Playbook for QRA week

Clues along the way...

*** Post Edit 4:58PM

So apparently its me who was on the struggle bus today. Obviously completely screwed up the day when the Marketable Borrowing Estimates was coming out. (came out today not tomorrow). Fortunately, you probably already knew that since I published this post literally after it was released. Anyways, apologies for that screw up. The day shift obviously alters the timing of the events and when/if they are relevant. However, the analysis on how to interpret the Marketable Borrowing Estimates is still sound. I will post something later tonight interpreting what its saying and suggesting about…. ahem….. Wednesday mornings recommending financing tables release.

*** End Post Edit

Greetings,

QRA week is finally here! Treasury will finally (well for at least 3 months) settle the question of whether the coupons really are coming. I threw my projection hat into the ring last week, which if you are reading this post you probably already read, but if not you can see my take on it here (https://johncomiskey.substack.com/p/projecting-the-quarterly-refunding). The purpose of this post is not to repeat that analysis as my position is unchanged since I wrote it. Rather the purpose of this post is to playbook out the week, what comes out when and what it will tell us. Oddly, the most interesting piece of information this week related to what the QRA says may not be in the QRA itself. Oh and also, I have been hearing rumors that some members of some Federal Reserve committee are having a party or a lock-in or some get together this week as well where monetary policy may be discussed, Ill try to find out more and report back. Kidding of course, its just striking to me how the focus seems so different than the norm for an FOMC week. Also I like humorous imagery and the mental thought of the FOMC hanging out all night watching movies like a church youth group on a Friday night was too funny to me not to pass on. Anyways, you’re not here for the jokes so lets get to the week.

The Schedule (all time EST)

Tuesday (tomorrow!)

11:00 AM – Auction announcements on the 4-week, 8-week, and 17-week bills come out found here (https://treasurydirect.gov/auctions/upcoming/) . Current weekly levels of those bills are 95b, 85b, and 56b respectively. They have been at those levels for the past 3 weeks after steadily rising each of the 3 weeks before that. What are we watching for? Whether those levels stay the same or change. What it means…

If the level drops – Financing need that will be reported in the Marketable Borrowing Estimates likely to be substantially lower than the 881b I projected for Q4. As a result, either the end of year TGA level will stay at 750b or Treasury’s projected fiscal deficit through the end of the year will be substantially lower than the 400b I projected. Does it say anything about coupon issuance? Probably not. much more pertinent to Q4 bill issuance I think. This scenario is plausible to me but I think unlikely.

If the level stays the same – My projections stay on track. I think this is the significantly most likely scenario.

If the level rises – All bets are off. Could mean the financing need is significantly more than the 881b I projected resulting in higher deficit or end of year level TGA higher than 850b. Also could signal an upcoming policy shift where increases anticipated in the August QRA for Q4 don’t happen. This scenario is very unlikely imo.

3:30 PM – Treasury Marketable Borrowing Estimates for Q4 and Q1 are released found here (https://home.treasury.gov/policy-issues/financing-the-government/quarterly-refunding/most-recent-quarterly-refunding-documents) . The first thing most (but not you since you were watching the bill announcements a few hours earlier) will be watching. It will tell three things for each quarter. A. The expected amount of publicly held (not including fed held) net new bills + coupons the Treasury intends to issue in each quarter. It’s the most important number since there will be some split of net new bills and coupons that add up to it for each quarter. The other two pieces of information are B. the end of year TGA level and C. the implied fiscal deficit. What it does not tell you is the split between coupons and bills for the quarter; for the full breakdown there we have to wait for the recommended financing tables on Thursday, but it may offer some clues. Since the thing everyone is most interested in is the upcoming coupon issuance. Here are my rules of thumb using my projections last week as the baseline.

First, figure out the Treasury projected deficit including QT. This will be the announced total net new marketable debt level less the announced rise in the TGA from 650b. So If the total net new marketable debt level comes in exactly as I have projected it at 881b and the EOY TGA rises to 850b, than the projected deficit including QT would be 881-200 = 681b. If the EOY TGA was 900b than the projected deficit including QT would be 631b.

Comparing whatever actually comes out tomorrow vs. my projected 681b, the scenarios:

Significantly > 681b - This means the estimated fiscal deficit is comin in hot. In that scenario, there is little chance imo they would reel back coupon increases and significant chance of bigger coupon increases in Q4 than I project. I don’t think this scenario is likely.

