TLDR

QT will reduce Fed balance sheet by ~80.7b in July: 60b for UST, 20.7b for MBS. UST reduction is again heavier on the end of month maturities. 10b of UST is bill rolloff spread through the month.

Note for new readers – If this is your first time reading my posts on QT and are interested in the mechanics behind QT and how I reach these projections. Please see my earlier posts starting with Reverse Engineering QT on July 29, 2022.

Also, if you are interested previewing the scripts authored by @dharmatrade that leverage the FED APIs to pre-calculate QT treasury/bill runoff schedules and MBS payments for the upcoming month implementing the QT rules and MBS estimation methods described in this series of posts, reach out to him on twitter. His scripts are a huge help in putting these posts together.

Greetings!

Busy summer so only a quick note this month. QT marches on in accordance with all the Feds official communications about it. That is all.

Actually one other quick note. MBS accuracy did all right in June. Not as close as May but not too far off. Seems the worse variance a few months ago might be outliers. I expect July will perform similarly.

Projected MBS payments in June – 20,690,844,257

Realized MBS payment in June - 20,027,842,100

Now, onto the numbers…

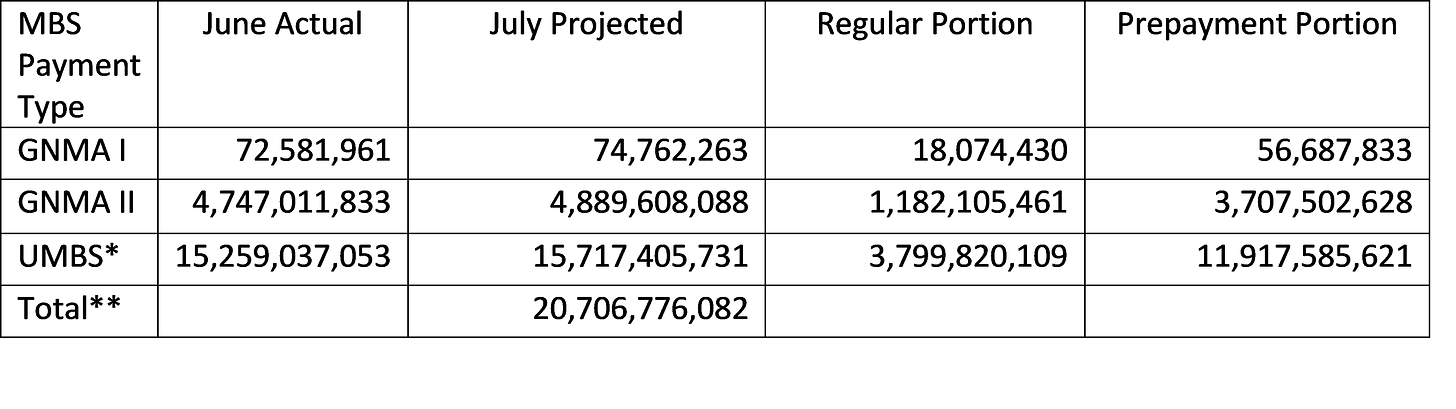

July MBS Payments

June prepayments were up just a touch, rising 4% vs May. Using @DharmaTrade ‘s scripts which faithfully only apply the 104% multiplier to the prepayment portion of each MBS payment, we reach the following MBS payment projections:

*The former FHLMC Gold amounts have been added to the UMBS as they were converted into it via the cusip consolidation process

**Note an additional 25,000,000 in Fed held CMBS is also expected to rolloff bringing us to a total MBS rolloff of 20,690,844,257

