TLDR

QT will reduce Fed balance sheet by ~75.42b in January: 60b for UST, 15.42b for MBS. UST coupon reduction is very slightly heavier on the end of month maturities. 6.6b of UST is bill rolloff spread through the month.

Greetings!

Here we go again. The FOMC minutes mention that several participants think its appropriate to begin figuring out what will guide a decision to slow the pace of runoff **well before** such a decision is reached.

And then one of those participants, Dallas Fed President Lorie Logan, gives a speech indicating she thinks reserves have transitioned below “super abundant” but are almost certainly still more than ample, and thinks that as the RRP approaches a “low level” that the pace of QT should slow to reduce the likelihood that it would have to stop prematurely due to an accident of reserve distribution potentially caused by a too aggressive pace of QT. Or put differently, so that QT can RUN LONGER to reach the optimal LCLoR.

But then of course, right on cue, folks like BoA think it “reasonable” to conclude as a base case that QT will taper starting in March and end shortly thereafter in June. I disagree of course. I think that’s a completely unreasonable base case. I have included the relevant portion of the minutes and Dallas Fed President Logan’s speech so you can read carefully yourself and decide on your own. In my opinion, a taper starting in September with an end to QT late in 2025 is a reasonable base case. Ill substantiate that view in an upcoming post in a related but different topic. I suppose we will see who ends up being correct.

Anyways, onto the numbers!

January MBS Payments

December prepayments were up just slightly, rising ~2% vs November. Using @DharmaTrade ‘s scripts which faithfully apply the 102% multiplier only to the prepayment portion of each MBS payment, we reach the following MBS payment projections:

*Note an additional 25,000,000 in Fed held CMBS is also expected to rolloff bringing us to a total MBS rolloff of 15,449,775,978

January UST Rolloff

Fed coupons maturing in January are:

· Total notes/bonds: 42,442,094,700

· Total FRNS/TIPS: 10,947,113,100

· Total Coupons: 53,389,207,800

Coupons will fall short of the 60b cap in January and accordingly there will be 6,619,792,200 rolloff of bills as well. The Fed does this proportionally to the amount of bills maturing each Tue/Thur. For January, the rolloff percentage for bills is ~ 13.9137%. This is calculated by 6,619,792,200 (total bills to rolloff) / 47,577,468,100 (total bills maturing).

QT Balance Sheet Impact by Date in January

*The GNMA I MBS payment due on Monday 1/15 will instead be received on Tuesday 1/16. Similarly, the coupons maturing 1/15 will be redeemed on 1/16.