Closeish to 681b – Estimated fiscal deficit is coming in as I projected. My analysis stays on track I think. Obviously I think this scenario is most likely.

Significantly < 681b – Estimated fiscal deficit is on the struggle bus (thanks for the turn of phrase @pinebrookcap, totally cribbed from one of his recent posts). This lends some support to the idea that there could be lower increases to coupons in the recommended financing tables though it is far from dispositive about it. (I think even a 100b miss to the downside likely keeps coupons the same in Q4 since its more about the long term deficit than the short term though a much lower short term deficit could certainly mean a little slower pace to get to the eventual coupon goal even if the end range is the same by say Q1 2025). In this scenario, if coupons are not reduced, than look for a reduction in bill supply through the end of the qtr to start within the next few weeks

So all our clues to what the coupon issuance will be come Thursday morning are in then and we just have to wait? NO! I alluded earlier to the most interesting data point maybe not being in any of the QRF documents. Well I was being a little hyperbolic to tease a further read, I mean the recommended financing tables on Thursday morning are going to be the most interesting thing since they will actually answer the question about Q4 and give a huge indication of Q1. That said there is another data point between Tuesday at 3:30 and Thursday at 8:00 that may be being overlooked and im not talking about the FOMC pizza party or whatever it is they have scheduled this week.

Wednesday

11:00 AM – Treasury will announce the actual offered amounts for the 3 year, 10 year and 30 year notes/bonds to issue mid month. No need to wait until Thursday morning, we will know it Wednesday morning. Depending on what these numbers turn out to be I think they will be strongly indicative of whats to come on Thursday morning.

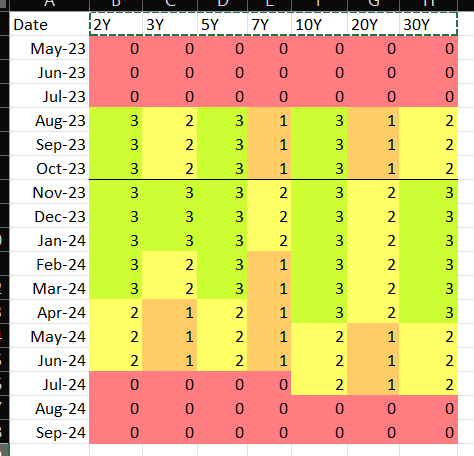

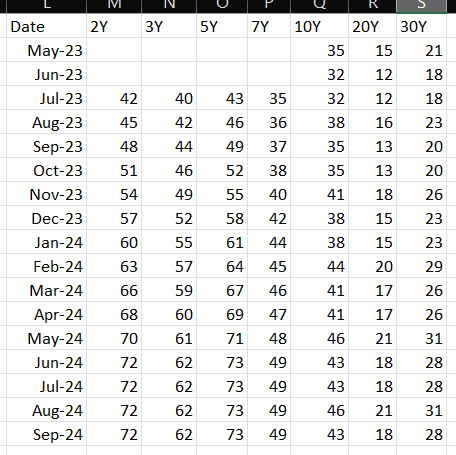

As a reminder, last week I projected the following increases for the 3, 7 and 10 on 11/15. Reflecting a blend of what was actually issued in Q3 and what the Aug QRA projected for issuance in Q4. Those projections were

3yr - +3 increase from 46 to 49

10yr - +3 increase from 38 to 41

30yr - +3 increase from 23 to 26

If the auction amounts announced match those, than my projections are on track. Regardless, whatever the 10yr and 30yr number is on Wednesday. The reopens for them in December and January are very likely increase/stay the same by the same amount based on recent Treasury reopen issuance history. To help visualize I am including my projected issuance increases and offering amounts from my post last week. Take the actual Nov numbers for 3,10,30 that come out on Wednesday and adjust accordingly.

Finally, we reach,

Thursday

8:30 AM – Recommended financing schedules for (remainder of) Q4 and Q1 will be released. Honestly not much more to say about this that hasn’t already been said. It will be what it will be. Until whatever that is is, ill hold off any further analysis.

Hopefully this playbook for the week proves helpful. Ill tweet out the updates on the pre-Thursday events as they happen.

Thanks for Reading!

John