Projecting the QRA and daily TGA levels thru FY24

Introducing the Total Treasury Model

TLDR

QRA recommended financing tables projections midway through the article. Moderately increased coupons in Q2. ~300b negative net bills in Q2. TGA level of 850-900b end of Q2.

Ive merged a completely overhauled TGA projection model with the Debt projection model to form a Total Treasury model which projects daily TGA level and adherence with policy proscribed minimum TGA levels through end of FY24. (output included)

Bills issuance increases this week and next, but will be reversed in early April only to rise again in late July. (projected treasury issuance through FY24 included)

Greetings,

I believe that to really understand a system, you have to understand it from the ground up. You have to understand all the component subsystems and how they interact with each other. You have to understand the design principles behind them, and what rules they are subject to to understand how their behavior will affect the overall system.

I further believe that the overall financial system is largely just a system and that while there are plenty of human actors that may do difficult to predict things, many of the subsystems that comprise the overall financial system are fairly predictable and if you can predict them with reasonable accuracy, you might be able to capture a little alpha for a while vs. those who cant.

One such subsystem that I think is fairly predictable over say a year (or maybe two) time horizon is the fiscal flows of the United States Treasury, the deposits and withdrawals from/to the TGA. Uh yeah John, the govt is running 1.5Tish deficits a year so withdrawals are gonna exceed deposits right? Well sure, but those deposit and withdrawal flows do not happen in a uniform manner and accordingly their effect on other parts of the overall financial system do not happen in a uniform manner. Sometimes and for some things it doesn’t really matter and the general trend is good enough. For other times and other things (like trying to accurately predict the x-date during a debt ceiling impasse) it matters a great deal. What is always true however is that a reasonably accurate, high fidelity understanding of how the flows will play out is better than a coarse view. Its neutral when it doesn’t matter, and valuable when it does.

To that point, I have developed a reasonably accurate, daily model of the non-debt TGA deposit and withdrawal flows. Uh De Ja Vue John, didn’t you already do this last May, publish its results and use it to predict the x-date? Yeah but…. That version of the model was super crude compared to where it is now. I literally developed it from concept to publishing its output in just over a week last May (@BartsQuandry challenged me to do it May 6 and I published my first x-date piece May 14th), which is a story in and of itself but not for this post, so there were plenty of hardcoded assumptions and crude estimations in there for various deposit and withdrawal flows. It was sort of stunning how well it actually did perform given its crudeness, but its time horizon was fixed to the end of last June, it literally couldn’t run longer without what turned out to be a massive overhaul. Save for tweaks, that overhaul is done now and I can run it for the most part to as long a time horizon as I want, though as a practical matter, going much beyond the end of FY24 until the FY24 budget is actually passed, doesn’t make a lot of sense to me and of course the farther out you go, the greater the tax receipt uncertainty becomes (particularly for non-withheld taxes sensitive to capital gains etc.) and to a lesser extent spending uncertainty. So for now I am running it through the end of FY24.

How does it work? For all the major deposit and withdrawal categories (Table II Daily Treasury Statement) I make monthly or fiscal year projections (depends on the category) based off a mixture of historical data, agency budgets, assumed growth rates for things like withholding income, expiring spending from previous legislation etc… Each category of any size is its own analysis. From there, I distribute the monthly amount by studying the historical deposit or withdrawal patterns and then mimicking them. Sometimes theres a pattern of one big payment a month and smaller ones rest of the month. Some like Social Security Benefits have 4 big payments a month on specific days. Some like corporate tax receipts happen on/around the 15th of particular months. There are lots of patterns but Ive put thought and study into each of the big ones to align the models projections as closely as possible to the correct historical patterns. I am under no illusion that I will estimate everything perfectly (either at a monthly/yearly level or distribute it correctly intramonth), but by putting a lot of thought and reasoning into all the major ones I think I can get close enough that in the aggregate allows me to reach “reasonably accurate”. If you follow me on X/Twitter, I post my models daily projections each day and then the actuals when they come in along with an analysis on how the model did that day (large daily or month to date variances from actuals for categories with big enough variances to care about) The model has done fairly well through January. Feel free to follow along and if you are interested in the daily detailed model output through end of FY24, please reach out to me in the comments or via X/Twitter.

