Builders are behind the concentrations of underwater FHA loans.

Show me a census tract that has a large concentration of FHA mortgages that are currently underwater and Ill show you a census tract where builders dominated the purchase mortgage lending. This is a consistent pattern spanning different states/cities. For example, in Dallas:

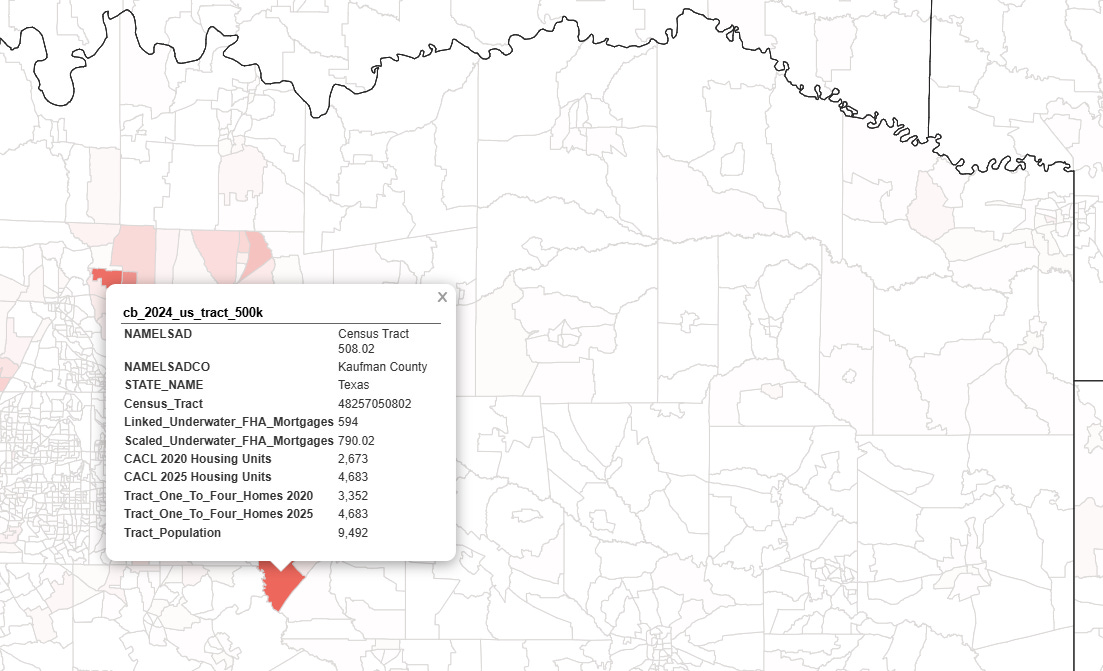

Tract 508.02 in the SE corner of the Dallas metroplex has 594 underwater FHA mortgages. The originators on those mortgages?

Overwhelmingly the lending affiliates of Lennar and DR Horton.

