Projecting QT Balance Sheet impact through 2022 (and next week 8/17/22)

TLDR

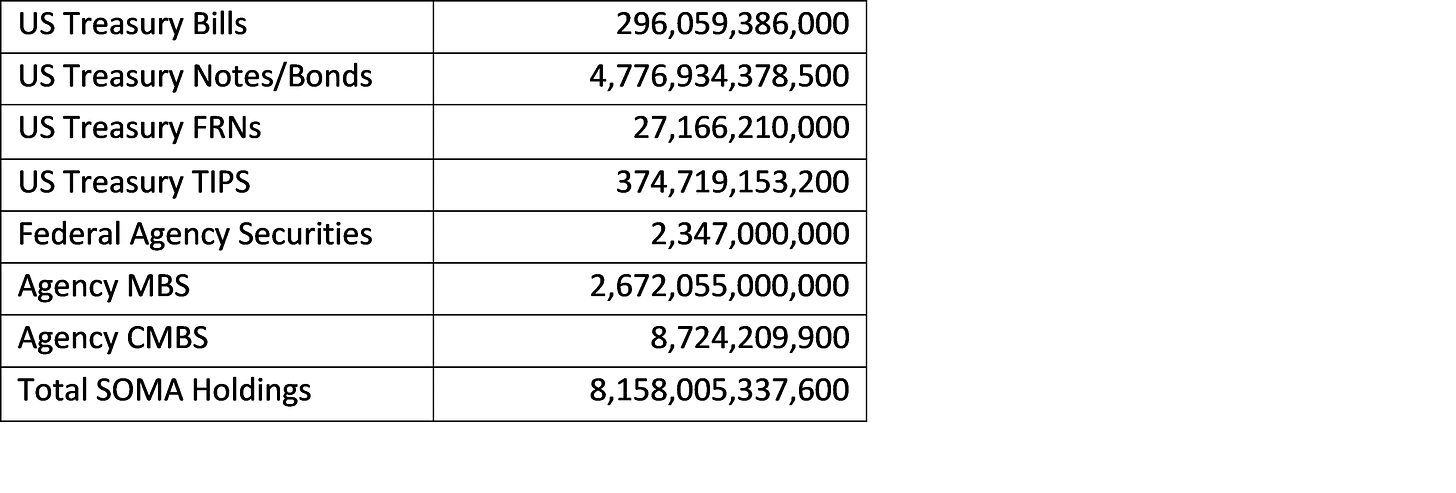

1/4/23 SOMA Domestic Security Holdings projection

8/17/22 SOMA Domestic Security Holdings projection

Hi again!

QT mechanics should get fairly vanilla soon. There is still some MBS to settle and even a little more to be purchased/reinvested but the largest impact of lagging MBS settlement is behind us. With the upcoming ramp in roll-off caps to 60b in UST and 35b in MBS (which will very likely never be hit) starting in September, I thought one last post with detailed projections and explanations for the FED SOMA Holdings/Balance sheet through the end of the year (and as a bonus also for next week) would be helpful. So lets dive in.

August

MBS

*Note the projected amount of MBS to settle could be reduced some if the trading desk opts to roll any of it into September. When the FED executes an MBS roll, they sell some amount of current month MBS with a simultaneous contract to re-purchase the same amount of similar MBS in the next month. For example, the FED rolled 4.3b of MBS from July to August, so 4.3b of the 17.741 MBS to settle and hit the BS this month was deferred from July. The rationale for doing rolls as explained by the FED is to facilitate orderly settlement and address any temporary imbalances in market supply and demand. This year from January to March, the FED rolled very little MBS, but in the past 4 months rolls have ranged between 2.1b6 rolled from May to June and 9.86b rolled from June to July. I cant project whether the FED will roll any MBS from August to September and wont know for sure until the next round of trading desk operational results are released, but with the total volume of 17.741b being a good bit less than prior months for the sake of simplicity I will assume they will not. Any rolls would change the BS drop for MBS over the next month or two but will have no impact on the projected BS number for the end of 2022 since they will have netted out by then.

*Note the FED telegraphed the Aggregate agency payments for August when they announced the purchase of 7.8b in MBS from mid August to mid September 17.5b + 7.8b = 25.3b. Read my earlier article on calculating agency payments to understand why I am confident that will be the MBS payment numbers this month.

UST

8/31/21 SOMA Balance sheet projections

September

MBS

*Note that MBS projected to settle is reached by adding the 8.969b of MBS purchased prior to today that with contractual settlement dates in September to the .446b in GNMA II MBS the FED tentatively plans to purchase on 8/17/2022 which is likely to settle next month

*Note I am using 23b a month as my projection for MBS payments through the end of the year. It is very much dependent on prepayment rates which reflect both refinancing activity (or lack thereof) and existing home sales (albeit with a lag, e.g. August MBS payments to Fed represent payoffs made in June which reflect rate locks/purchase contracts from mid April through mid May) Based on slowing sales traffic and expecting mtge rates to stay high enough to keep refinances frozen I think a little down from August’s number of 25.3b makes sense. Others have projected it a bit lower at 21b.

UST

10/5/21 SOMA Balance sheet projection

October

MBS

*Note the projected MBS to settle reflects the remainder of the 7.8b in MBS the FED will purchase between 8/12 and 9/14 after subtracting the .446b we expected to settle in September

UST

*Note, because there are insufficient coupon USTs maturing to meet the 60b cap in October, the FED will then reduce the reinvestment in Bills which it was otherwise keeping level.

11/2/21 SOMA Domestic Security Holdings projection

November

MBS

*Unless prepayment rates rise significantly, the 7.8b in MBS the FED is purchasing between 8/12 and 9/14 will be its last thus all settlement of MBS should complete prior to November

UST

11/30/21 SOMA Domestic Security Holdings projection

December

MBS

UST

1/4/23 SOMA Domestic Security Holdings projection

Next week - 8/17/2022

I purposely made my projections for the SOMA Holdings at the end of each month, and made no attempt to do weekly projections. While possible to get weekly projections somewhat close the big problem with doing it is for the months where maturing UST coupons exceeds the cap, its impossible, as far as I know, to project what the FED will do with its reinvestments until it actually makes them. For example, in November they will need to reinvest 50b to runoff 60b from 110b maturing. How much will they reinvest on the 15th vs the 30th? Who knows. Doing it at month end is cleaner since however they spread it, they will reinvest 50b that month. That said, we can get a pretty good idea of what the balance sheet will look like next week (8/17/2022) because the FED has already made the UST reinvestments at the treasury auctions over the past few weeks.

MBS

*Note GNMA I and FHLMC Gold were ~8.65% of the aggregate MBS payment in July, so I am applying the same percentage to the 25.3b payment for August.

UST

*Note UST Coupons Reinvested on 8/15

· 13.28b in 30yr Aug 11 auction

· 22.13b in 10yr Aug 10 auction

· 26.56b in 3yr Aug 9 auction

*Note The drop of 22.85b means the remaining 7.15b of the cap for August will be met with the 31st maturing coupons.

8/17/22 SOMA Domestic Security Holdings projection

Thanks again for reading!

John

Hi John, Great post. Thought I'd offer a resource to satisfy your intellectual curiosity on how Fed manages roll over process.

https://www.newyorkfed.org/markets/treasury-rollover-faq