February QT

TLDR

QT will reduce Fed balance sheet by ~74.67b in February: 60b for UST, 14.67 for MBS. UST reduction is nearly balanced this month between the mid month and end of month maturities with the latter reflecting on the 3/1/23 B/S.

Note for new readers – If this is your first time reading my posts on QT and are interested in the mechanics behind QT and how I reach these projections. Please see my earlier posts starting with Reverse Engineering QT on July 29, 2022.

Hello again!

Chairman Powell confirmed today that the Fed is planning to continue QT for years. This confirmation is not surprising to me as I believe the Fed has somewhere between 2.5-3T excess reserves in the system (a subject I intend to address in a future post). On the other hand, the confirmation also brought home the point that many more of these articles will be needed. Not that I mind terribly, I enjoy putting together the posts, but its kind of a formulaic somewhat mundane task. Gone are the wild early days of lagged MBS settlement and big B/S rises in the midst of QT. Now a days the excitement is confined to figuring out how 700m of TIPS inflation compensation impacts the daily B/S runoff or reducing the level of delta between our projected MBS payments for a month and the actual payments that end up realizing that month from 7% to 1%. Cool but… getting kinda close to paint drying.

Enter @dharmatrade . Dharma is one of the really good folks on fintwit, well worth a follow if you aren’t already. He is also a talented software developer who has made use of the treasury and fed APIs to provide regular daily updates on Net Liquidity over the past months. Awesomely, he decided to help make my life easier by writing scripts to leverage the Fed APIs to pre-calculate QT treasury/bill runoff schedules and MBS payments and share them with me to significantly speed up the time it takes me to generate this report. I am very grateful for him and his effort. Once the scripts have gone through a couple of months of QT with different variations (bills runoff, TIPS etc.) to make sure they are comprehensive, he intends to make them publicly available and a later dispatch will link to them. Prior to that if you are interested in them, reach out to him on twitter.

So with all that said, lets dive into this months numbers.

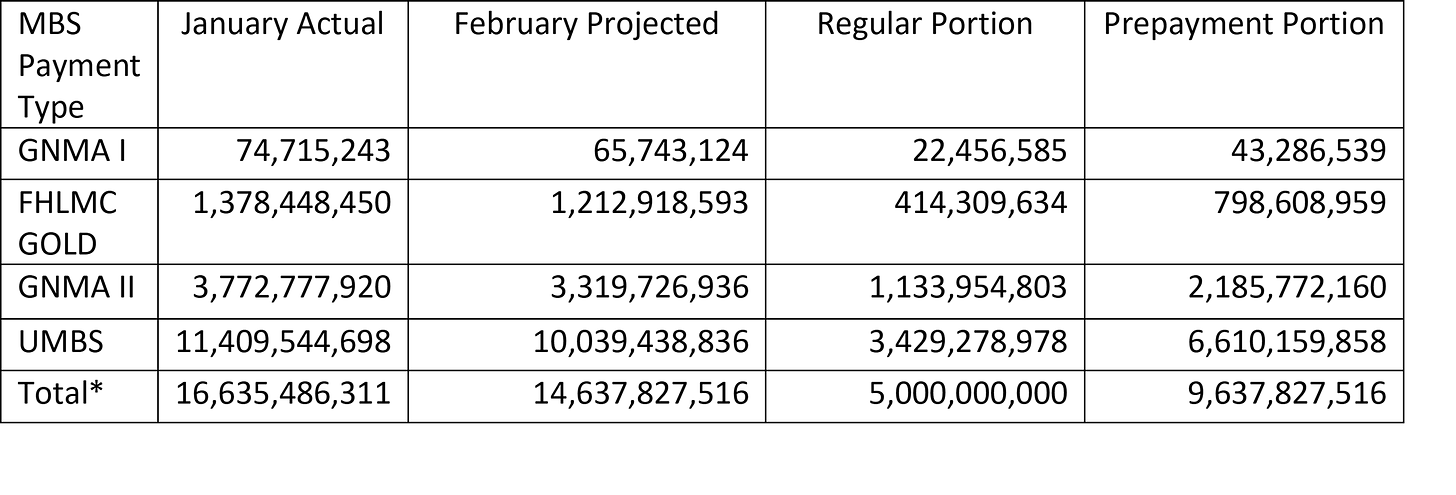

February MBS Payments

Last month, I updated the methodology used to project the MBS payments the Fed will receive in the current month to attempt to solve for a mild but persistent underprojection of the MBS payments the Fed actually received in a month. (see January’s QT dispatch for details). So how did it turn out? Well pretty great honestly.

