March QT

TLDR

QT will reduce Fed balance sheet by ~76.46b in March: 60b for UST, 16.46b for MBS. UST reduction is heavily weighted on the end of month maturities which will reflect on the 4/5/23 B/S. There will be a small amount, ~4b, of bill rolloff spread through the month.

Note for new readers – If this is your first time reading my posts on QT and are interested in the mechanics behind QT and how I reach these projections. Please see my earlier posts starting with Reverse Engineering QT on July 29, 2022.

Also, if you are interested previewing the scripts authored by @dharmatrade that leverage the FED APIs to pre-calculate QT treasury/bill runoff schedules and MBS payments for the upcoming month implementing the QT rules and MBS estimation methods described in this series of posts, reach out to him on twitter. His scripts are a huge help in putting these posts together.

Hello!

Its QT projection time again. There is nothing new this month to the methodology used to generate these posts but there is one QT related point I would like to weigh in on. I often see references to the Fed being behind its 35b monthly “target” on MBS reduction. It is certainly true that the Fed has not reached the 35b cap on MBS rolloff established originally in the May 2022 FOMC minutes since that cap raised from 17.5 to 35b last September (including this month where only 16.46b will rolloff). A cap is not the same thing as a target though. I nitpick on this point because I get the sense that some who view it as a target use the missing of it as evidence the Fed will engage in MBS sales (the only way to reach a 35b rolloff amount given prepayment rates these days) in the near future. Consider though why the Fed is not hitting the 35b cap (or target if you like). Its because housing transactions are slow, really really slow (though admittedly up a tick this month). There are almost no refinances and very few purchases happening. The extraordinarily slow prepayment rates reflect this. Fed selling MBS in size would certainly raise mortgage rates a bit and likely further slow housing transactions but with the level is so low as it is, I don’t really see the point. If the point is to push home valuations lower to impact/offset inflation than I think whats really needed to reset home valuations in line with rates is simply time with rates at these levels. Also, as this post indicates, as the level of those housing transactions (reflected in the prepayment rates) increase, the amount of actual MBS rolloff increases accordingly (up a little this month vs. last). That said, various Fed speakers including Chairman Powell have indeed discussed that MBS sales may be appropriate at some point in the future. If and when that is officially communicated by the FOMC and becomes part of the QT plan, these reports will incorporate them.

Lets dive in!