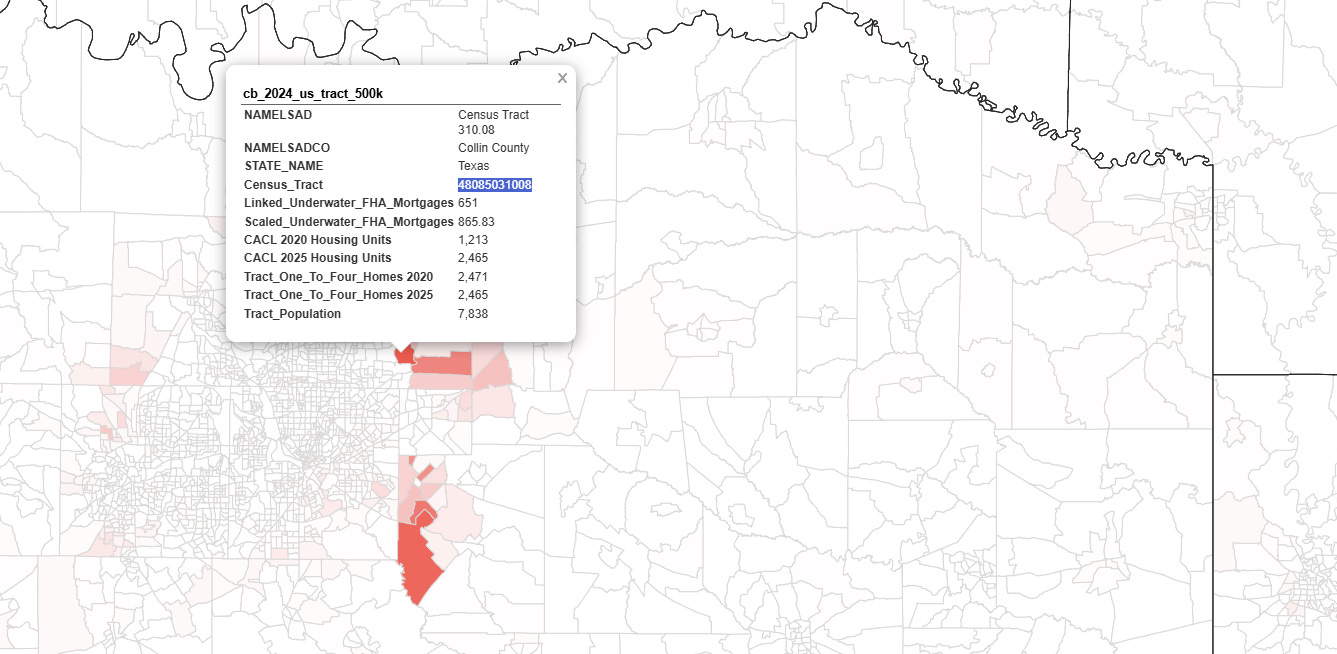

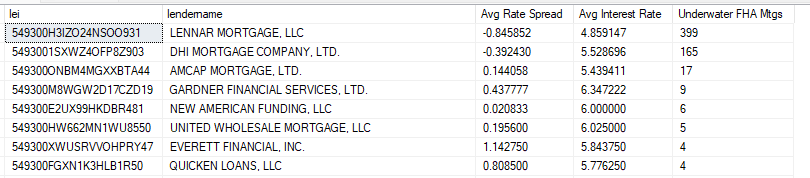

For tract 310.08 in the NE corner of the metroplex, 651 underwater FHA mortgages.

and again the lending arms of Lennar and DR Horton dominate the originations.

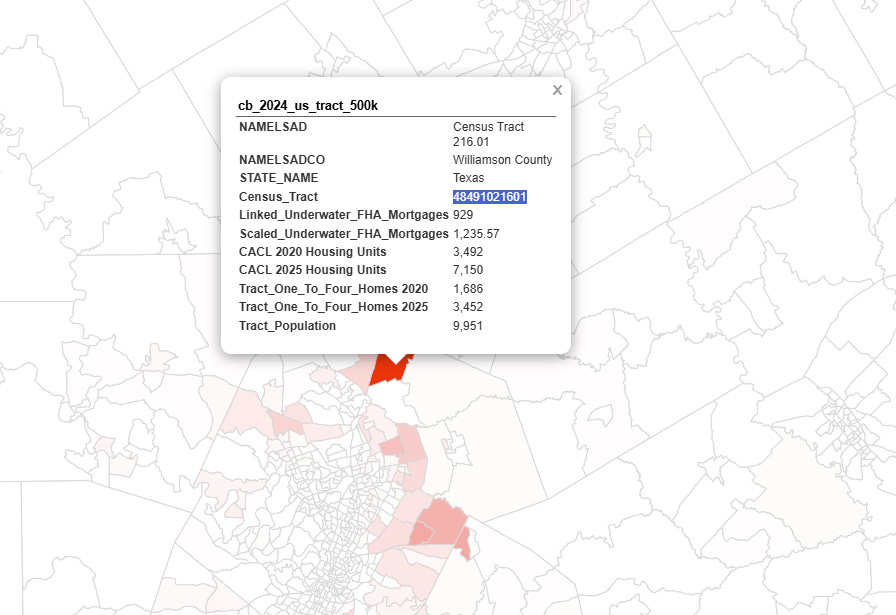

Austin? similar story. Tract 216.01, 929 underwater FHAs

and originators dominated by builder lending arms. KBHS = KB Homes, Velocio is affiliated with Starlight Homes, hell even Pulte makes an appearance.