But wait, there’s more! Keen readers of my x-date projection posts last May might recall that while my x-date predictions were ultimately flawed, it wasn’t because of badly misprojected Table II DTS deposit/withdrawal flows (though I got sort of lucky, end of May into early June is considerably easier to get accurate than other times of the year so the crudeness in the model at that point worked way better than it would at other times of the year). I mostly got the deposit/withdrawals flows close enough. My bigger issue with predicting the TGA balance level was that I completely missed the effect of bill drop on the TGA level, or put another way, If the Treasury auctions 44b in 52w bills that price at an investment rate of 4.841%, the Treasury only collects 95.353944 dollars per 100 dollars issued or 41.96b for the 44b issue. Across all the bill auctions this makes a significant difference. But even more important than that, volume of Treasury issuance obviously has a huge effect on the level in the TGA. Sure the Treasury may collect 2b less than the 44b issuance for my scenario above, but they could always make that up (if they need the cash) by just issuing 2b (plus a little due to bill drop) more that day. The bottom line being that the non-debt receipts and outlays are just part of the equation driving the TGA level. The debt receipts and outlays are every bit as important. Fortunately, I have developed a detailed model that projects debt issuance and maturity (initially published https://johncomiskey.substack.com/p/treasury-issuance-is-what-really) with QT fully baked into it. So naturally, like Apple in 2007 (or Voltron from my childhood days) I have combined these two models into one Total Treasury model for projecting the TGA level in detail through the end of FY24.

Combining these models is necessary because as it turns out, you need to know the non-debt deposit/withdrawal flows to anticipate the debt issuance, and of course you also need to know the existing debt maturity schedule to anticipate the debt issuance, but that just tells you what you would need to maintain a steady TGA level. But what is that steady TGA level? Well there isn’t one actually. Huh? The last two QRAs have forecast end of Quarter TGA levels of 750b, that seems pretty steady. Yeah it is qtr end to qtr end but it fluctuated between 650 and 850b in Q4 and will likely fluctuate between 700 and 850b in Q1. OK technically that’s not precisely steady but cmon John you gotta nitpick on that? Well yeah I do, because in Q2 that range of fluctuation will be more like 700b to 1.1T and this time the TGA will probably end the qtr at around 875b.

Dial it back a second John, haven’t you said in the past that there is a Treasury policy that determines the “steady level” of the TGA? Yep. There is indeed a Treasury policy regarding the TGA level (shout out to @hegedusaero who brought it to my attention). But it doesn’t require a steady level, rather it proscribes a minimum level in the TGA to meet a week aheads gross debt redemptions (gross because the cushion assumptions are that the debt markets are closed due to some calamity during that week) but only net fiscal (non-debt) outflow over that same week. The Treasury is not prevented by this policy from holding more cash in the TGA than that level proscribes and in fact often does. Why? Because as a general principle Treasury doesn’t want to change auction sizes too suddenly or too frequently, favoring more gradual increases and decreases/more predictable issuance to meet the funding need. When you combine that principle with the reality that the minimum TGA level proscribed by the policy (week ahead gross debt redemptions + net fiscal outflow) varies dramatically intramonth (the level is much higher the week before end of month maturities, which also spans the big withdrawal vs. deposit spread at the first of the next month, somewhat higher the week before midmonth coupon maturities and lower otherwise, (a 300b difference is not uncommon) and the result is that Treasury is gearing their (gradually changing) bill issuance at mostly making sure the TGA stays above the policy proscribed minimum the week before the end of the month and occasionally the week before midmonth if there is a large coupon redemption, and fiscal flows are heavy out (like Feb, May, Aug, Nov with large coupon interest payments midmonth and no large offsetting non-withheld/corp tax payments).