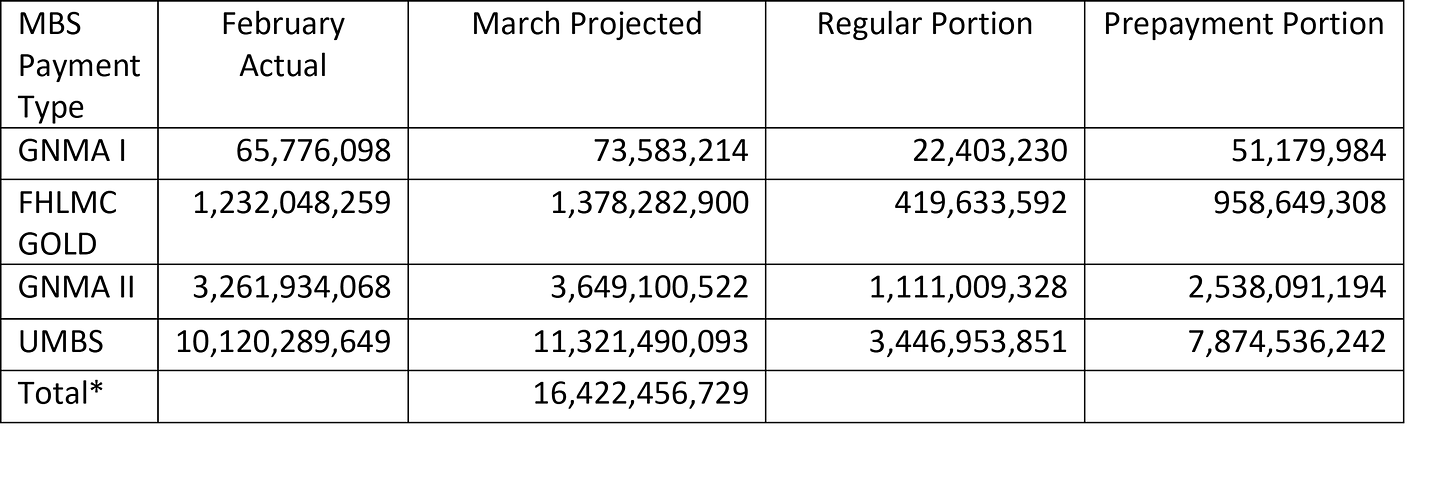

March MBS Payments

The updated methodology (see January QT projections for details) to project the MBS payments the Fed will receive in the current month continued to perform well last month.

Projected 3/1 SOMA MBS level = 2,601,635,645,584

Realized 3/1 SOMA MBS level = 2,601,598,207,100

I feel pretty comfortable with the accuracy of the approach at this point. I expect that accuracy will continue.

As for March well, February prepayment rates did something a little unusual recently, they actually rose a bit (albeit from a glacial level) rising ~118% vs January. Using @DharmaTrade ‘s scripts which faithfully only apply the 118% multiplier to the prepayment portion of each MBS payment, we reach the following MBS payment projections

*Note an additional 35,000,000 in Fed held CMBS is also expected to rolloff bringing us to a total MBS rolloff of 16,457,456,729

