May QT

(be with you)

TLDR

QT will reduce Fed balance sheet by ~77.81b in May: 60b for UST, 17.81b for MBS. UST reduction is again heavier on the end of month maturities, though only slightly this month There will be no bill rolloff in May.

Note for new readers – If this is your first time reading my posts on QT and are interested in the mechanics behind QT and how I reach these projections. Please see my earlier posts starting with Reverse Engineering QT on July 29, 2022.

Also, if you are interested previewing the scripts authored by @dharmatrade that leverage the FED APIs to pre-calculate QT treasury/bill runoff schedules and MBS payments for the upcoming month implementing the QT rules and MBS estimation methods described in this series of posts, reach out to him on twitter. His scripts are a huge help in putting these posts together.

Greetings!

When I write these QT reports I like to be as precise as I can, it just a facet of who I am. On the other hand, I think the bigger value my QT posts provide (outside of initially exploring and explaining the mechanics of it) is providing an easy reference for whats actually going to happen within reasonable accuracy. I think the reality that rolloff will be ~77.81b this month instead of the oft mis assumed 95b matters. Maybe not a ton, but I think its enough of a difference that folks who care about the subject enough to read these posts are better off with more accurate context for whatever decisions they may make that take whats happening with QT as an input. I also think showing that QT is not uniform within the month but instead is chunky due to discrete UST maturity schedules and MBS payment receipt schedules matters, particularly for those highly attuned to liquidity.

With that said, the fact that my methodology over projected MBS payments (and thus total QT) last month to the tune of ~1.2b (19.87b projected, 18.67b realized) probably doesn’t matter that much but it irritates me, particularly after being almost stunningly precise with the MBS payment projection in February after I tweaked the methodology to isolate the regular principal returned from the prepayment portion and thinking I had it nailed. Even more irritating is I don’t think I have enough information about the Feds MBS holdings to improve the methodology. The agency, coupon, and maturity (15 vs. 30yr) are available on the Feds MBS holdings, but as far as I can tell the vintage (year of origination) is not, so I cant do a more detailed comparison against the granular (by coupon and vintage) prepayment rates reported by the GSEs and instead have to use a more coarse top line number. So I think we are going to just have to live with a little imprecision in the MBS projections some months. In the grand scheme of things that’s probably ok.

While investigating my MBS overprojection last month though, I did stumble on a Fed portfolio maintenance program that doesn’t meaningfully impact QT but thought readers might be interested in. The gist is the Fed in conjunction with the GSEs is doing cusip consolidation, which basically means they are consolidating the underlying loans still in some of their older MBS spread across many cusips with small remaining principal balances (many/most of the mortgages once in those MBS have prepaid) into new cusips, and while they are at it moving from a 45 day delayed payment (pays on the 15th) (old FHLMC GOLD) to a 55 day delayed payment (pays on the 25th) (UMBS). In April, this meant about 700m of FHLMC GOLD MBS “converted” into 700m of UMBS. More details on the program can be found here. https://www.newyorkfed.org/markets/agency_mbs_cusip_aggregation_faqs

