong (like say some huge batch of late submitted capital gains taxes inconsistent with patterns of receipt in prior years) then we should see that increased borrowing need reflected tomorrow.

Upcoming bill issuance

Regarding that bill issuance. As expected and projected in my previous posts, Treasury hit the bill issuance brakes late March/early April. That trend should reverse next week. Why? The pesky TGA minimum policy level. It hits a high point of ~700b on 5/28 and even with the burn off of the tax receipts that have swelled it to over 900b today, Treasury will need more dollars to meet the fiscal outflows ahead and keep it comfortably above the min level on 5/28. Since it’s a temporary need (after 5/28 they are good through the end of June) I expect them to meet it by increasing short tenor issuance starting this week and then reversing it in early June. Seems the easiest way to handle a short term need outside of CMBs

After June, Treasury will need a series of across the board increases to all bill tenors for the first 2-3 weeks in July to meet the roughly 540b in net new bills they will need to issue in Q3. There is another high point in the TGA min level in late July which sort of forces the early July increases timing.

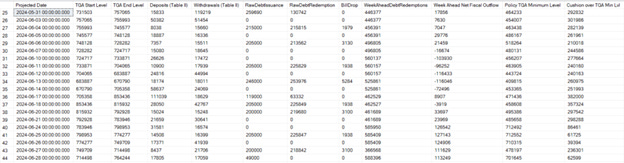

My daily TGA projections through 9/30 upon which this analysis has been based are as follows:

Thru May

June

July

August

September

Thanks for reading!

John

PS, if you would like to verify/validate the Total Treasury models detailed daily output, feel free to reach out to me on X.

Impressive work. Thanks

Thanks for sharing!