Projected MBS payments last month = 16,500,000,000

Actual MBS payments last month = 16,634,768,600

Reducing the error to around 1% from 7% the month before. One data point isn’t total confirmation we have this problem licked but it’s a great starting point and of course we will continue to use the updated methodology.

Additionally, instead of me using a little estimation to determine the breakdown of the individual MBS payments (GNMA I, FHLMC GOLD, GNMA II, and UMBS) based on historical proportions, @DharmaTrade ‘s scripts get the precise actual payment values for each MBS type aggregating by security type using the Feds APIs (essentially repeating the method I originally detailed in my How to Calculate MBS payments post last summer but doing so in a much easier to repeat way)

Moving to the actual February projections. Prepayment rates in January slowed again (more than I was expecting honestly) and were ~83% vs December. Using @DharmaTrade ‘s scripts which faithfully only apply the 83% multiplier to the prepayment portion of each MBS payment, we reach the following MBS payment projections.

*Note an additional 35,000,000 in Fed held CMBS is also expected to rolloff bringing us to a total MBS rolloff of 14,672,827,516

February UST Runoff

Fed coupons maturing in February are

· Total notes/bonds: 130,233,057,000

· Total FRNS/TIPS: 0

· Total Coupons: 130,233,057,000

Since Coupons maturing exceed the 60b cap, the Fed will fully reinvest their bill maturities in February.

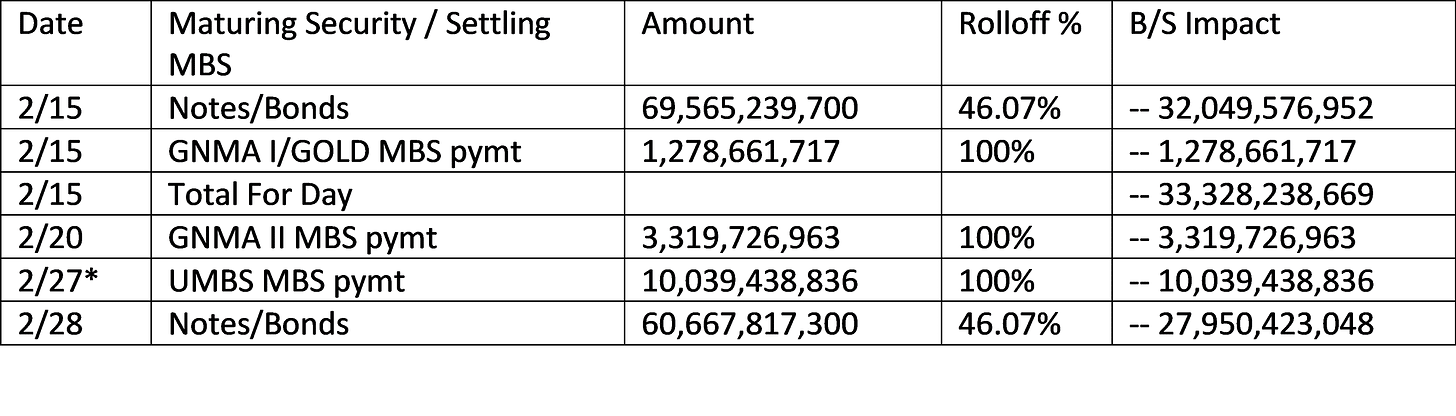

Between the mid month and end month maturities, the Fed rolls off an amount proportional to the total amount maturing. Accordingly, since 60b will be rolled off out of a total ~130b for the month. ~46.07% (60/130.23) of the amounts maturing on 2/15 and 2/28 will roll off.