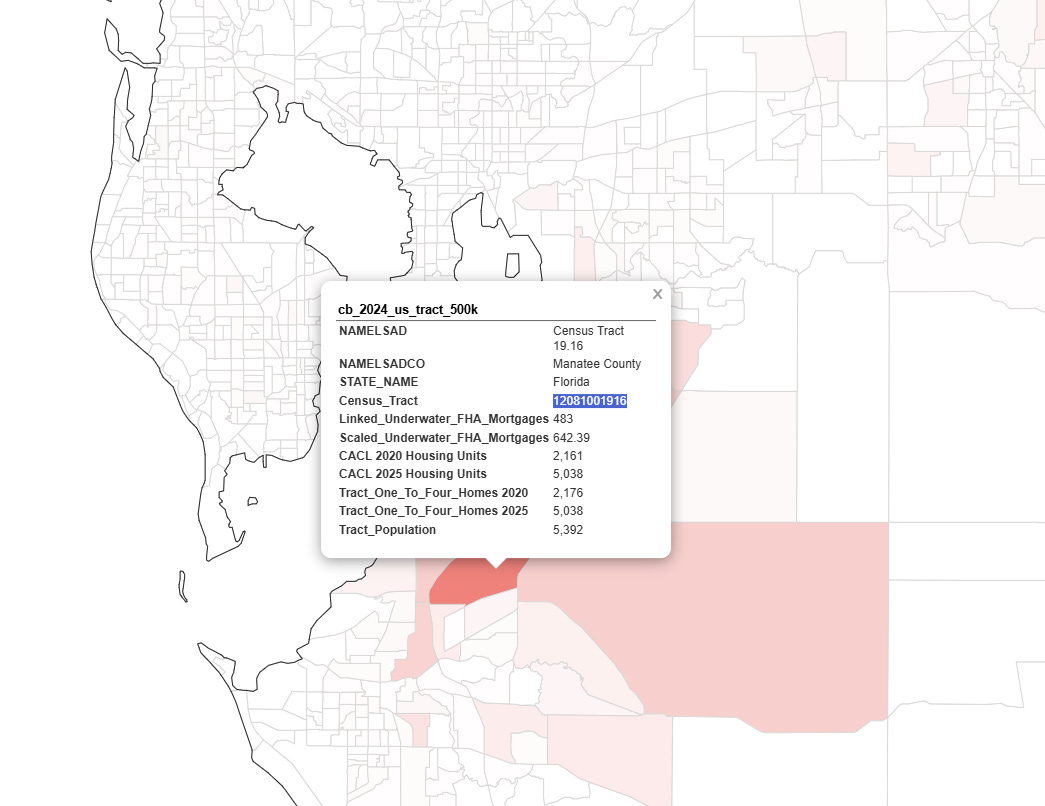

Same story in Florida? Yep, take tract 19.16 in the Bradenton area SE of Tampa

483 underwater FHA mortgages and originators dominated by builders. (NVR = Ryan Homes, NV Homes, Heartland Homes and Trailblazer is affiliated with Ashton Woods)

Why are pockets of underwater FHAs dominated by Builder Lending Affiliate originations?

Part of the explanation comes from large development projects that completed in the 2022-2024 time frames (almost all of the underwater FHAs in the maps above originated during those years) resulting in a large amount of Purchase originations in the census tract in a compressed time frame. If the census tract then experiences home value declines, which all of the tracts I reference have, it impacts a whole bunch of mortgages. in contrast to already built out census tracts that only saw a smaller number of move-based purchase originations over those years.

