January QT

TLDR

B/S will rolloff by ~76.5b in January: 60b for UST, 16.5 for MBS. UST reduction is once again more heavily weighted on the end of month maturities with those maturities reflecting on the 2/1/23 Fed balance sheet.

*Note for new readers – If this is your first time reading my posts on QT and are interested in the mechanics behind QT and how I reach these projections. Please see my earlier posts starting with Reverse Engineering QT on July 29, 2022.

** Post Edit 1: 1/10/23

A keenly observant twitter account @JoaoBAssuncao posed the question of whether the inflation compensation on TIPS counts towards the 60b UST reinvestment cap. When I originally posted this article I did not think they did largely because the SOMA does not include the inflation compensation for TIPS in the TIPS total or Total SOMA Holdings fields in their Domestic Security Holdings Summary found here https://www.newyorkfed.org/markets/soma-holdings. However, after conducting a detailed review of the SOMA holdings over July (the last time a TIPS matured) and QTs effects on them it is clear that it is, in fact, included in the reinvestment caps. Accordingly, this post needed to be updated to so reflect.

Fortunately, the impact this month is small. The amount of inflation compensation in play is just a bit more than 700m. Note though that value adjusts weekly so while I used the amount of inflation compensation on the maturing TIPS from the 1/4/23 SOMA holdings, this may adjust slightly prior to the TIPS maturing on the 15th. The impact is to reduce the amount of bills the Fed needs to rollover this month by 700m (spread across the bill maturities in the usual way by reducing the rolloff percentage) and increase the TIPS maturing on the 15th. For the broader balance sheet this is true (and accordingly included in the daily B/S impact), but, the weekly SOMA Holdings projections project what the summary tab for the SOMA holdings will report week to week and since the inflation compensation is not included in those totals, I have not increased the TIPs reduction amount by 700m for the projected SOMA holdings on 1/18. This slight disconnect is present in the July 2022 SOMA holdings as well.

The text for January UST runoff has been updated to reflect the new bills rolloff amount and all tables updated to reflect with a special note below the 1/18 week projection.

** End Post Edit 1

Happy New Year!

With MBS prepayment numbers out its time for January QT projections (or if you prefer, in advance tallies). Lets get to it!

A refinement to the MBS payments projection methodology.

Keenly observant readers may have noticed that I have consistently been a touch low in my MBS projections over the past few months. For example, I projected December MBS payments to come in at around 16b for the month, whereas ~17.2b in MBS payments actually realized. I believe I have identified the source of the persistent error and will correct for it this month.

Previously my estimation methodology was simply to compare the FNMA and FHLMC prepayment rates for the month two months back vs. the same rates for the month one month back. (Prepayment rates collected in the prior month determine prepayment amounts to investors like the Fed for the current month). I would then apply the change in prepayment rates to the prior months MBS payment amounts to arrive at the projected payments for the current month. The problem with that methodology is I was applying the prepayment change to the full MBS payment amounts from the prior month, but the full MBS payment amount is comprised of more than just prepayments.

MBS payments to the Fed are comprised of two things:

1. Regular mortgage monthly principal and interest payments from homeowners. The interest received is separated and used (along with interest from treasuries) to offset what the Fed pays on bank reserves (IORB) or RRP deposits. The principal (as part of QT) is used to retire reserves in an equal amount (or reinvested in new MBS if the Fed was over the 35b reinvestment cap which it is not). For the Feds ~2.6T MBS portfolio the principal portion due to regular payments is ~5b each month. This number stays effectively constant month to month. (Reduction in the total size due to QT reduces the number very slightly offset by an also very slightly higher portion of principal vs. interest as the mtges advance another month on their amortization schedule)

2. Prepaid principal for any folks who refinanced or paid off their loan because they moved or just because (maybe they hit the lotto). This portion of the MBS payment varies from month to month and can be projected pretty accurately based on the prior months general FNMA and FHLMC prepayment rates. For December this amount would have been about 12.2b

So last month I incorrectly also reduced the 5b by 18% shaving nearly a billion from what I should have projected. Add that .9b to the 16b estimate and suddenly 16.9b estimated vs. 17.2b realized looks much better. Hopefully this new methodology will get closer to nailing it this month.

January MBS payments

Prepayment rates in December slowed again and were ~94.5% vs November. Since the prepayment portion of December Fed MBS payments realized at ~12.2b, ~94.5% of that is ~11.5b. Accordingly, 5b due to regular mortgage payments + 11.5b from prepayments = ~16.5b total MBS payments are expected in January.