QT Balance Sheet Impact by Date in February

*The UMBS MBS payment scheduled to be received on Saturday Feb 25th will instead be received the next business day which is Monday Feb 27th.

Weekly Projections for February

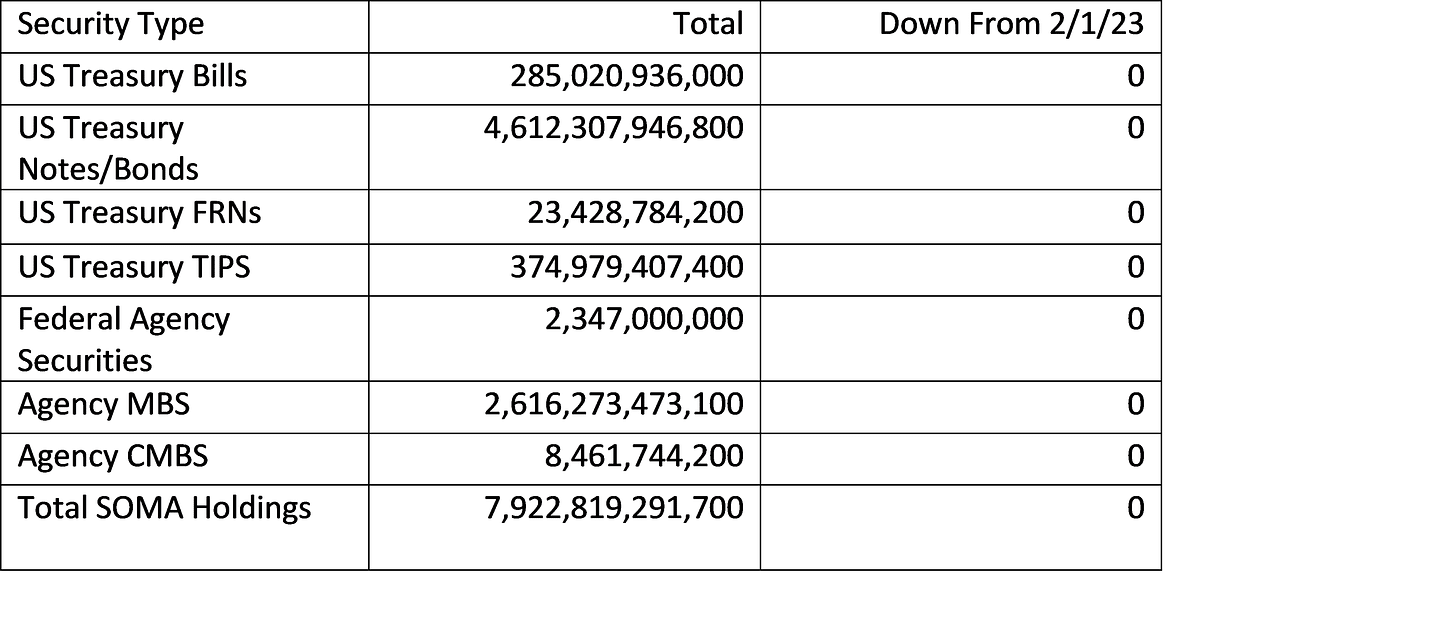

2/8/23 SOMA Domestic Security Holdings projection

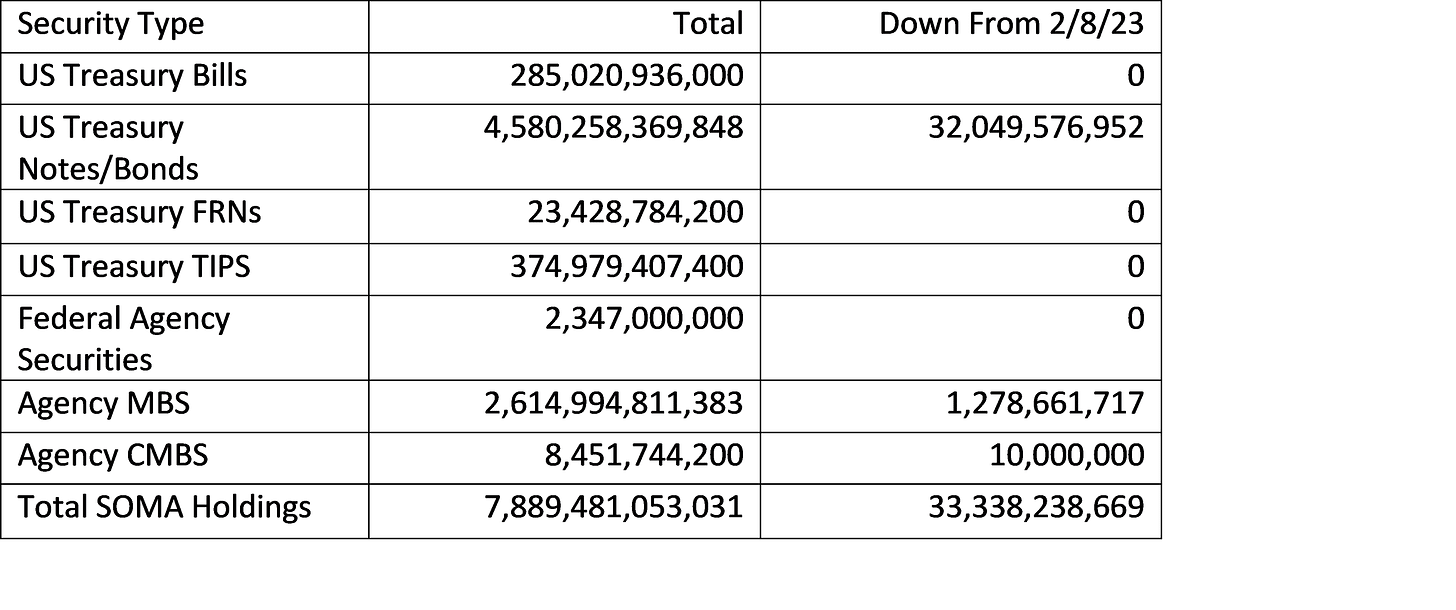

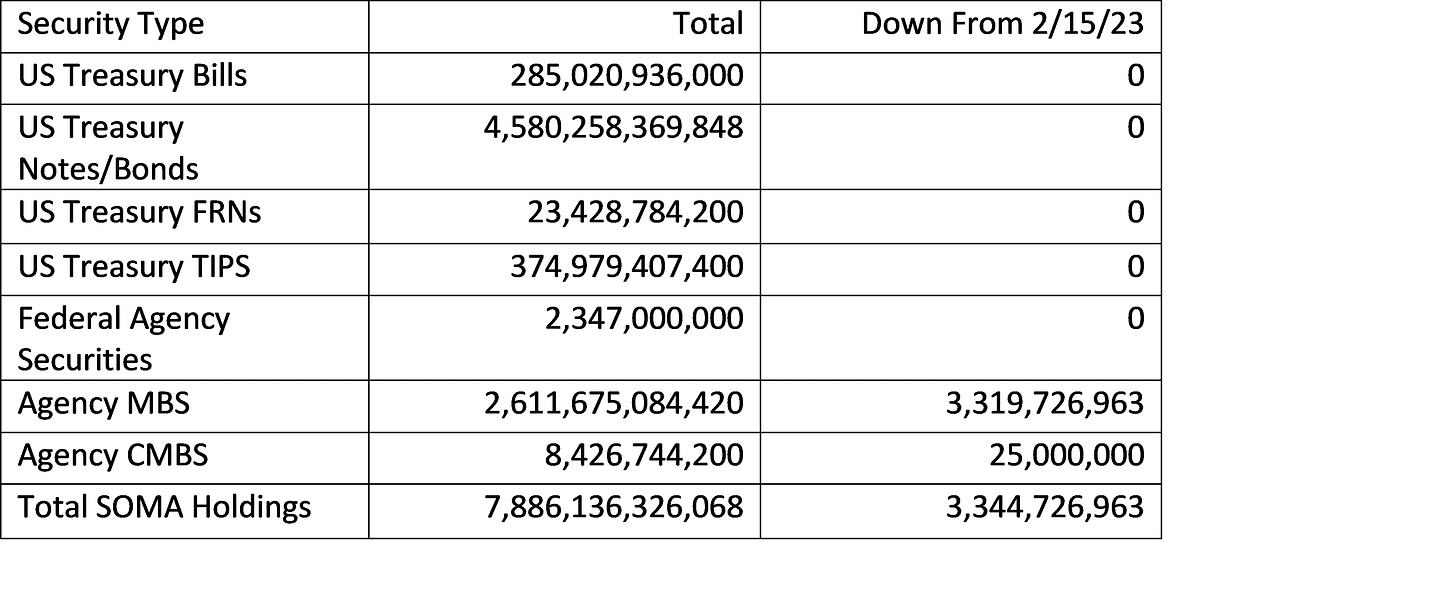

2/15/23 SOMA Domestic Security Holdings projection