April is a different ballgame

That intramonth variation in the TGA level will get supercharged in April. Why? Tax receipts. April is a huge month for them. The USA is largely a pay as you go tax system meaning as you earn income, you shortly thereafter pay taxes on it. For W2 wage earners, you pay as you go via your employer withholding your estimated income taxes (as well as social security and medicare). These deposit in uniformish manner to the TGA each week/month through the year. For corporations, self-employed, and retired folks however, they “pay as they go” mostly at 4 distinct points in the year remitting tax payments to the Treasury in April, June, September, and December for Corporations and April, June, September and the following January for self-employed plus retired folks. April then, sees first quarter remittances for both corporations and self employed folks. Of course, April is also the deadline for individuals to “true up” with the Treasury for the prior years taxes. For certain types of income, notably capital gains, while technically tax on a gain should be paid in the next quarterly estimated tax payment date (April, June, September, and next January), practically it usually isn’t and accordingly it gets paid when that true up occurs with the year return in April. For the TGA deposit categories which reflect this income (Taxes - Noth Withheld Ind/SECA Electronic and Taxes - Noth Withheld Ind/SECA Other) it means April is particularly large, in the range of 40-50% of the total amount collected in those categories for the whole year. It all adds up to April being a huge tax receipt month.

Where does the Total Treasury model predict the TGA is going?

Currently, the Total Treasury model + TGA minimum level policy projects a policy-proscribed minimum TGA level of 706b at the end of March with an actual TGA end of qtr level at 748b. (detailed daily path in the images a few paragraphs down) 20-40b of cushion is roughly in line with what Treasury has been carrying over the “high points” of week ahead gross debt plus net fiscal outflows. Notably though I have the Total Treasury model only configured to add 440b in new bills in Q1. This is 27b less than the 467b in net new bills projected for Q1 from the Nov QRA. While a little lighter, I think it’s a reasonable projection based on the likely bill issuance pattern. Treasury increased all tenors by 5b (tenors 8w and shorter) and 2b (tenors 13w and longer) this past week and will likely do so again next week. Treasury mostly followed this same issuance increase pattern this fall as they ramped up to rebuild the TGA post debt ceiling resolution. Doing so for these two weeks and then holding issuance amounts steady through end of March gets Treasury to 440b by end of qtr. Considering that the TGA ended last year at 768 instead of the 750b assumed by the Nov QRA also lends support to the idea that Treasury will need a little less new bills than anticipated in the Nov QRA. Of course, January’s estimated tax receipts that sometimes don’t fully hit until the end of this month could prove light and/or the tax refund outflows start and run heavy in February through March could come in heavy, but Treasury would still have 25-50b of cushion during the last week of March before dipping below the policy proscribed level. So for the upcoming QRA I think 440 net new bills for Q1 with an end of qtr TGA level of 750b is the most likely outcome and indeed my model predicts an actual TGA right near 750b at end of March.

Once the “high point” in the policy required minimum level of the TGA at the end of March has been passed through however, the policy required minimum level of the TGA falls off a cliff. By April 10th, that level falls to only ~217b which is mostly a result of the huge tax inflows to the TGA around April 15th (the usual week ahead fiscal outlow turns into a massive week ahead fiscal inflow). As a result Treasury will significantly cut bill issuance. The Total Treasury model currently projects 2 cuts (5b/2b) across all bill tenors for the bills issued the weeks of 4/2 and 4/9 with an additional cut to the short tenors week of 4/16. This amounts to 57b fewer bills a week late April vs. late March. Even with cuts of that magnitude to bill issuance though, the TGA will still rise to ~1.1T in late April before drawing down due to the mid 700bs in late May where another “high point” in the policy required minimum level of the TGA occurs at ~700b on May 28 (technically there was an even higher point on April 29th at around 780b but with the TGA still over 1T due to the April tax receipts at that time, its not in play and shouldn’t bear on Treasurys decisions on bill issuance).