Now, onto the numbers…

May MBS Payments

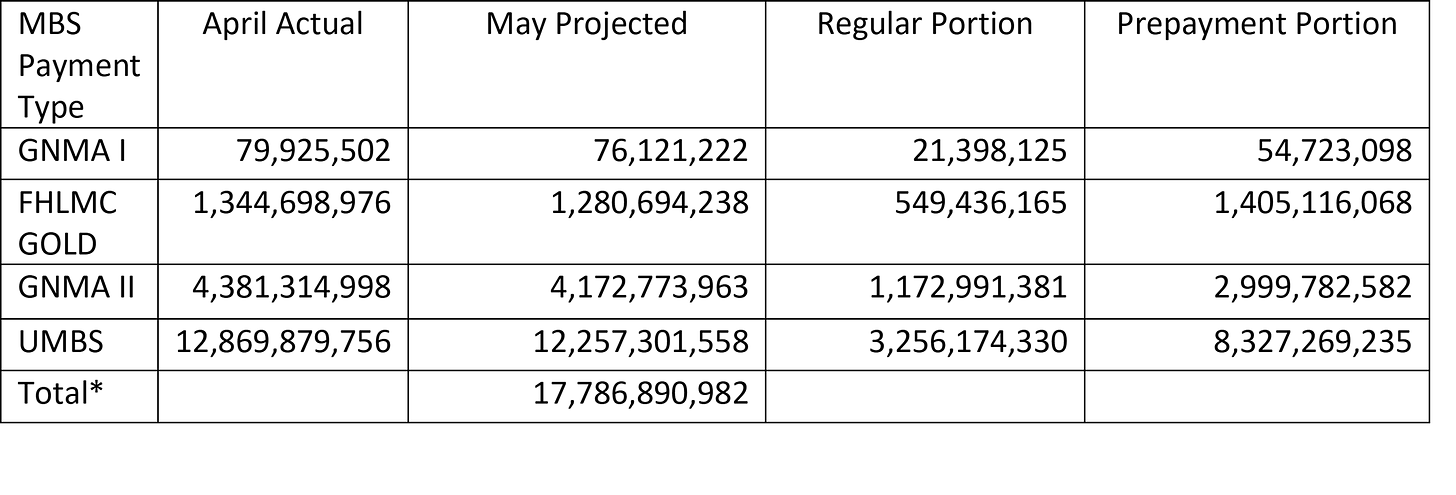

April prepayments pulled back a bit, falling ~6.5% vs March. Using @DharmaTrade ‘s scripts which faithfully only apply the 93.5% multiplier to the prepayment portion of each MBS payment, we reach the following MBS payment projections:

*Note an additional 25,000,000 in Fed held CMBS is also expected to rolloff bringing us to a total MBS rolloff of 17,811,890,982

May UST Rolloff

Fed coupons maturing in May are:

· Total notes/bonds: 114,324,066,900

· Total FRNS/TIPS: 0

· Total Coupons: 114,324,066,900

Since Coupons maturing exceed the 60b cap, the Fed will fully reinvest their bill maturities in May.

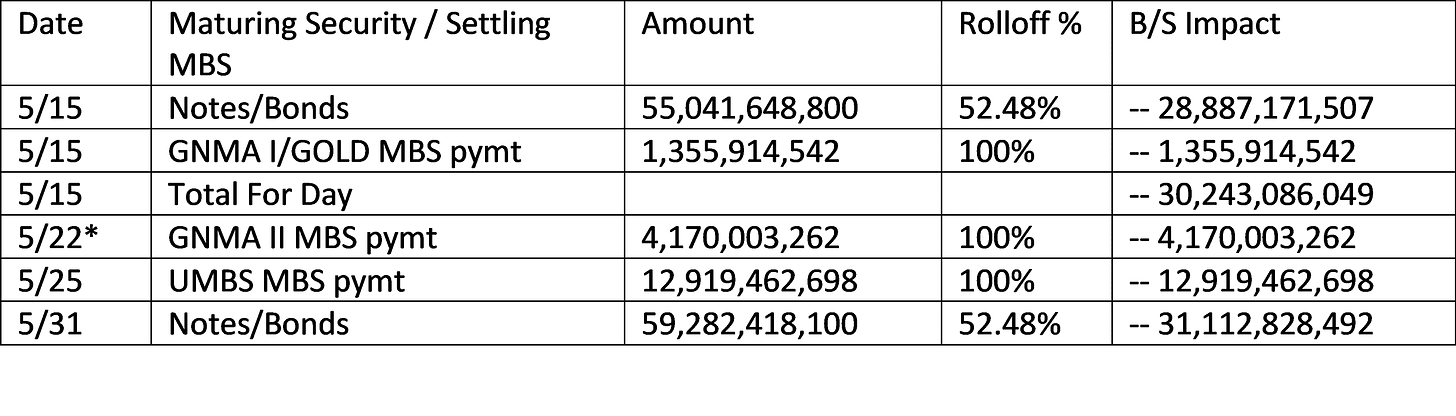

Between the mid month and end month maturities, the Fed rolls off an amount proportional to the total amount maturing. Accordingly, since 60b will be rolled off out of a total ~114.32b for the month. ~52.482% (60/114.32) of the amounts maturing on 5/15 and 5/31 will roll off.