Weekly Projections for January

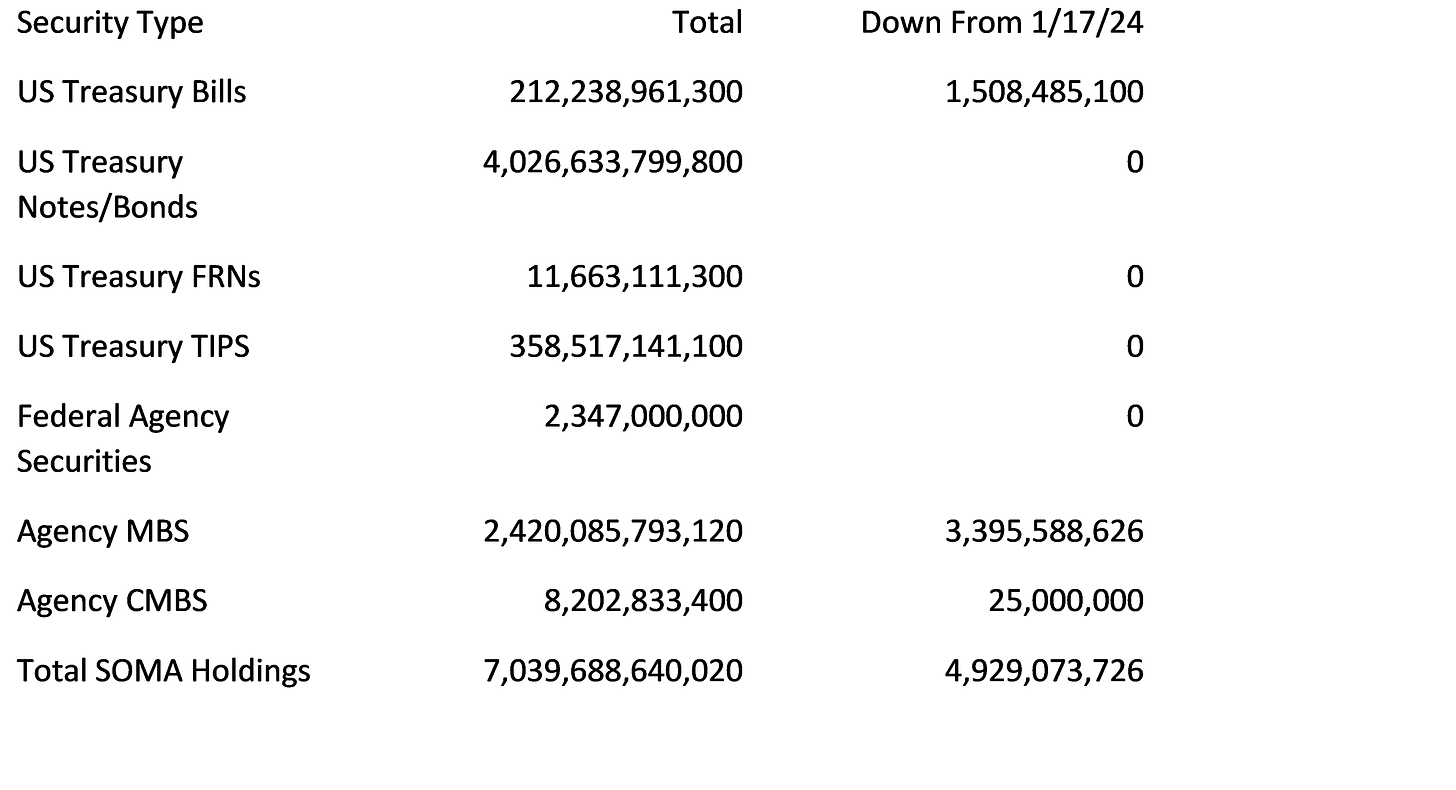

1/3/24 SOMA Domestic Security Holdings baseline

1/10/24 SOMA Domestic Security Holdings projection

1/17/24 SOMA Domestic Security Holdings projection

1/24/24 SOMA Domestic Security Holdings projection

1/31/24 SOMA Domestic Security Holdings projection

Add Ons

These posts detail QT from a rolloff perspective, but rolloff is really just reduced reinvestment that would otherwise be required to maintain the balance sheet level. Until June 2024 when UST QT will hit its first month it doesn’t hit the 60b cap across both bills and coupons, every month includes some reinvestment of bills, or bills and coupons. If you know (or can accurately project) the offering amounts, then these reinvestment (Fed Add Ons to auctions) amounts can be known in advance. The Projected Add Ons for January are below. (Note the 4-week bill that issued on 1/2/2024 has an identical add on to the 8-week)

As always, thanks for reading.

Best,

John

Note for new readers – If this is your first time reading my posts on QT and are interested in the mechanics behind QT and how I reach these projections. Please see my earlier posts starting with Reverse Engineering QT on July 29, 2022.

Also, if you are interested previewing the scripts authored by @dharmatrade that leverage the FED APIs to pre-calculate QT treasury/bill runoff schedules and MBS payments for the upcoming month implementing the QT rules and MBS estimation methods described in this series of posts, reach out to him on twitter. His scripts are a huge help in putting these posts together.

Does the need for fed add ons give more comfort to treasury to increase coupon issuances in next QRA?

If MMF use of RRPs falls by $200 billion as it’s been doing, bank reserves will go up again in January.