The next “high point” for the required minimum level of the TGA is late June at a little less than 700b. So on the surface it would seem that an end of Q2 target of 750b would be on tap for the upcoming QRA. But I don’t expect it to play out that way. Why? Two reasons. The first is again tax receipts. Mid June is the second quarterly collection time for corporate and self employed/retirees estimated tax payments. Pair them with a sizeable net new coupon issuance in mid June (net size exaggerated due to the treasury issuance/maturity schedule, the 10s and 30s issue new via reopenings of the May issue but have no maturity since those bonds only mature in feb, may, aug, and November) and you get a large spike in the TGA in mid June, which is further topped up on the last business day of the quarter (Friday June 28th) where reopenings of both FRNS and TIPs issue with no corresponding maturities. The end result is an actual TGA likely to be between 850-900b. The second reason is the next “high point” for the minimum TGA level (around 750b) which occurs between July 25 and July 30. This “high point” is driven by the combination of the large payment outflow on Aug 1, but also the large FRN maturity on 7/31 (again sort of a quirk of the issuance/maturity schedule /w reopenings). With no notable tax inflows outside of withholding (and July typically has the least “extra” (like bonuses etc.) withholding of any month of the year), and with Debt inflows (outside of the 1st which will largely offset the large payment outflows that day) essentially netural. The TGA should drift down 100b to about 775-800b at the end of the month, right in line with whats needed to meet the 750b policy need plus a little cushion. So effectively, from the high point at the end of May to the high point at the end of August the TGA will stay between 150 and 450b above its policy proscribed minimum level. Could Treasury ramp down bill issuance in early June and then increase it again in early July to keep the TGA level a little lower from the end of May to end of July time period? They could. Basically you have at tension Treasury’s desire to issue as cheaply as they can ( having a higher TGA than is necessary means unnecessary interest cost) versus having predictable and gradually changing bill issuance rates. I think they will favor the latter in this case. If they do then do not be surprised with an end of Q2 TGA level of 850-900b in the upcoming QRA and do not assume it means anything other than Treasury favoring more gradual and fewer bill issuance rate changes and quirks in the mechanics of how all this plays out. On the other hand, if we see an end of Q2 target of 750-800b, it likely means either more frequent changes to bill supply levels over the summer with a ramp down in early June and a ramp back up in early July. The daily details of what the Total Treasury model projects are below.

TGA in the First Quarter.

TGA in the Second Quarter

TGA in the Third Quarter

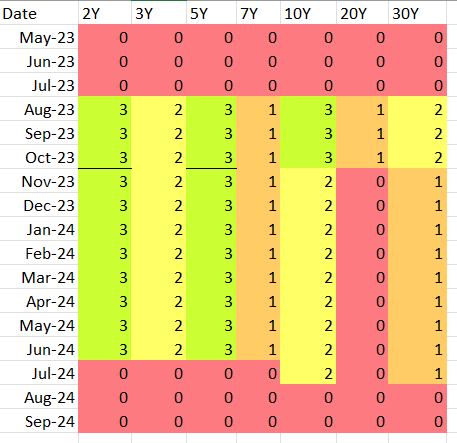

Treasury Issuance Expectations in the Total Treasury Model

The future treasury issuance in the Total Treasury Model is configurable so I can run it with different configurations. Doing so is actually how I determine what the most likely future issuance looks like for t-bills. I try various rises and falls in the rates of various t-bill tenors (sticking to some broad principles of gradual rises (+/- 5b for short tenors, 2b for long tenors) adjusting all tenors in unison when big moves (up or down) are required and then tinkering with the short tenors when more subtle moves are needed (e.g. wouldn’t be stunning to me if Treasury bumped the 4 week bill up by 5b week after next if they determined they needed an additional 20b to crest the “high points” at the end of Q1. I also have it configured for coupon issuance. So in essence, right now that issuance configuration doubles as my upcoming QRA projection.

How do I have it configured to generate the output shown in this post? Well for coupons, issuance is actual through today (note that issuance is actually different than the Nov QRA TBAC recommended financing since 10s and 30s were 1 less a month as issued vs. recommended and the FRN reopens were 2 more a month). My projections for future coupon issuance carries forward the new FRN pattern of equal New and Reopen issuance and also continues forward the slower increases to 10s and 30s into Q1. Otherwise it matches the Q1 recommended financing from the Nov QRA for Q1 and continues one more quarter of increases. Considering the following language from the Nov QRA TBAC Report to Secretary Yellen “At this point the Committee expects that the need for similar further increases at the Q2 FY2024 meeting is likely, but increases beyond Q2 FY2024 may not be required.” I think these are reasonable projections. We shall see.