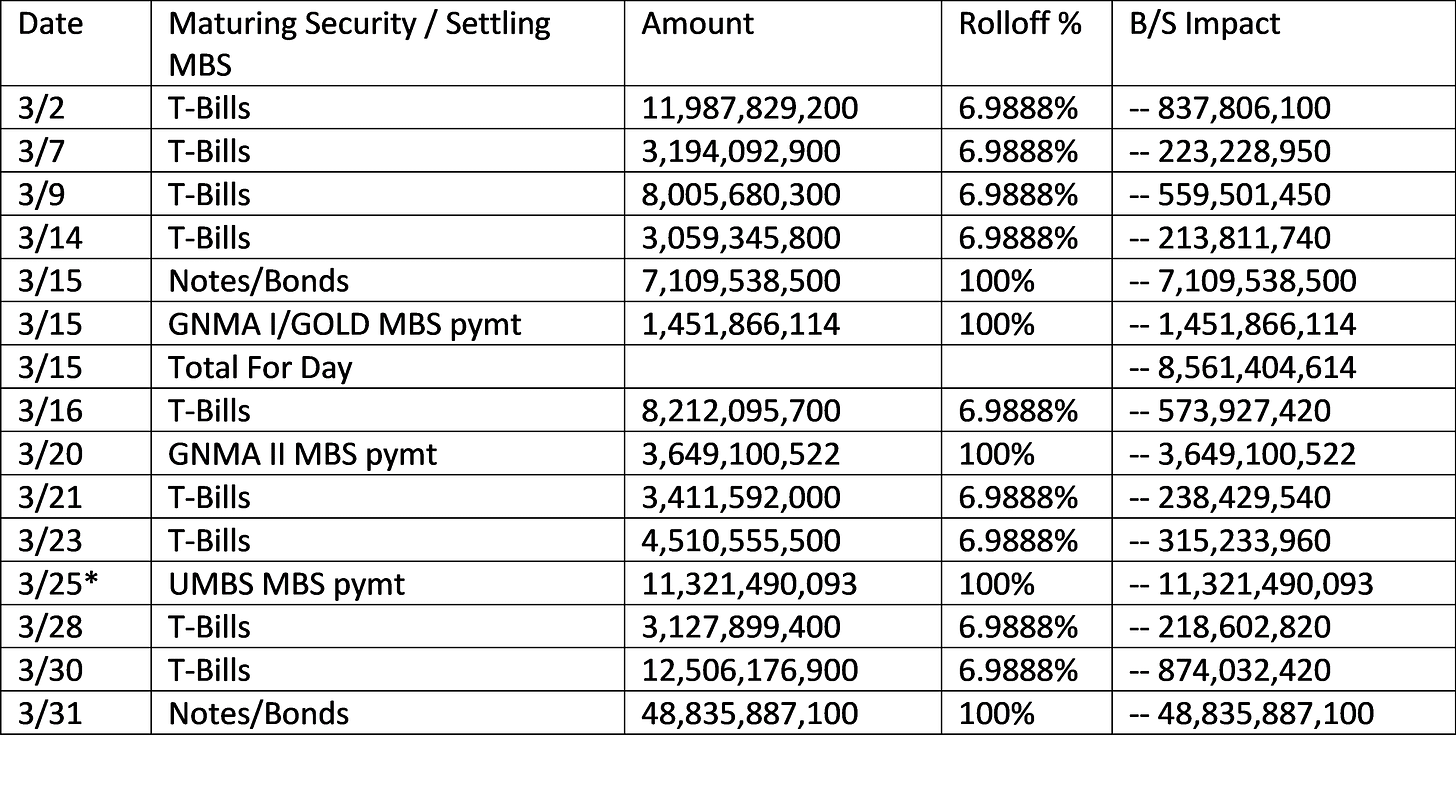

March UST Rolloff

Fed coupons maturing in March are:

· Total notes/bonds: 55,945,425,600

· Total FRNS/TIPS: 0

· Total Coupons: 55,945,425,600

So coupons will narrowly miss the 60b cap meaning there will be 4,054,574,400 rolloff of bills as well. The Fed does this proportionally to the amount of bills maturing each week. For March, the rolloff percentage for bills is ~ 6.9888%. This is calculated by 4,054,574,400 (total bills to rolloff) / 58,015,267,700 (total bills maturing).

QT Balance Sheet Impact by Date in March

*The UMBS MBS payment scheduled to be received on Saturday March 25th will instead be received the next business day which is Monday March 27th.

