TLDR

QT will reduce Fed balance sheet by ~79.87b in April: 60b for UST, 19.87b for MBS. UST reduction is once again heavily weighted on the end of month maturities which will reflect on the 5/3/23 balance sheet. There will be no bill rolloff this month.

Note for new readers – If this is your first time reading my posts on QT and are interested in the mechanics behind QT and how I reach these projections. Please see my earlier posts starting with Reverse Engineering QT on July 29, 2022.

Also, if you are interested previewing the scripts authored by @dharmatrade that leverage the FED APIs to pre-calculate QT treasury/bill runoff schedules and MBS payments for the upcoming month implementing the QT rules and MBS estimation methods described in this series of posts, reach out to him on twitter. His scripts are a huge help in putting these posts together.

Greetings!

QT got interesting again this month. Not because the Fed altered the plan by upping the caps or damning the torpedos with MBS sales. No, it got interesting because various voices (looking at you zerohedge) started calling its imminent demise. Failure of some and significant stress in some other banks notwithstanding. I think these voices are wholly premature. I expect QT as it is being conducted (the rolloff of securities from the feds balance sheet as laid out in the May 2022 FOMC minutes) to last for a few years to come. Why?

Very much unlike September of 2019, the monetary system just does NOT have a problem with an aggregate lack of reserves in the system. Quite to the contrary, there is at least 2T+ excess reserves in the system sitting in the RRP alone, just waiting to be unlocked (as soon as the next day at 3:30) back to bank reserves when an MMF finds a better alternative (e.g. FHLB agency debt, other UST/Agency secured repo) to invest in. (or is funding an outflow back to an investors bank account) Put another way, if banks are willing to pay (above RRP) for them and those banks have acceptable collateral to pledge to FHLB, they can more or less have as many reserves from the RRP as they want right now. Specifically, a number of banks did just that during the week of March 13. FHLB debt issuance spiked, was bought by MMFs, and was paid for in part by MMFs reallocating from their RRP holdings (RRP dropped ~188b from 3/9 -> 3/14) . Granted many of those reserves have come back to the RRP due to continued weekly inflow to MMFs and FHLB issuance settling down but it demonstrates the mechanic that is available to the banks that do have a lack of reserves problem due to deposit outflow. (Of course those banks can also solve their reserve problem by borrowing new reserves from the Fed via the Discount Window or BTFP).

To the extent there is a problem with reserves in the banking system, it is a distribution problem. Some banks (money center banks like jpm) got lots of em now and some banks not so much, though as of this week, it appears that the problem for only SOME banks having a lack of reserves is no longer acute. It may become acute again, but the mechanisms are there for those banks to solve that problem in most cases if it does.

Anyways, the point is there is plenty of reserves in the banking system right now in the aggregate. 3.38T on this weeks h.4, though when you take out the recent fed lending its closer to 3T. For context in September 2019, repo rates spiked when the system had about 1.5T (genuinely a case of in my opinion of aggregate reserve scarcity) and notable there was ZERO in the RRP then. Granted banking system deposits have grown about 35% since then so maybe figure the system needs 2T in reserves to settle without crankiness today, and further assume we are structurally short 400b in the TGA due to the debt ceiling right now, that still puts us close to 3T in excess reserves (1T in banking + 2.2 in RRP – 400 shortage in TGA). So is the Fed stopping anytime soon? I highly doubt it. I don’t know why they would.

Now onto the details of April QT.

April MBS Payments

The updated methodology (see my January QT post for details) to project the MBS payments the Fed will receive in the current month performed ok, but notably less well than in the prior two months.

Projected 4/5 SOMA MBS level = 2,585,175,750,371

Realized 4/5 SOMA MBS level = 2,586,045,583,400

Close enough for horseshoes I suppose but suggests my estimation technique isn’t as hyper accurate as the last two months indicated. Ill see how it does this month and tweak the formula as needed next month with another datapoint to extrapolate from.