As for bill issuance. Treasury increased the issuance amounts across all tenors this past week. I expect the same for next. Further expecting a reversal of that in early April and another build in July. Specifically,

Will it play out exactly as I have projected? Maybe, maybe not, but the broad themes should be correct.

· Increases to bill issuance amounts through early February

· Reductions to bill issuance amount in early April

· Increases to bill issuance amounts in late July

Upcoming QRA Projection

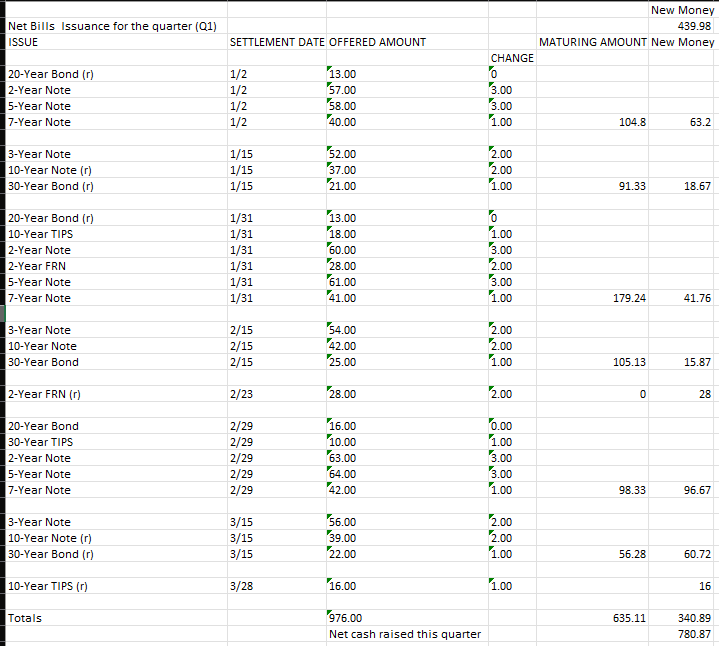

Guided by the output of the Total Treasury model for bills issuance and my expected <remainder of> Q1 and Q2 coupon issuance explained above. I project the following for the recommended financing tables in the upcoming QRA (Note that the old format may not be included next week but Ive included here because of the additional nuance it contains)

Q1 Projection Old Format (assumes end of QTR TGA of 750b)

Q2 Projection Old Format (assumes end of QTR TGA of 875b)