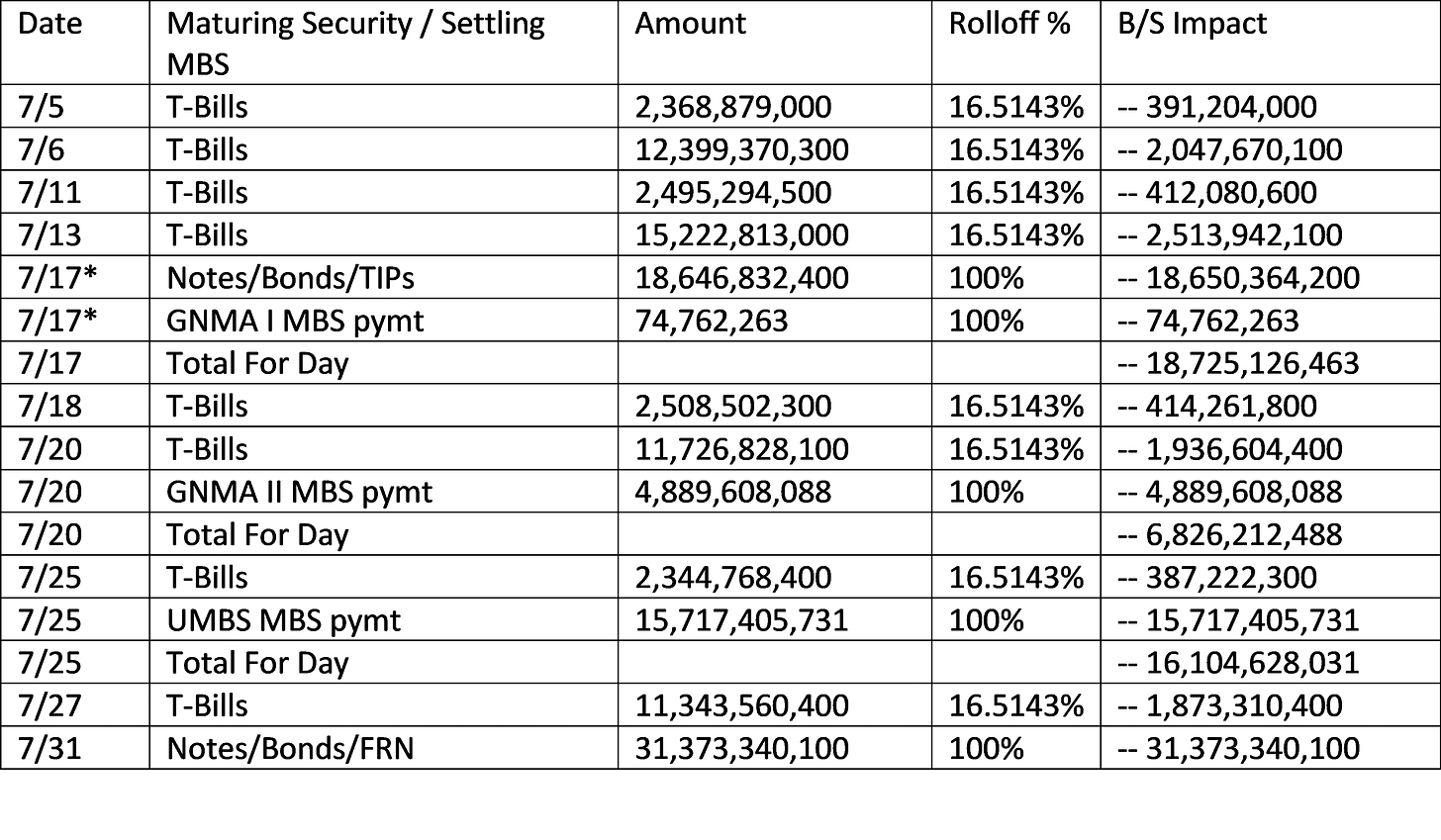

July UST Rolloff

Fed coupons maturing in July are:

· Total notes/bonds: 42,544,593,800

· Total FRNS/TIPS: 7,479,110,500

· Total Coupons: 50,023,704,300

Coupons will fall short of the 60b cap in July and accordingly there will be 9,976,295,700 rolloff of bills as well. The Fed does this proportionally to the amount of bills maturing each Tue/Thur. For July, the rolloff percentage for bills is ~ 16.5143%. This is calculated by 9,976,295,700 (total bills to rolloff) / 60,410,016,000 (total bills maturing).