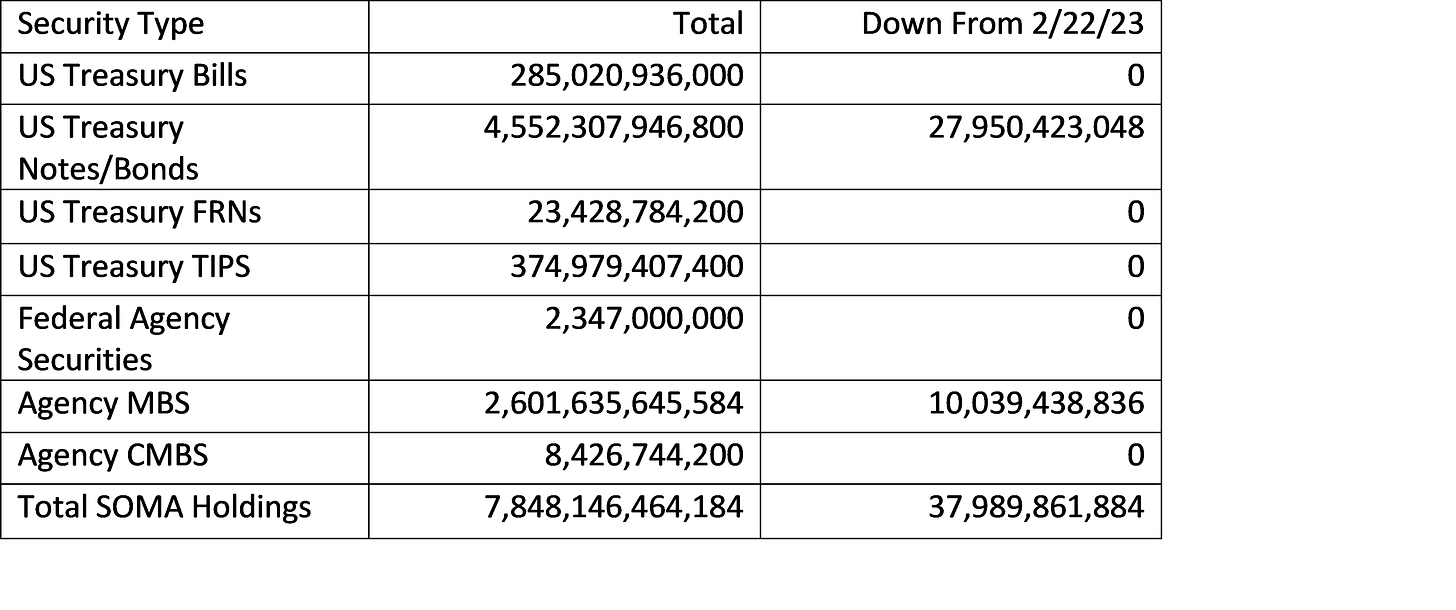

2/22/23 SOMA Domestic Security Holdings projection

3/01/23 SOMA Domestic Security Holdings projection

As always, thanks for reading.

Best,

John