Accordingly, detailed MBS payment projections are

UMBS: 3,430,000,000 (regular) + 7,720,000,000 (prepayments) = 11,150,000,000

GNMA I + GOLD : 415,000,000 (regular) + 935,000,000 (prepayments) = 1,350,000,000

GNMA II: 1,155,000,000 (regular) + 3,845,000,000 (prepayments) = 4,000,000,000

Total Projected Dec MBS: 16,500,000,000

January UST Rolloff

Total coupons (all notes/bonds/FRNs/TIPs): 55,497,636,800

Coupons maturing in January are less than 60b, so the Fed will have to allow 4,502,363,200 of bills to rolloff as well this month. The Fed does this proportionally to the amount of bills maturing each week. For January, the rolloff percentage for bills is ~ 6.6281%. This is calculated by 4,502,363,200 (total bills to rolloff) / 67,928,329,300 (total bills maturing).

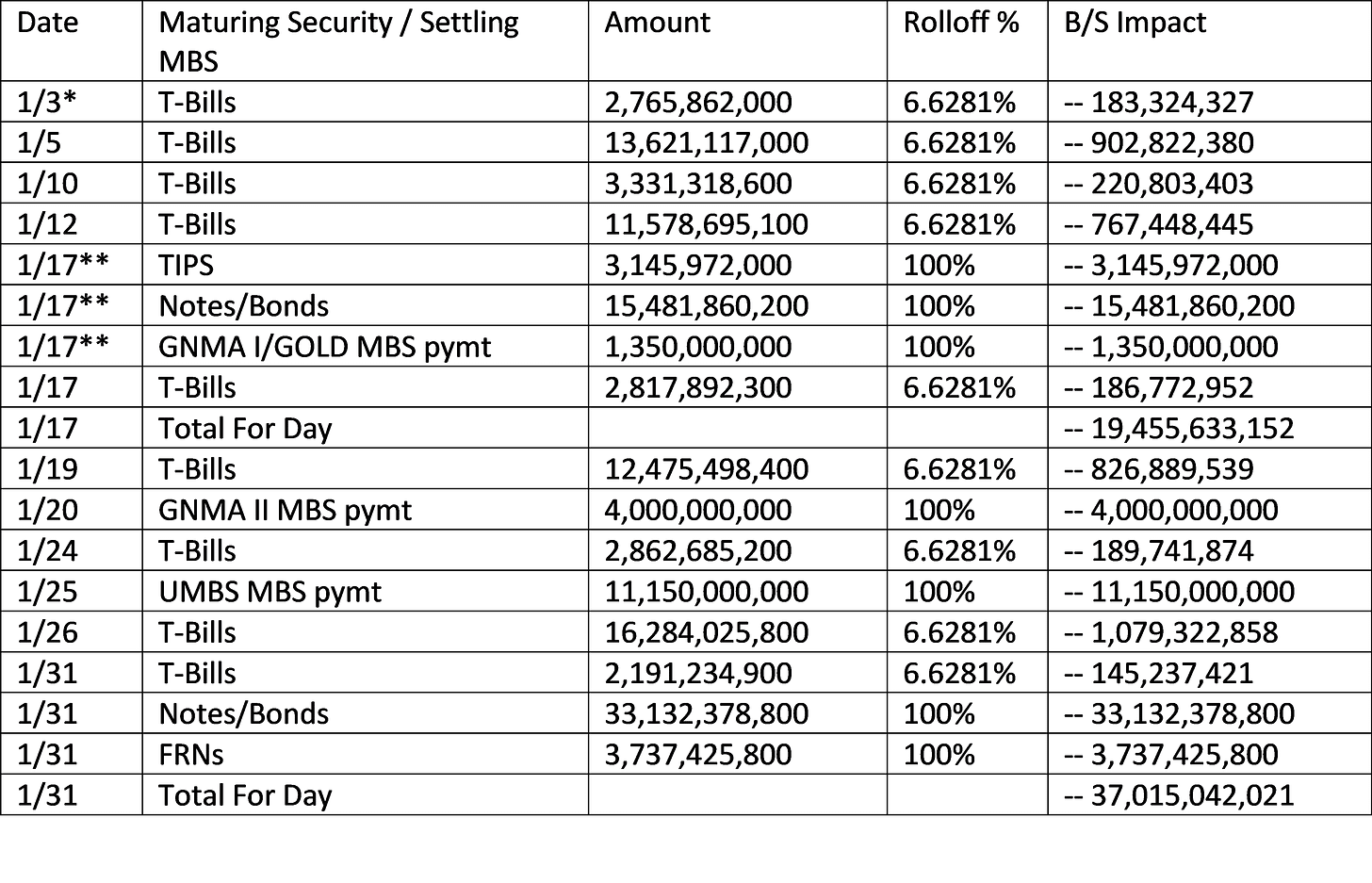

QT Balance Sheet Impact by Date in January

*The amount reflected for 1/3 only reflects the bill roll off associated with January QT. The late month December UST maturities that settled on 1/3 due to the weekend and the observed holiday on Monday the 2nd are not included here, rather they are included in last months December QT report.

**The UST maturing on Sunday 1/15 will settle on the next business day which is Tuesday Jan 17th. The GNMA I/GOLD MBS payment scheduled to be received on Sunday 1/15 will instead be received the next business day which is Tuesday Jan 17th.