Weekly Projections for March

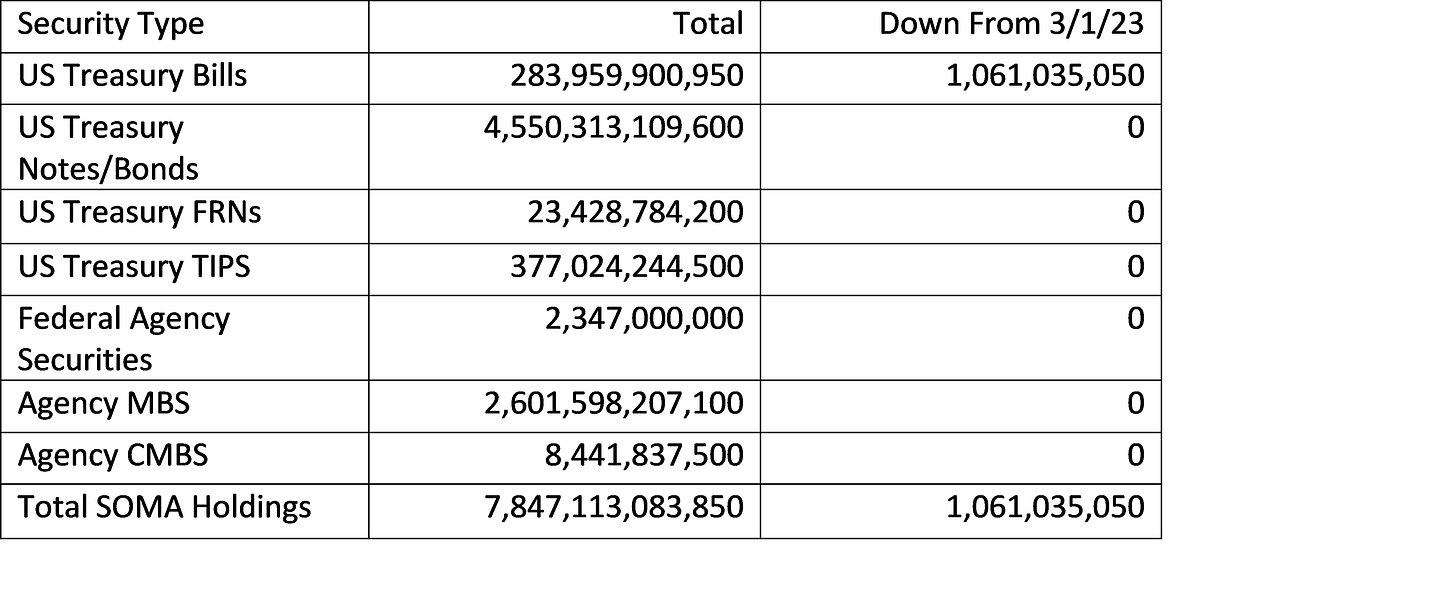

3/8/23 SOMA Domestic Security Holdings projection

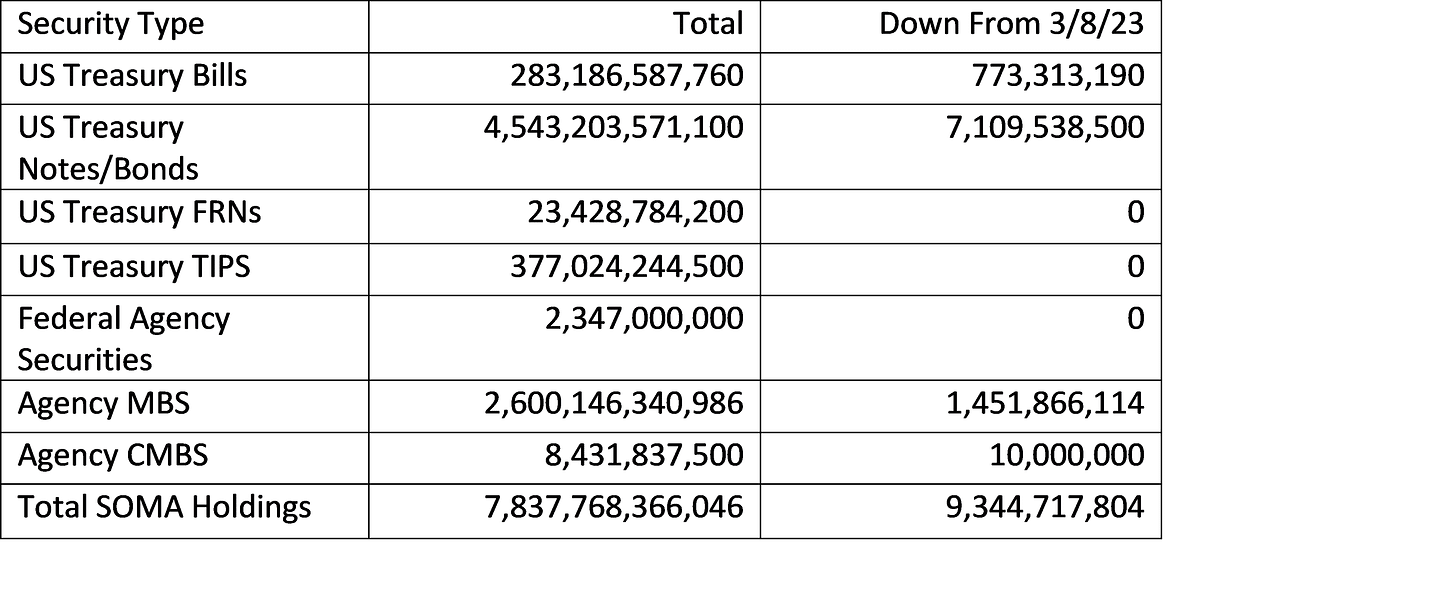

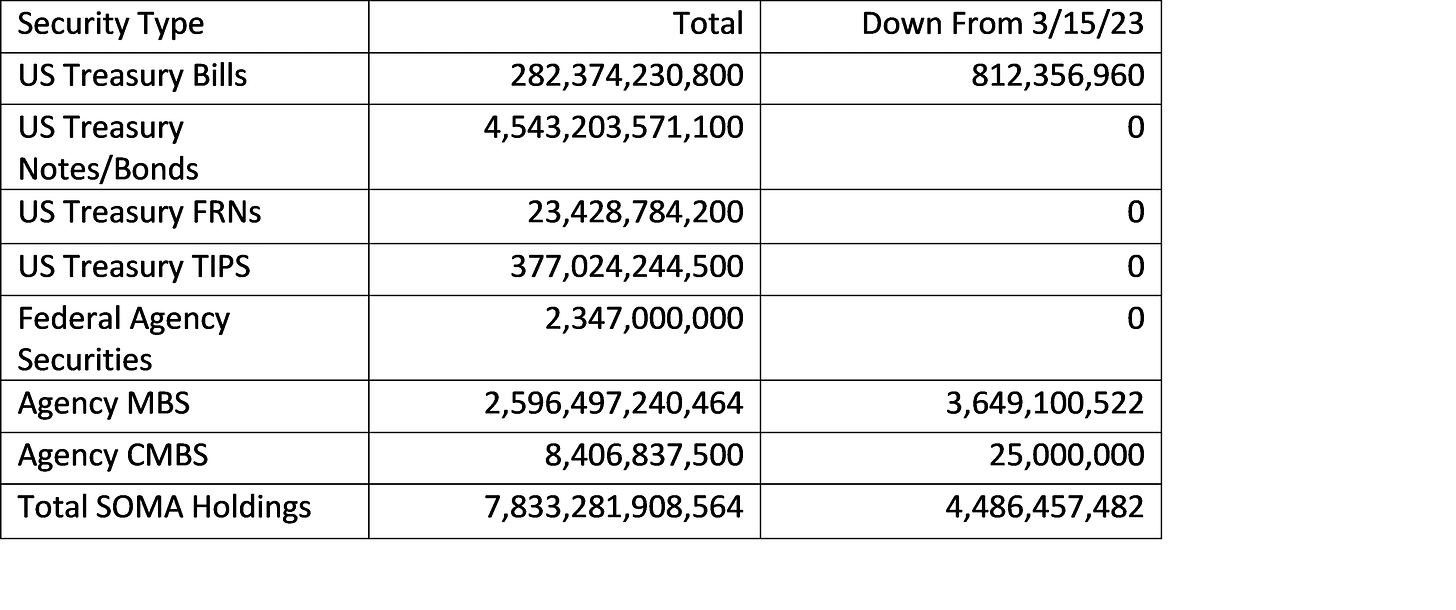