QT Balance Sheet Impact by Date in May

*The GNMA II payment scheduled to be received on Saturday May 20th will instead be received the next business day which is Monday May 22nd.

Weekly Projections for May

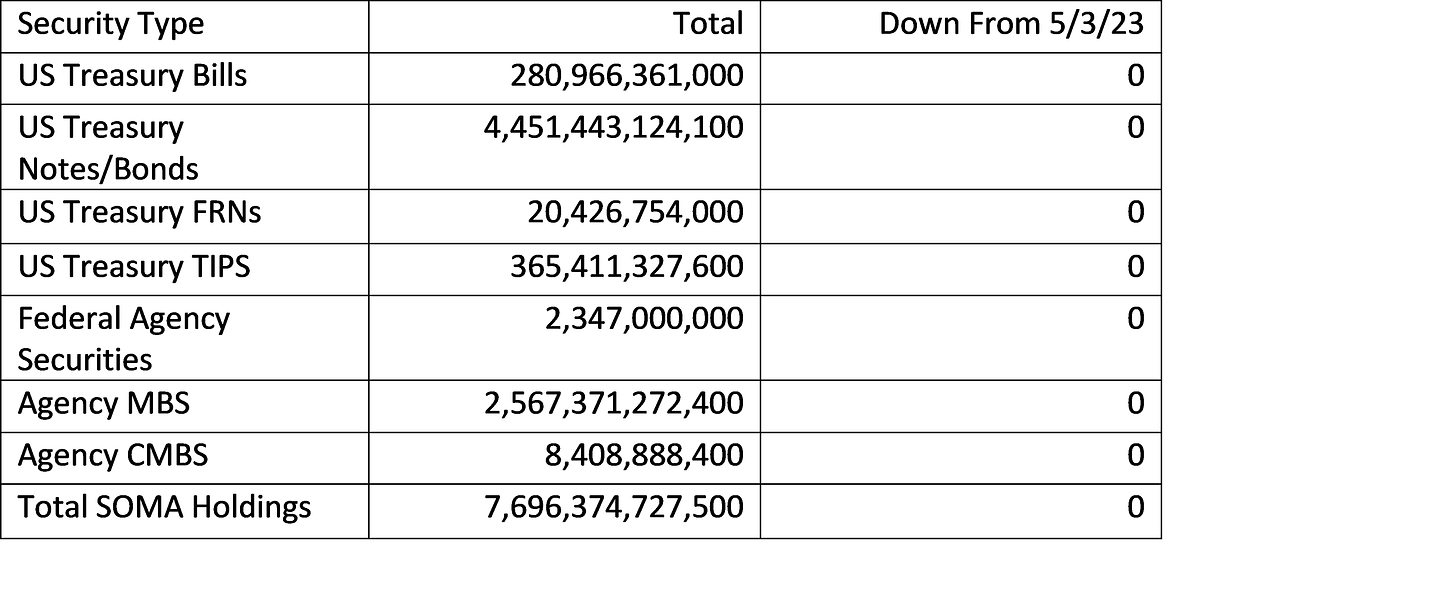

5/10/23 SOMA Domestic Security Holdings projection

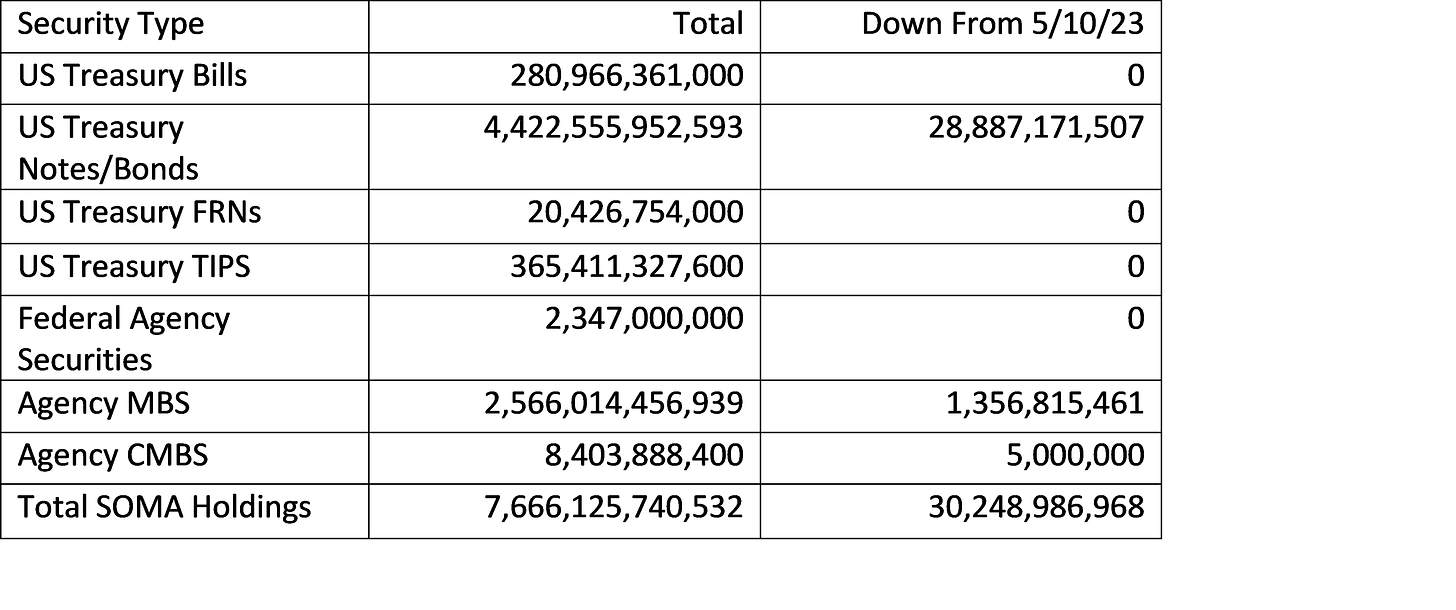

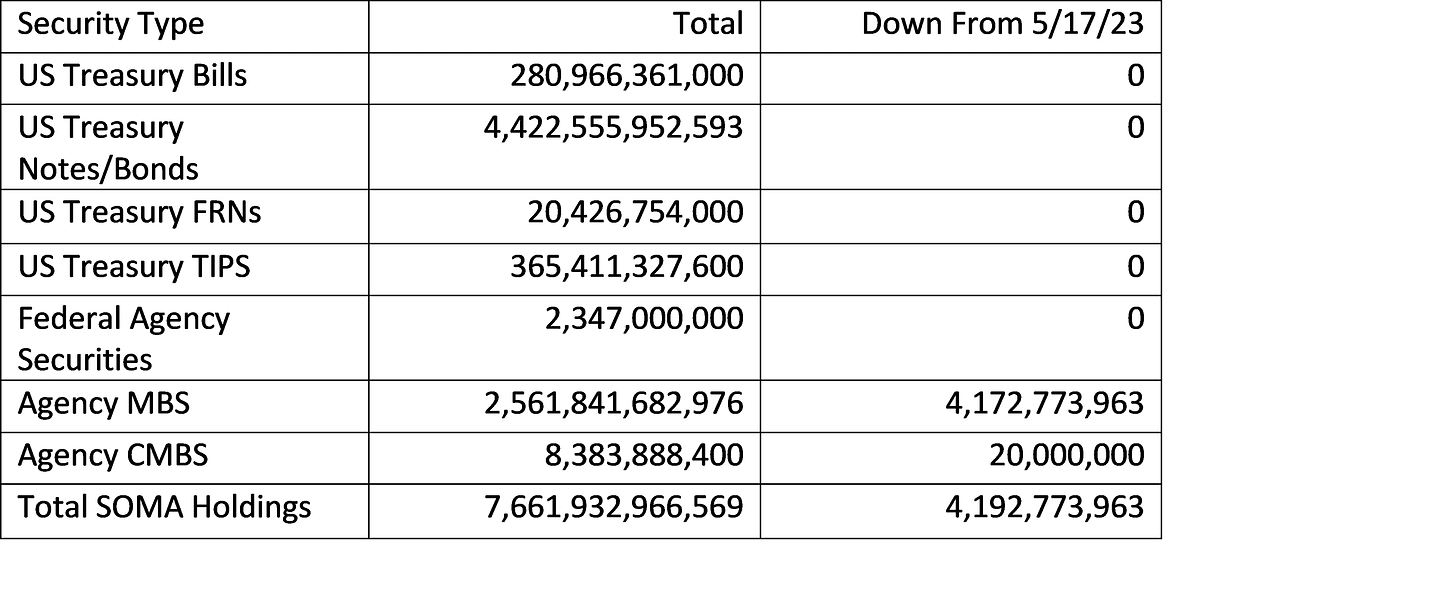

5/17/23 SOMA Domestic Security Holdings projection