Weekly Projections for January

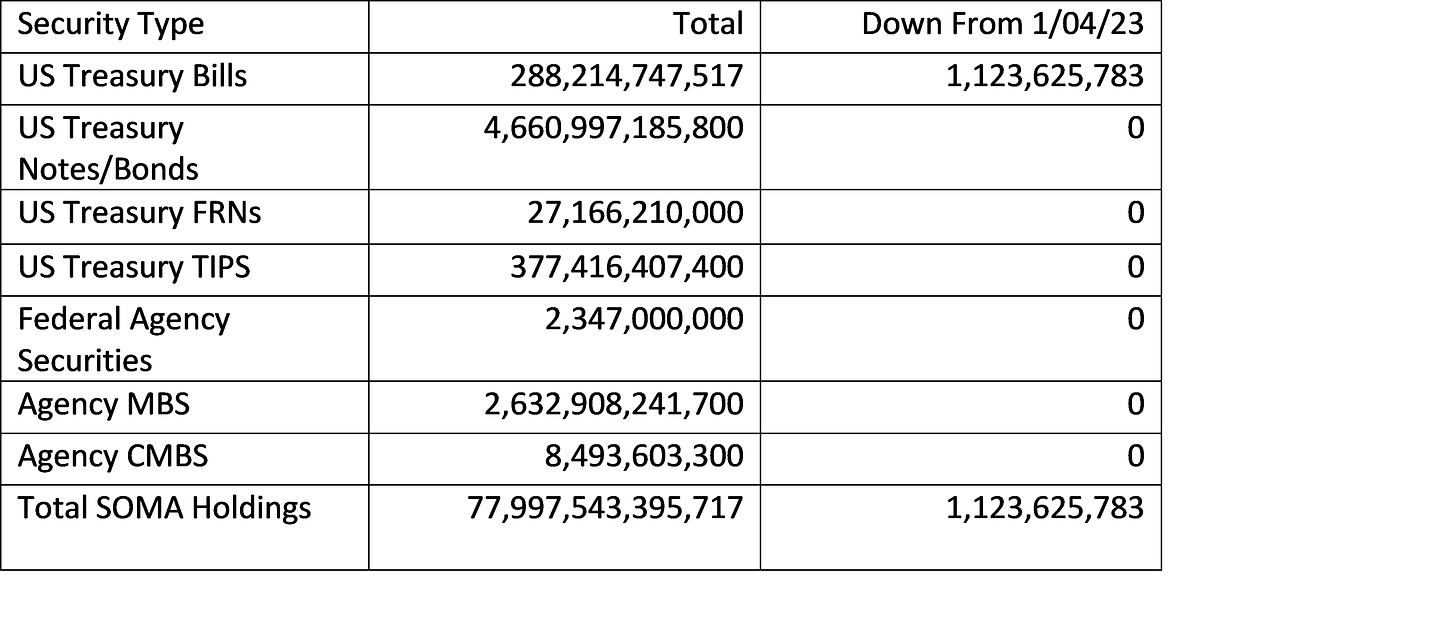

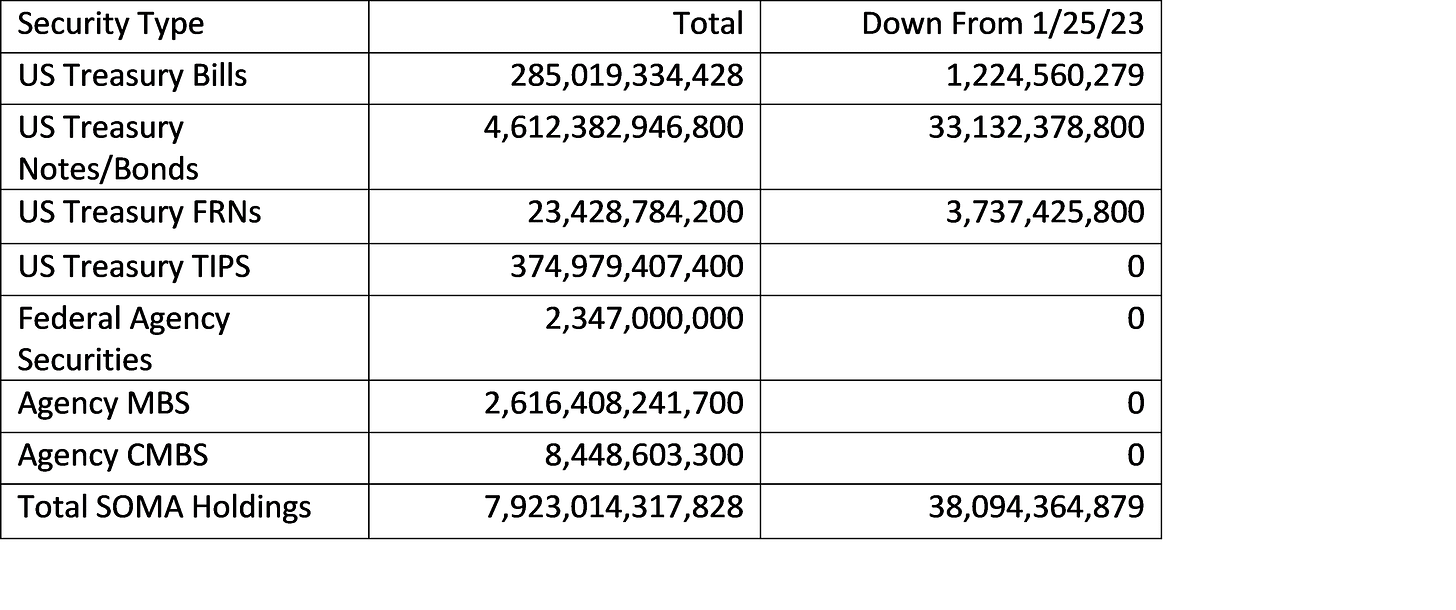

1/11/23 SOMA Domestic Security Holdings projection

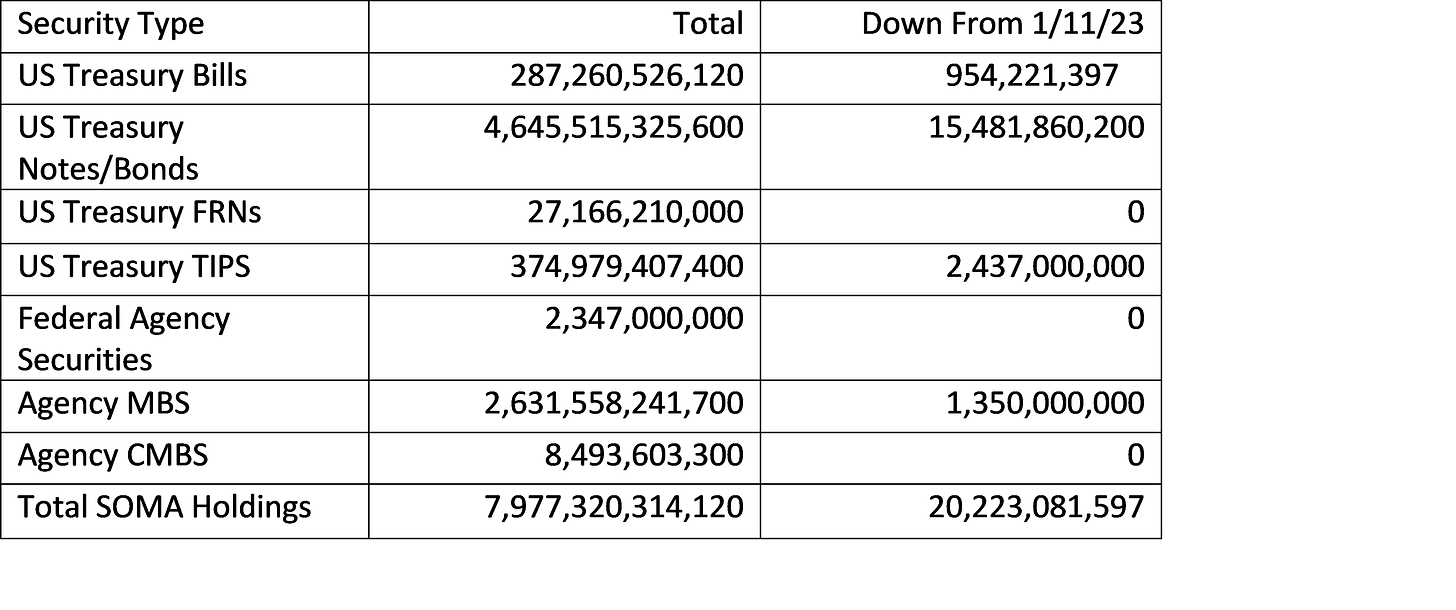

1/18/23 SOMA Domestic Security Holdings projection