3/15/23 SOMA Domestic Security Holdings projection

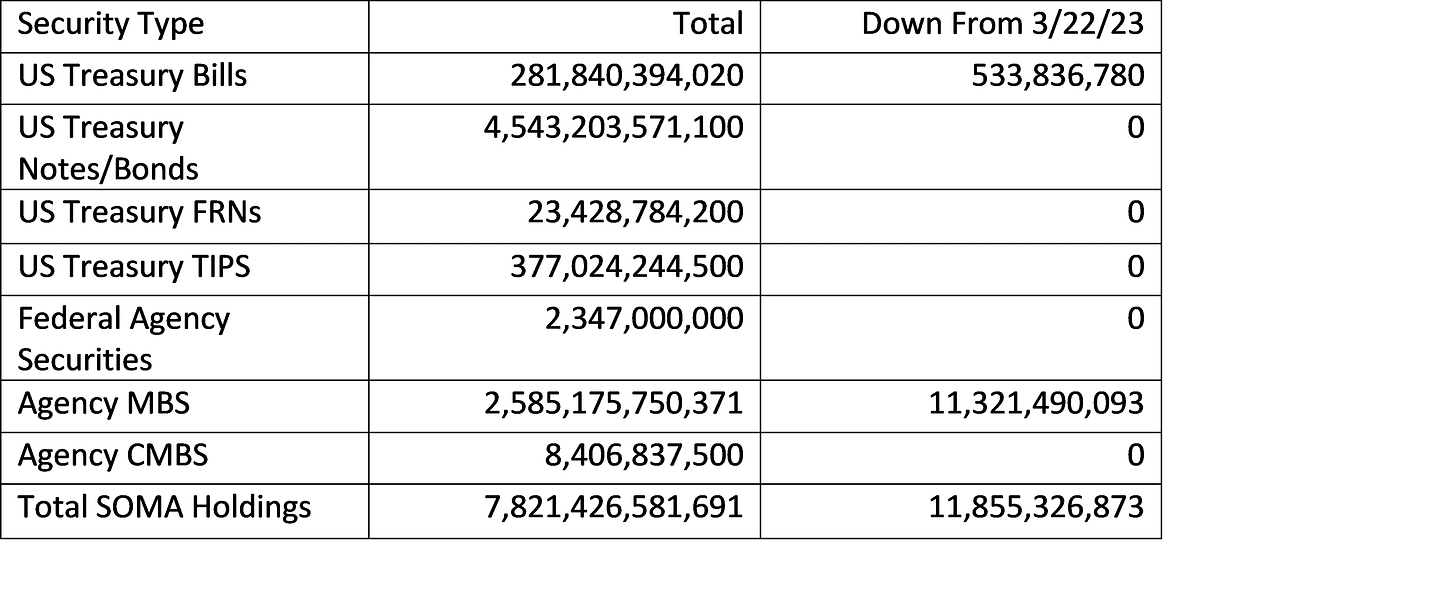

3/22/23 SOMA Domestic Security Holdings projection

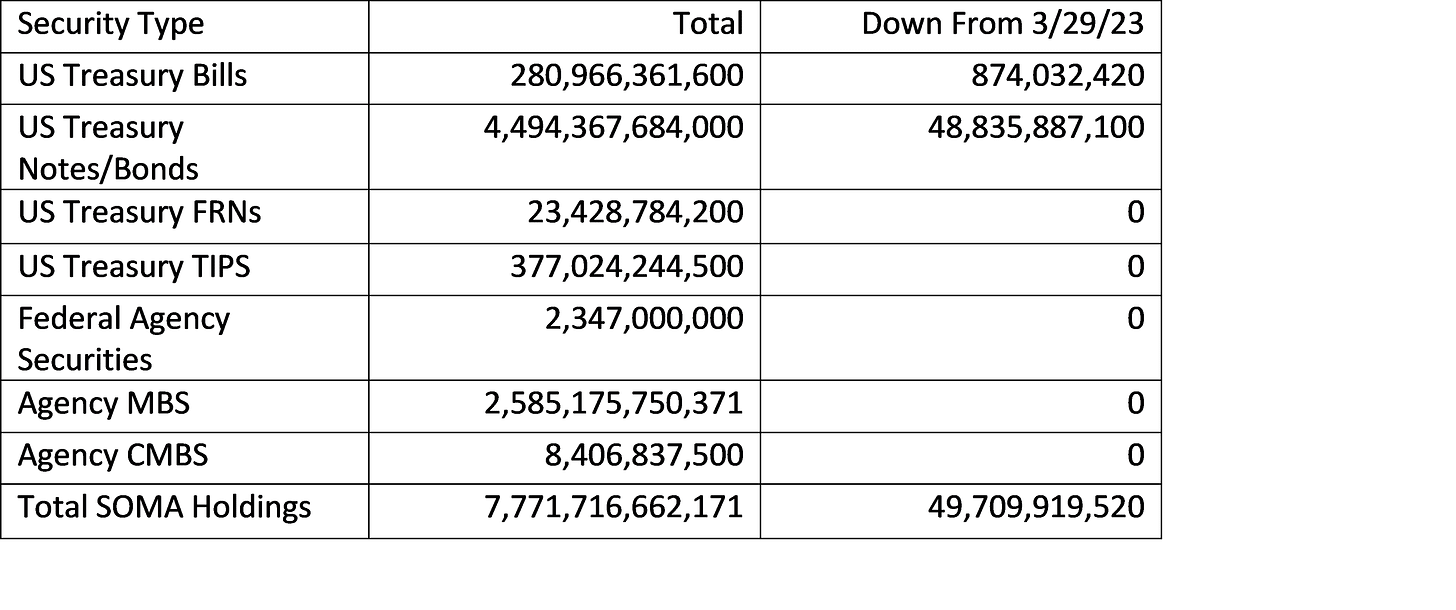

3/29/23 SOMA Domestic Security Holdings projection

4/5/23 SOMA Domestic Security Holdings projection

As always, thanks for reading.

Best,

John

great take, thank you!