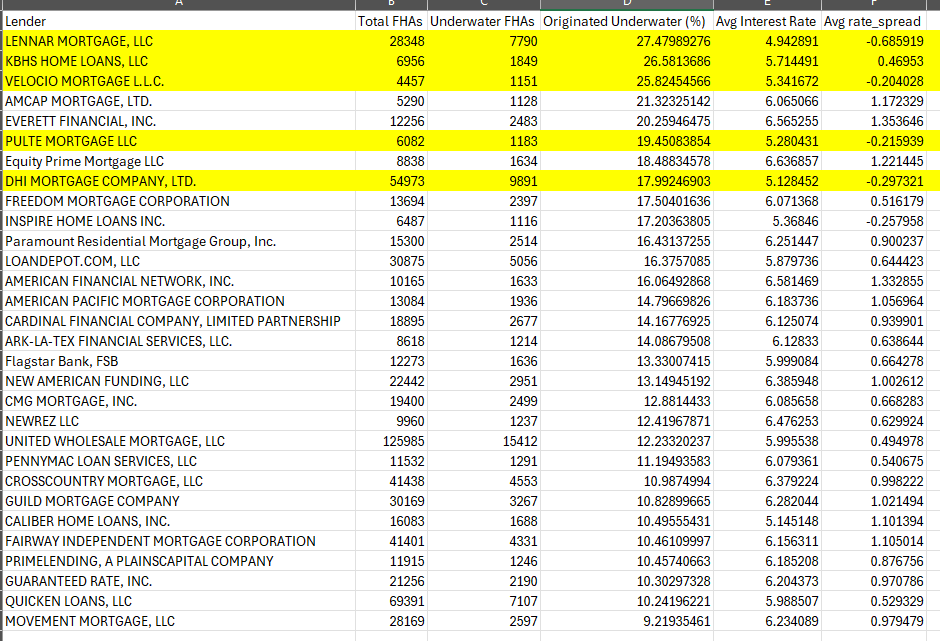

Another large reason for the decline is that the prices borrowers paid were artificially high. Builders incent buyers/borrowers to pay those artificially high prices by significantly buying down the rate. Scroll back up and look at the average rate spread and average interest rates on the mortgages. Rate spread is a measure of how cheap the mortgage is relative to a prime borrower and is reported in the HMDA data. Negative numbers mean cheaper. Unlike borrower paid discount points, the builder funded buydowns, since they are couched as seller concessions, are not counted towards how expensive the mortgage is. But practically speaking they might as well be discount points.

To be sure, the borrower is getting a below market rate. But they are paying for it by paying more on the purchase price and when non-builder transactions occur on comparable homes where seller funded buydowns dont occur, Its a recipe for home value decline and broad swaths of underwater mortgages.

The following table lists the FHA purchase lenders with the largest number of underwater FHA mortgages for mortgages originated in 2022-2024. The top of the list by % originated over that time that are now underwater is mostly populated with builder lending arms, almost all of whom have low average interest rates and rate_spreads (due to builder funded buydowns)

Implications for the FHA Insurance Fund

The FHA does not allow the financing of borrower-funded discount points on a purchase origination. Nor should they. Why should the insurance fund (aka taxpayers) bear increased risk when the borrower is effectively just increasing price for a lower rate? Yet FHA does allow seller (including builder) concessions—up to 6%—to buy down the rate, and builders routinely fund those buydowns by raising the contract price. Functionally, that pushes a larger base loan amount onto the Fund whenever the appraisal supports the higher price, and when that builder had many other homes in the locale on which it is performing the same stunt, the appraisal likely will.

More exposure for the fund and more impetus for the borrower to walkaway (less skin in the game) if home values decline sharply. Its bad policy and the FHA should change it.

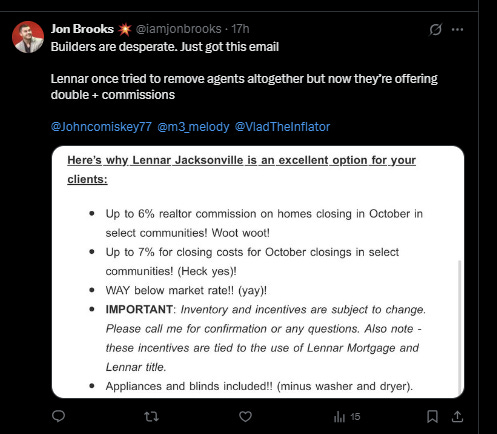

But until they do, the builders will keep bolstering that purchasing price at the cost of buydowns and other incentives.

Why not let the FHA insurance fund absorb the extra risk if you can get it to appraise?

Thanks for reading. If you enjoyed this article please consider supporting me by becoming a paid subscriber. (full interactive maps of where the underwater FHA mortgages are located were made available to paid subscribers on Friday). Alternatively if you have specific questions you want answered about the data I am available for consulting engagements as well.

John

Even if it challenges the mortgage industry narrative, the stronger case is that rate cuts aren’t a real solution?

I'm trying to square builders engineering higher transaction values with new home sales being lower than existing home sales:

https://www.marketplace.org/story/2025/09/30/price-inversion-in-the-housing-market-is-just-weird

Any theories?