QT Balance Sheet Impact by Date in July

*The GNMA I MBS payment scheduled to be received on Saturday July 15th will instead be received the next business day which is Monday July 17th as will the July 15th coupon maturities.

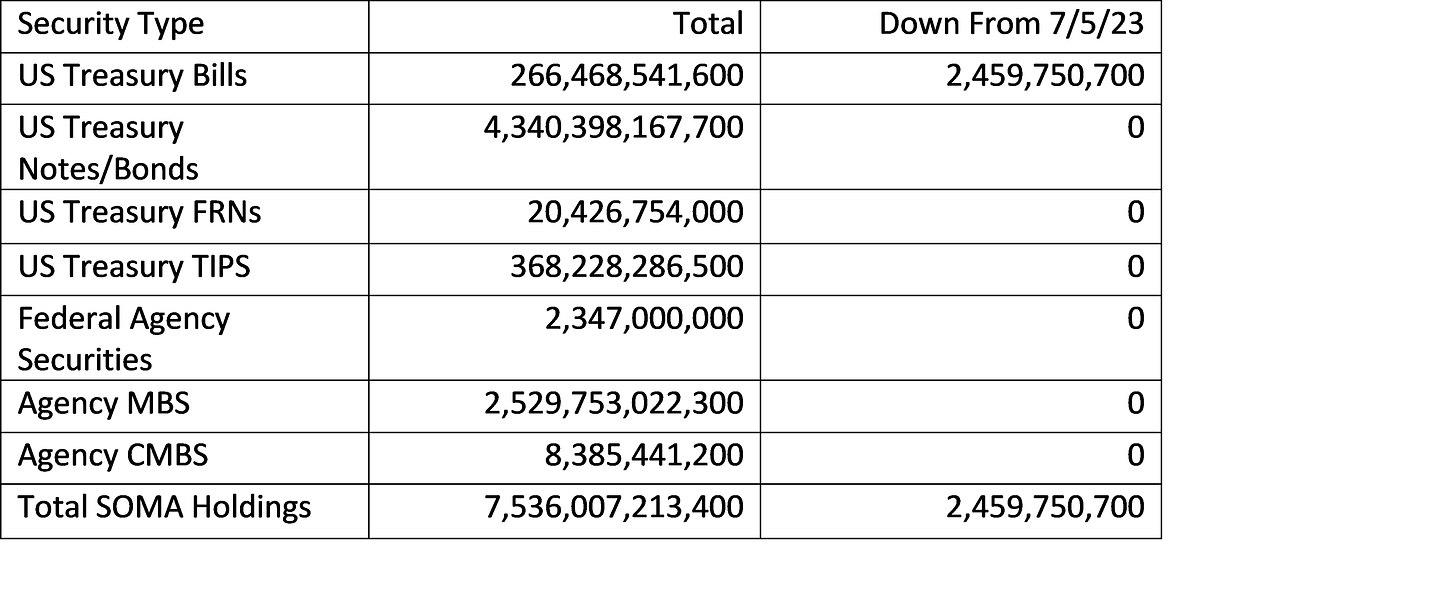

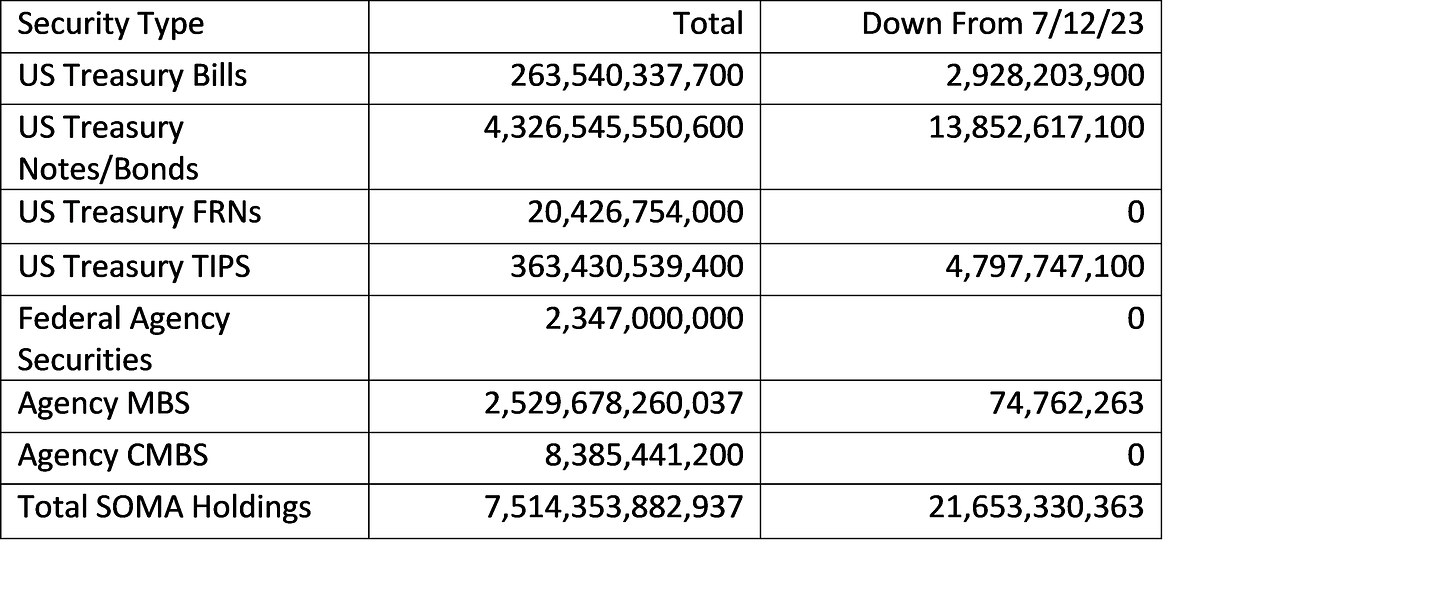

Weekly Projections for July

7/12/23 SOMA Domestic Security Holdings projection

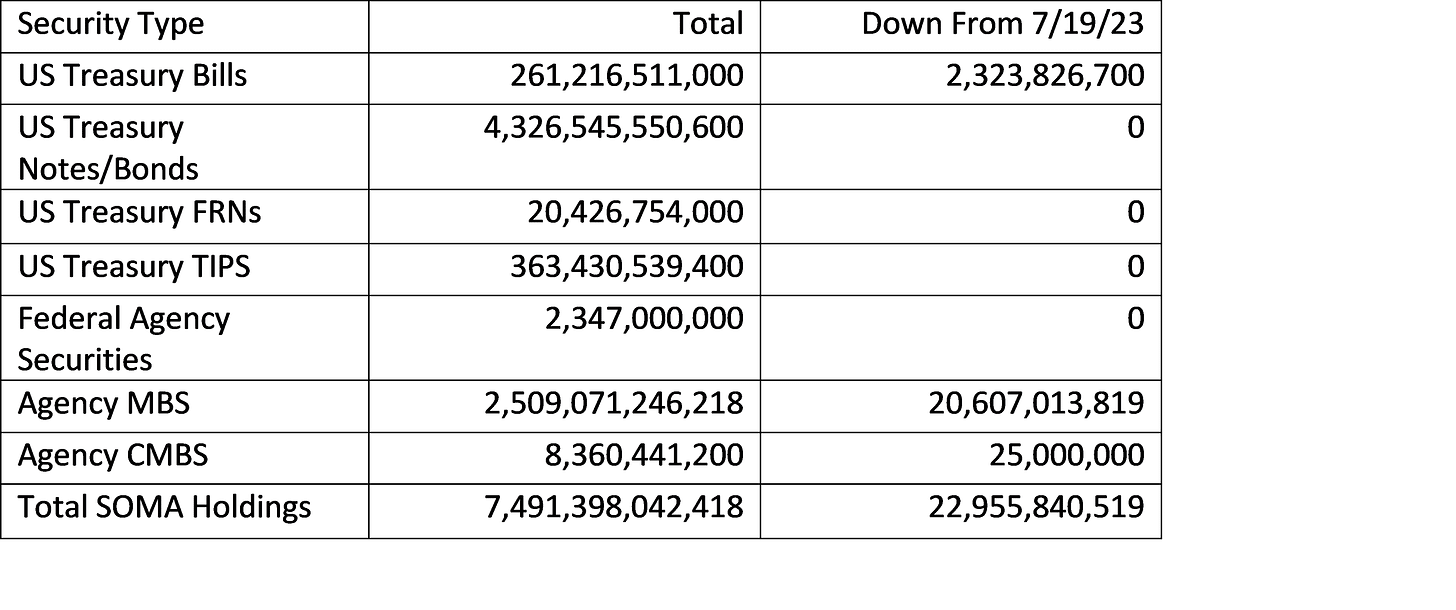

7/19/23 SOMA Domestic Security Holdings projection