Turning to April,

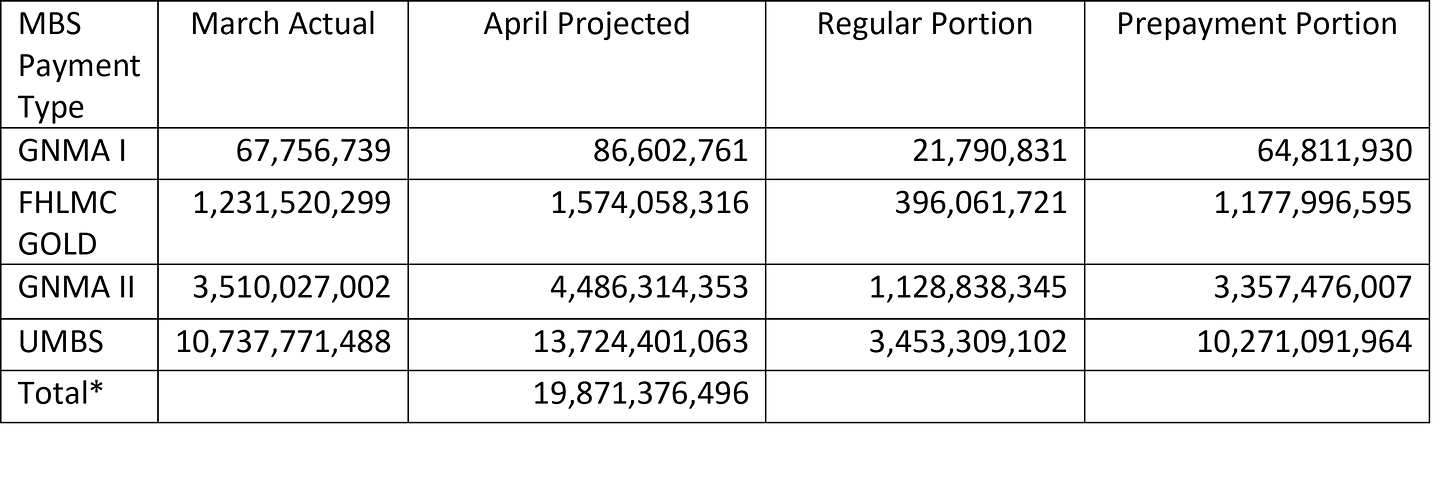

March prepayment rates rose significantly, rising ~41% vs February. Using @DharmaTrade ‘s scripts which faithfully only apply the 141% multiplier to the prepayment portion of each MBS payment, we reach the following MBS payment projections:

*Note an additional 35,000,000 in Fed held CMBS is also expected to rolloff bringing us to a total MBS rolloff of 19,906,376,496

April UST Rolloff

Fed coupons maturing in April are:

· Total notes/bonds: 61,611,001,600

· Total FRNS/TIPS: 19,344,181,900 (par value + TIPs inflation compensation)

· Total Coupons: 80,955,183,500

Since Coupons maturing exceed the 60b cap, the Fed will fully reinvest their bill maturities in April.