Please note that while the reported SOMA holdings for the week of 1/18 reported here https://www.newyorkfed.org/markets/soma-holdings are projected to drop 20,223,081,597. The B/S drop for the week due to QT is projected to be 20,932,053,597 due to 708,972,000 of inflation compensation.

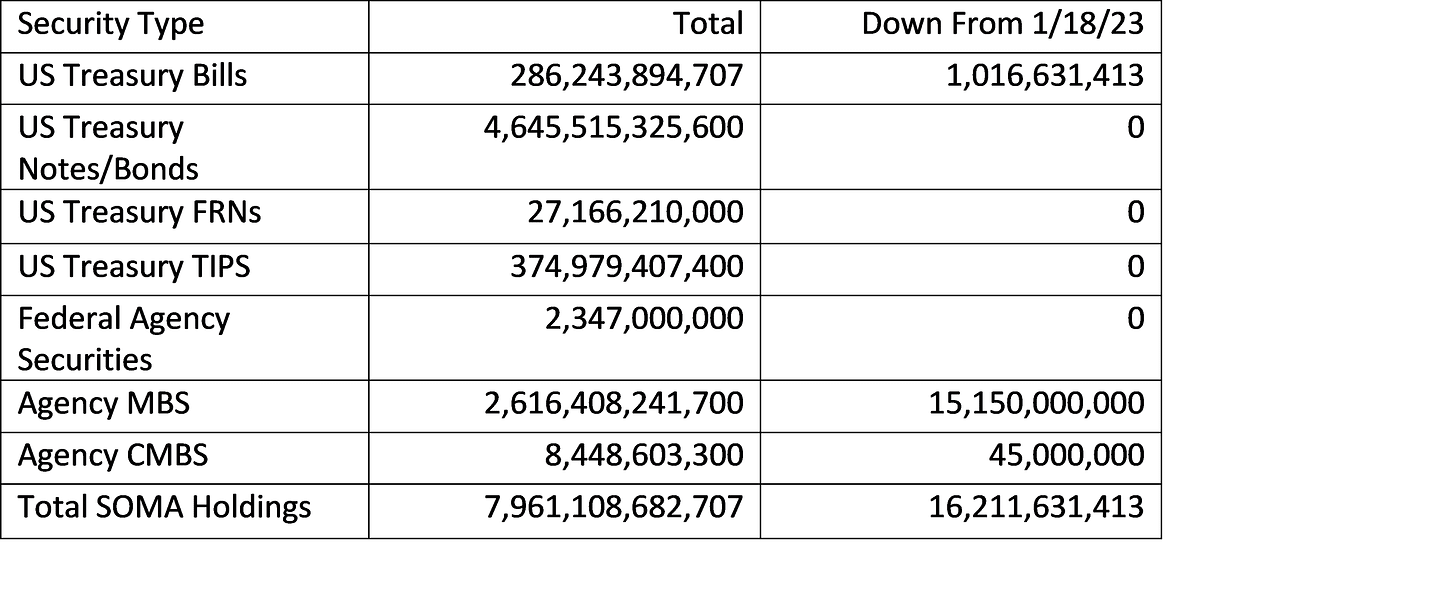

1/25/23 SOMA Domestic Security Holdings projection

2/01/23 SOMA Domestic Security Holdings projection

As always, thanks for reading.

Best,

John