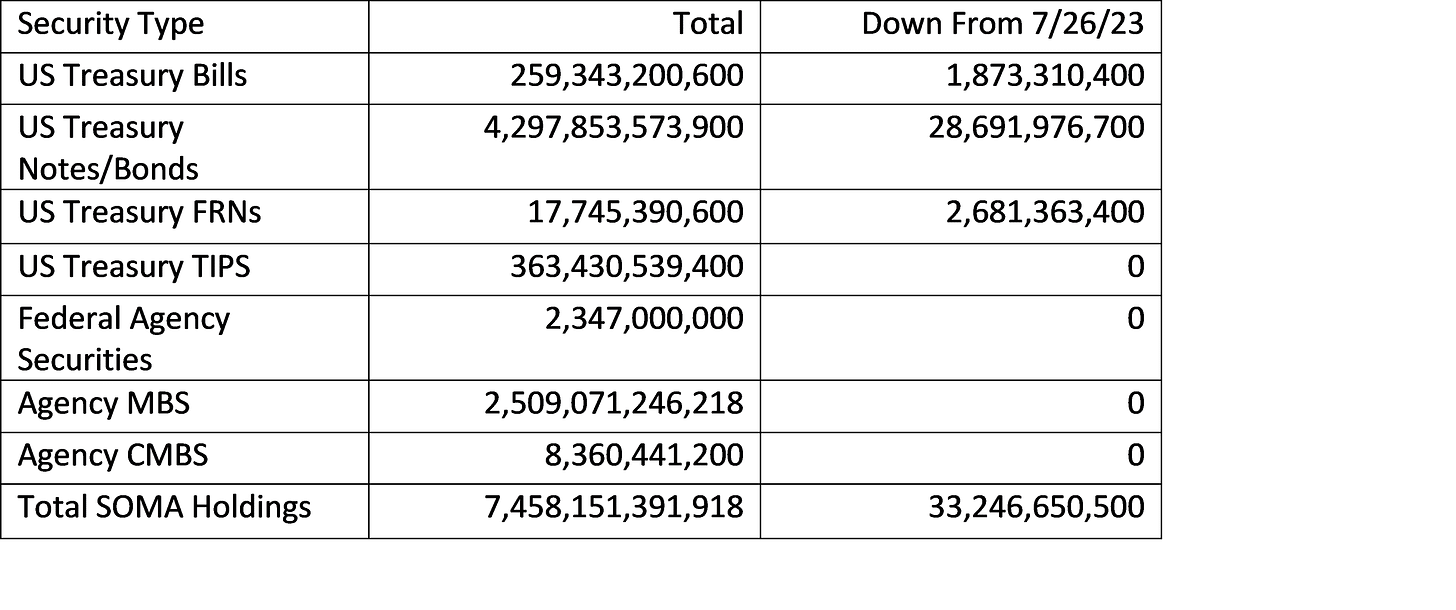

7/26/23 SOMA Domestic Security Holdings projection

8/2/23 SOMA Domestic Security Holdings projection

As always, thanks for reading.

Best,

John

As always, thanks for writing.