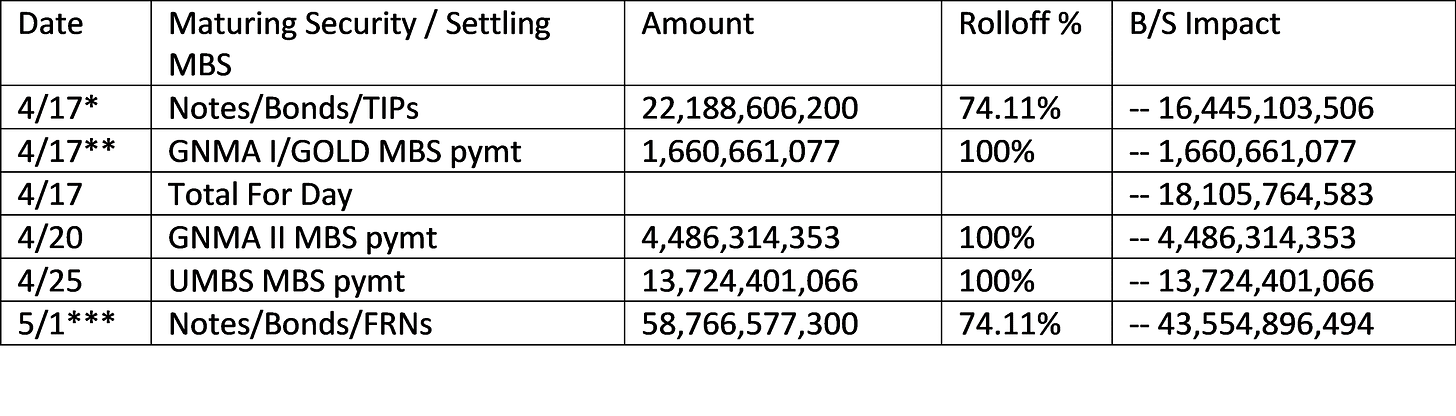

Between the mid month and end month maturities, the Fed rolls off an amount proportional to the total amount maturing. Accordingly, since 60b will be rolled off out of a total ~80.96b for the month. ~74.11% (60/80.96) of the amounts maturing on 4/15 and 4/30 will roll off.

QT Balance Sheet Impact by Date in April

*The UST maturing on Saturday April 15th will settle on the next business day which is Monday April 17th.

**The GNMAI and FHLMC GOLD MBS payments scheduled to be received on Saturday April 15th will instead be received the next business day which is Monday April 17th.