New Format Recommended Financing

The Future of the Total Treasury Model

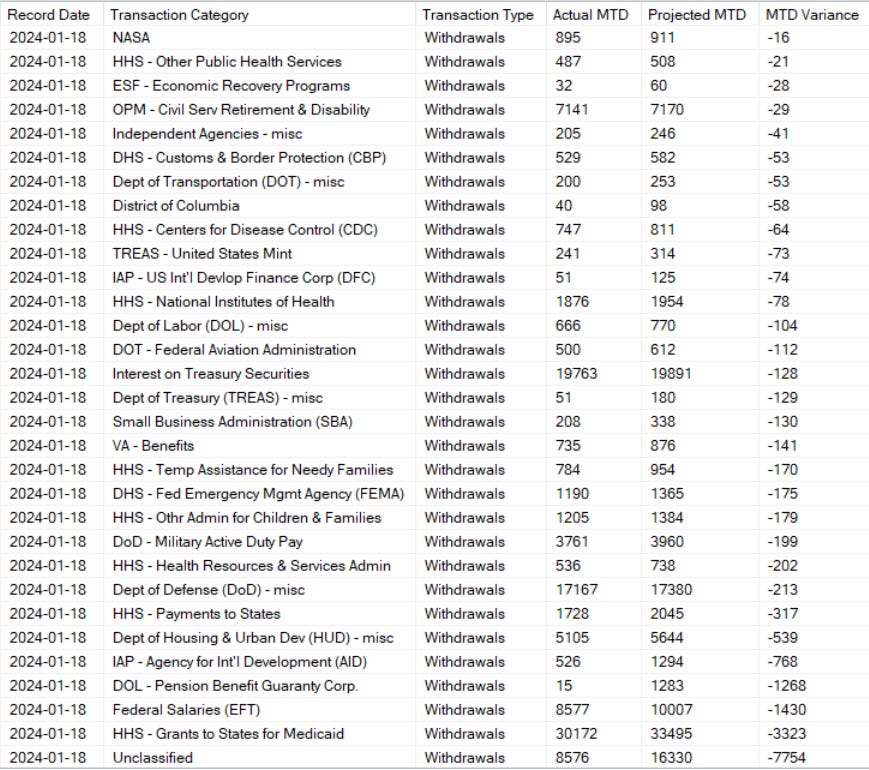

Presently, I think of the model as in Beta. Through January 18th, its performance speaks for itself, which is pretty good I think. Good enough for me to feel comfortable relying on when making QRA projections. Lets dive into the details

Deposit Category Performance through January 18th

The FDIC Deposit is a one time deposit related to the Federal Financing Bank purchasing the cash flows from SVB receivership assets and is almost entirely matched by a corresponding withdrawal from the Federal Financing Bank. One-time extraordinary transactions the timing of which I don’t think are projectable. I give the model a pass on that one. The other large MTD variances involve Corporate Taxes where the model has underprojected actuals. January is not one of the four corporate tax remittance months, but some amount always flows in the off months due to late filings, refilings etc. (you know, reasons). This model unexpected spike (vs. recent history) may be due to refilings of earlier year returns for companies that received ERC funding creating additional tax liability for those earlier years (shoutout to @EfflerPubah for that insight). Something Ill keep my eye on and tweak the models formula if it becomes more persistent. The other source of large variance involves the non-withheld receipts. There are likely two things going on there. A. There has been a shift over time from folks mailing in those estimated tax payments to electronically filing those payments. So the models underprojection of SECA/ELECTRONIC and a portion of the models overprojection of SECA/OTHER looks due to a somewhat quicker move this year to how those folks file. When January is all in, I will adjust the split between ELECTRONIC and OTHER to reflect and reduce that (netting) variance in future months.

Still though, it leaves a 14b hole in collected estimated taxes vs. what the model projected. I think this will be eventually explained by the model expecting the mailed in returns to come earlier in the month than they have. Historically, the mailed in returns flow in heavy starting a little after the 15th and continue through the end of the month, but it varies each year just exactly when during that half month. Its most likely to me that most of the models overprojection through the 18th will be realized in the next 10 days but we shall see.

Withdrawal Category Performance through Jan 18th

Again the sore thumb is the Federal Financing Banks purchase of the cash flows from SVB assets mentioned above. Otherwise, there may be some tweaking to be done to the withdrawals from the medical trust funds but its pretty largely in line. Finally, the model seems to be structurally overestimating Unclassified withdrawals. Treasury shifted some of the spending from Unclassified to other categories back in October so the comparisons to historical “unclassified” withdrawal flows are tougher right now. When January is through I may need to tweak the model here. In the aggregate though, I think the model has a reasonably accurate handle on these flows.

Commercial Viability?

Once the model has more track record under its belt, is its output commercially viable as a data product? I think it might be? I have received an inquiry or two in the past about whether I offered a subscription service to this sort of data, but its only now where I think the models output for Table II withdrawals/deposits might be good enough in conjunction with Treasury issuance/maturity to continue its development and go this route. So Ill end this post with an appeal to my readers for their opinions on its viability or any directions to take it that would make it more so. Finance/economics/trading/markets is a fairly new arena for me so any and all feedback/advice is most welcome. Feel free to respond in the comments or reach out directly to me via DM on twitter/X if you are inclined.

And of course as always,

Thanks for Reading,

John

Hey John great work! Is there a way to see how much “new money” (additional debt needed for interest payments on current debt) was projected by treasury every fiscal year?