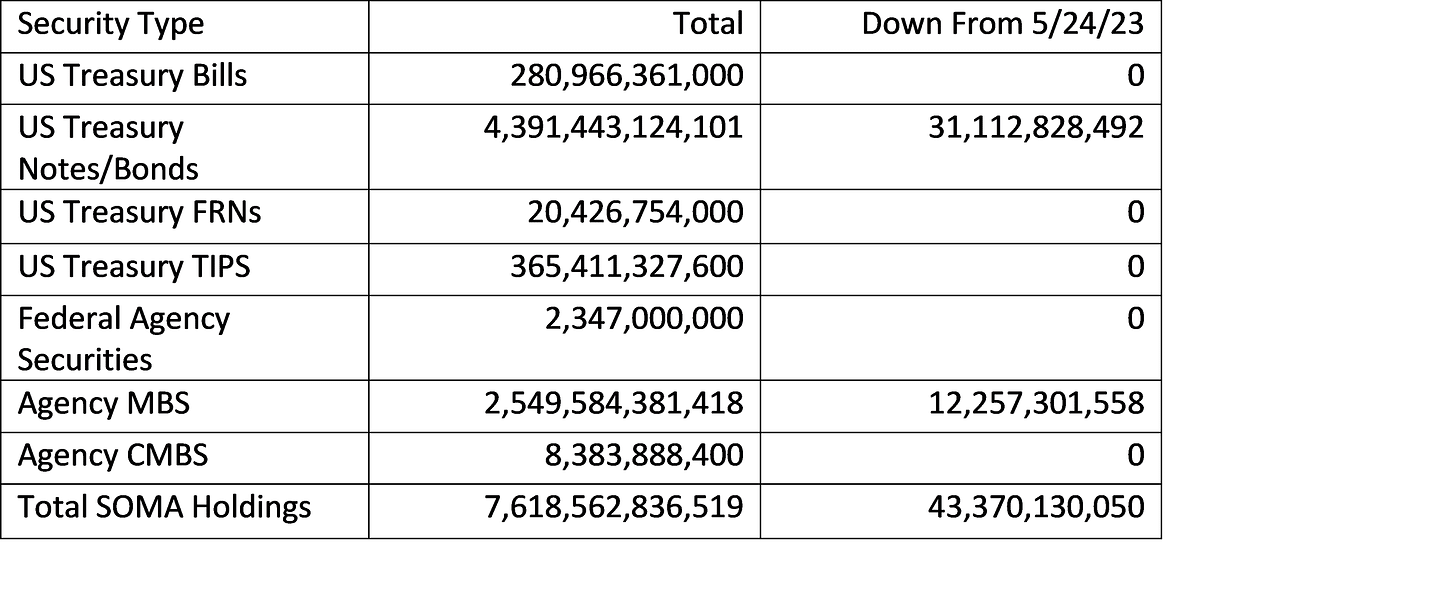

5/24/23 SOMA Domestic Security Holdings projection

5/31/23 SOMA Domestic Security Holdings projection

As always, thanks for reading.

Best,

John