***The UST maturing on Sunday April 30th will settle on the next business day which is Monday May 1st.

Weekly Projections for April

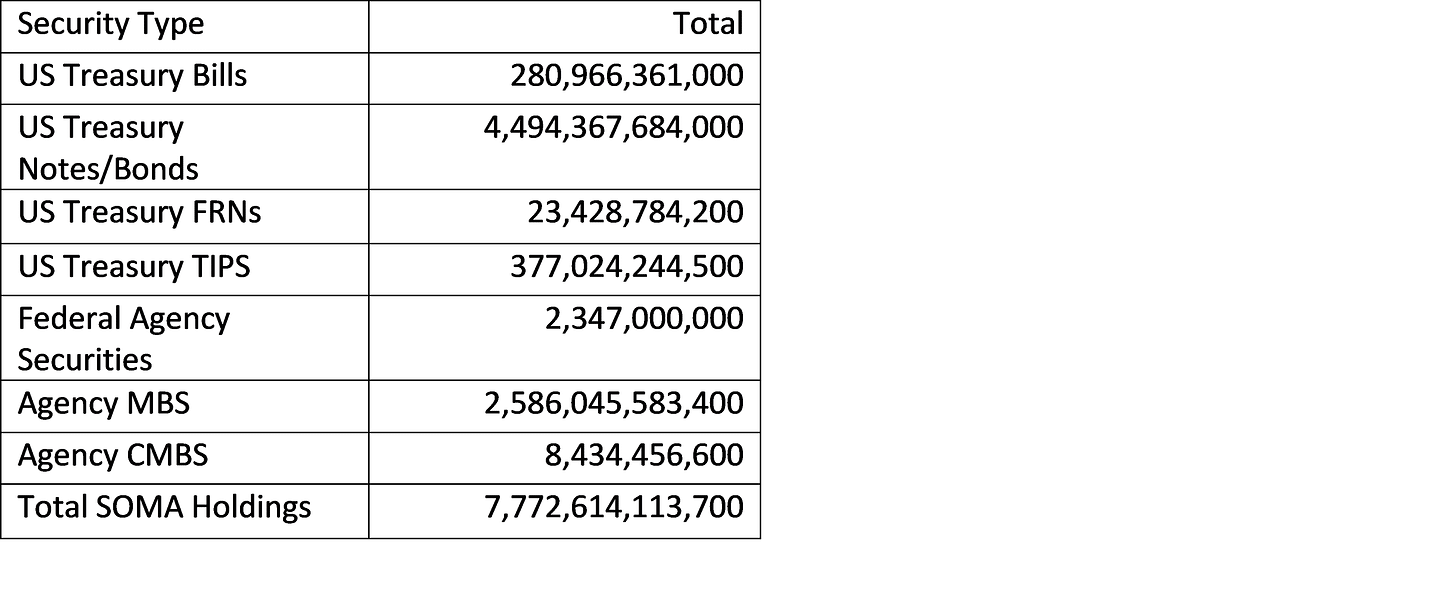

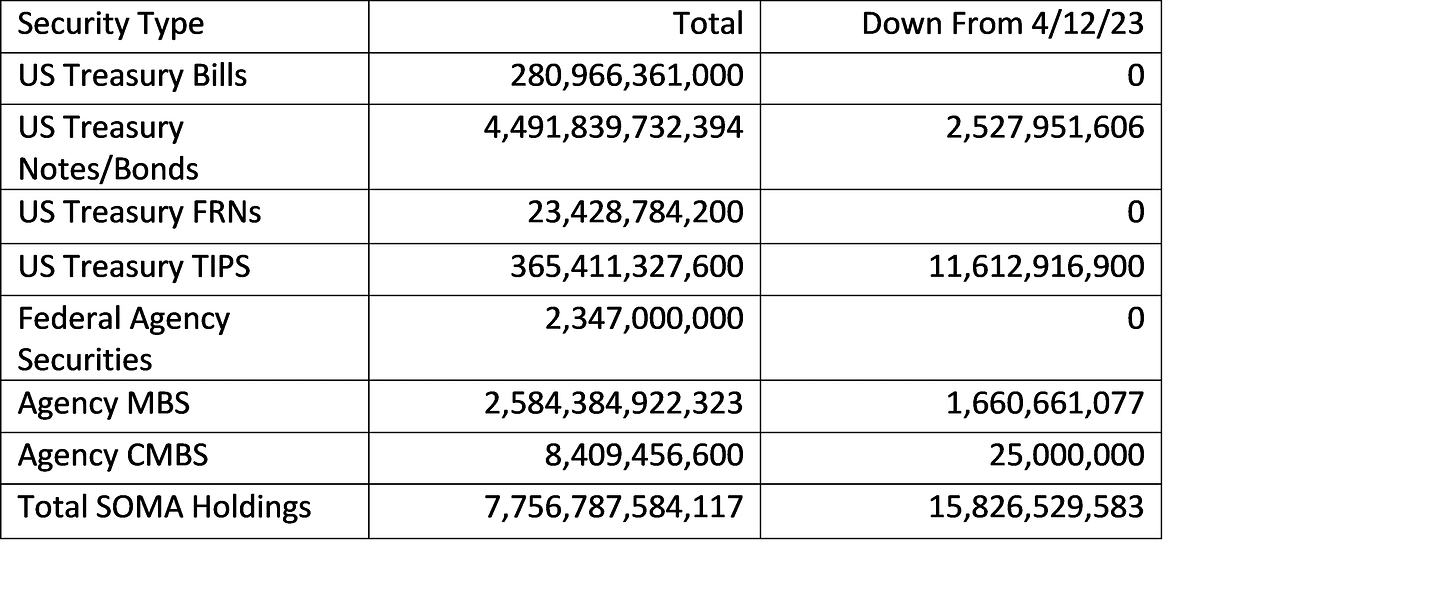

4/5/23 SOMA Domestic Security Holdings baseline

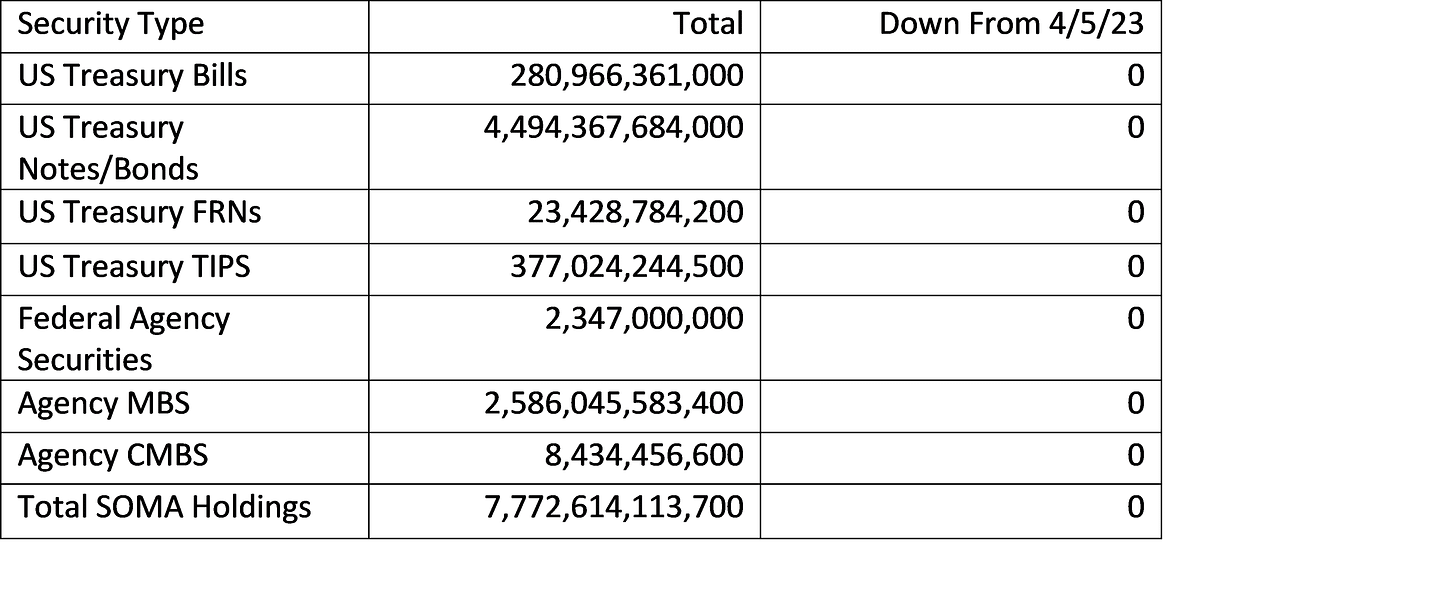

4/12/23 SOMA Domestic Security Holdings projection

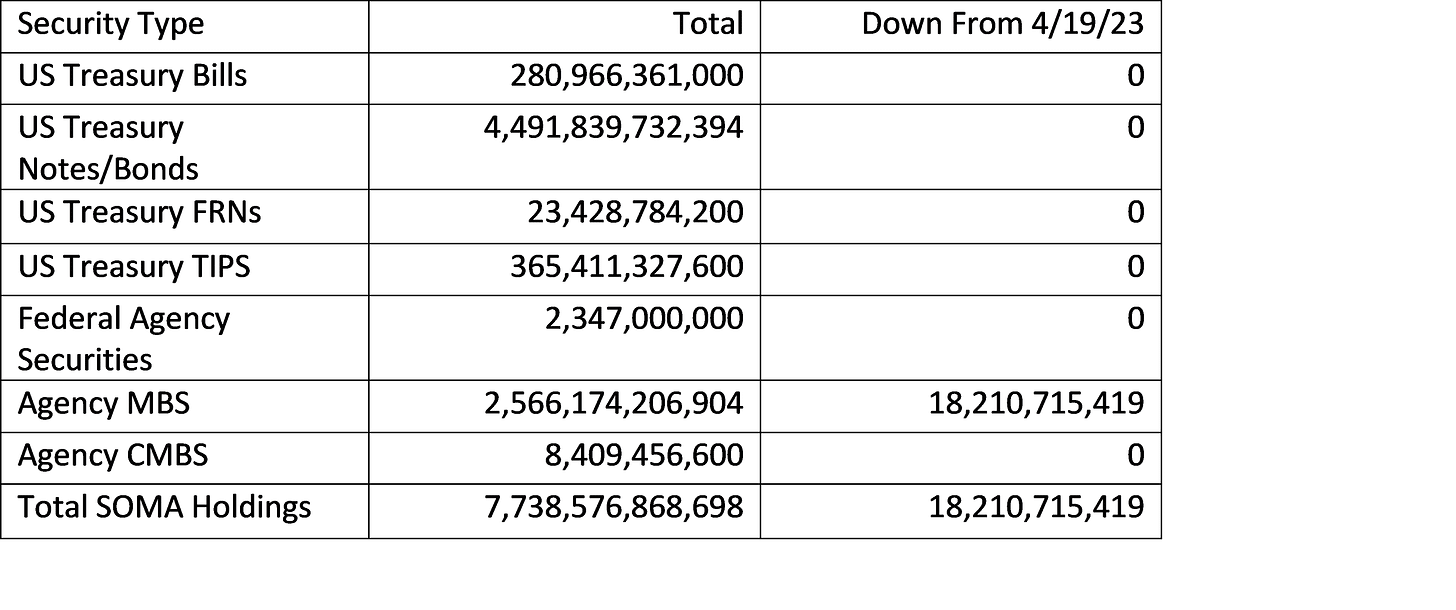

4/19/23 SOMA Domestic Security Holdings projection

Note that the SOMA Holdings (as reflected in the summary tab) will only drop by 15,826,529,583, shy of the 18,105,764,583 drop attributable to QT. The difference is due to the 2,304,235,000 in inflation compensation on the TIPS which will drop in the balance sheet but is not reflected in the TIPS line item in the summary tab of the SOMA holdings.

Also note that the full par value of the TIPS will drop, leaving a much smaller drop in notes and bonds. This is because there is no TIPS issuance occurring in mid April so it must fully drop off with the reinvestment difference made up in other notes and bonds issuing then.

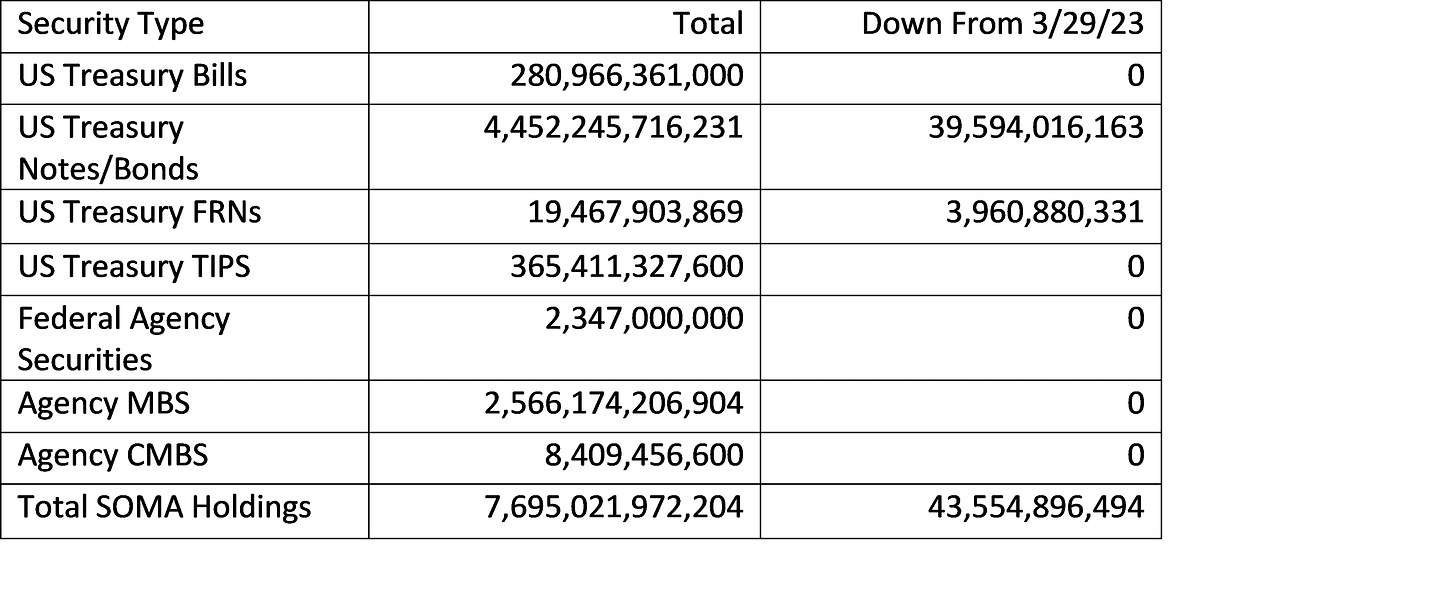

4/26/23 SOMA Domestic Security Holdings projection

5/3/23 SOMA Domestic Security Holdings projection

As always, thanks for reading.

Best,

John

Thank you Sir!

Thanks for the article.

I recently wrote an article on the impact of Tax season on liquidity.

If you have the time, it would be great to get any comments or corrections form you.

thanks!

https://seekingalpha.com/article/4593058-tax-season-and-the-coming-liquidity-downturn